ADA Price Prediction 2025: Bearish Signals vs. Bullish Catalysts – What’s Next for Cardano?

- How Bearish Are ADA's Technical Indicators Really?

- What Bullish Factors Could Offset ADA's Technical Weakness?

- How Are Traders Positioning Themselves Amid the Mixed Signals?

- What Key Price Levels Should ADA Traders Watch?

- Is ADA a Good Investment in Current Market Conditions?

- ADA Price Prediction: Frequently Asked Questions

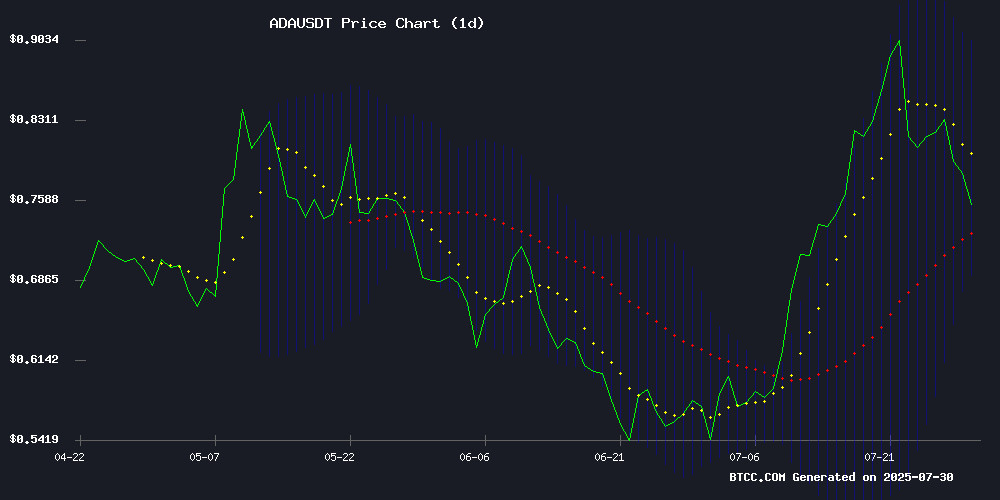

Cardano (ADA) finds itself at a critical juncture in July 2025, caught between concerning technical indicators and promising ecosystem developments. Currently trading at $0.7682, ADA shows bearish momentum with its price below key moving averages, while simultaneously benefiting from upcoming airdrops and renewed speculative interest. This comprehensive analysis examines both sides of the ADA equation, providing traders with the nuanced perspective needed to navigate this volatile period.

How Bearish Are ADA's Technical Indicators Really?

As of July 30, 2025, ADA's technical picture paints a concerning story. The cryptocurrency trades significantly below its 20-day moving average of $0.7976, typically a sign of weakening momentum. The MACD histogram, while showing a slight positive crossover at 0.0276, remains deep in negative territory with a concerning -0.0739 signal line. Bollinger Bands analysis reveals ADA testing the lower band at $0.6921, which might indicate oversold conditions but could also foreshadow further declines.

Source: BTCC trading platform

"The technicals suggest ADA is struggling to regain bullish momentum," notes a BTCC market analyst. "While we're seeing tentative signs of reversal in the MACD, traders should wait for confirmation—specifically a sustained break above the middle Bollinger Band at $0.7976—before assuming any trend change."

What Bullish Factors Could Offset ADA's Technical Weakness?

Despite the bearish technicals, several fundamental factors could provide support for ADA:

| Catalyst | Potential Impact | Timeline |

|---|---|---|

| Midnight Glacier Airdrop | 50% allocation to ADA holders | Early August 2025 |

| Ecosystem Development | Increased network activity | Ongoing |

| Market Speculation | Telegram traders eyeing 100x opportunities | Current |

The upcoming Midnight Glacier airdrop has particularly captured market attention, with cardano founder Charles Hoskinson confirming an early August announcement. Such distributions historically precede periods of increased network activity and can provide temporary price support.

How Are Traders Positioning Themselves Amid the Mixed Signals?

The current market sentiment around Cardano presents a fascinating dichotomy. On one hand, technical traders are noting the clear seller dominance and waning buyer interest shown in recent volume profiles. On the other, fundamental analysts point to the ecosystem's continued development and the potential for airdrop-related boosts.

A prominent Telegram trader recently highlighted an emerging crypto project as the next potential 100x opportunity, drawing comparisons to Cardano's historic 2021 rally. This has reignited speculative interest in the ADA ecosystem, though some analysts caution that such comparisons may be premature given current market conditions.

What Key Price Levels Should ADA Traders Watch?

For traders navigating ADA's current volatility, several critical price levels demand attention:

- Immediate Resistance: $0.7976 (20-day MA)

- Psychological Barrier: $0.80

- Strong Resistance: $0.90

- Support Level: $0.80 (weaker)

- Strong Support: $0.64

"The $0.80 level is crucial," explains our analyst. "A sustained hold above this point could signal bullish potential and enable a retest of $0.90. However, if we break below $0.64, we're likely looking at an extended consolidation period before any meaningful recovery."

Is ADA a Good Investment in Current Market Conditions?

ADA presents a complex case for investors in July 2025. The technical indicators clearly favor bears, while fundamental developments offer potential upside catalysts. Here's a quick breakdown of key metrics:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.7682 | Below key MA levels |

| 20-day MA | $0.7976 | Immediate resistance |

| MACD | -0.0739 | Bearish but improving |

| Bollinger Bands | $0.6921-$0.9031 | Testing lower range |

Risk-tolerant investors might find current levels attractive for dollar-cost averaging, while conservative traders may prefer waiting for confirmation of trend reversal above the $0.80 psychological level. As always in crypto markets, position sizing and risk management remain paramount.

ADA Price Prediction: Frequently Asked Questions

What is the current ADA price as of July 2025?

As of July 30, 2025, Cardano (ADA) is trading at $0.7682, below its 20-day moving average of $0.7976, indicating bearish momentum in the short term.

What are the key technical indicators for ADA?

Key technical indicators show ADA testing the lower Bollinger Band at $0.6921, with MACD at -0.0739 (bearish but showing slight improvement). The cryptocurrency faces immediate resistance at its 20-day MA of $0.7976.

What bullish catalysts could affect ADA's price?

The upcoming Midnight Glacier airdrop (with 50% allocation to ADA holders) and continued ecosystem development serve as potential bullish catalysts that could offset current technical weakness.

What are the critical price levels to watch for ADA?

Traders should monitor $0.7976 (20-day MA), the psychological $0.80 level, and $0.90 resistance above. Support levels include $0.80 (weaker) and $0.64 (stronger).

Is now a good time to invest in ADA?

The decision depends on risk tolerance. While current prices may appeal to long-term investors comfortable with volatility, conservative traders might wait for confirmation of trend reversal above $0.80.