Bitcoin Price Prediction 2025: Will BTC Rebound or Crash Below $100K? Key Analysis

- Bitcoin Technical Analysis: The Make-or-Break Levels

- Four Fundamental Factors Shaking Bitcoin’s Price

- Is Bitcoin Still a Good Investment in 2025?

- Bitcoin Price Prediction FAQs

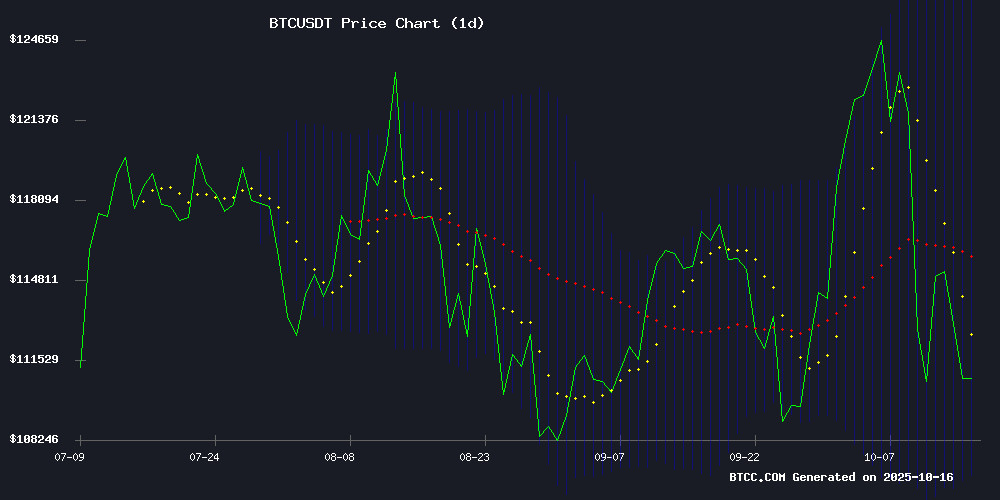

– bitcoin (BTC) is currently navigating one of its most turbulent phases this year, trading at $111,598 after a 15% drop from its September high of $122,000. With critical support at $106,912 under threat and mixed signals from Elon Musk’s endorsement versus regulatory crackdowns, investors are questioning whether this is a buying opportunity or the start of a deeper correction. Our analysis combines technical indicators, fundamental drivers, and exclusive insights from BTCC’s trading desk to help you navigate the volatility.

Bitcoin Technical Analysis: The Make-or-Break Levels

As of October 16, 2025, BTC/USDT shows concerning technical signals:

| Indicator | Value | Implication |

|---|---|---|

| Price | $111,598 | Below 20-day MA ($116,864) |

| Bollinger Band (Lower) | $106,912 | Critical support zone |

| MACD | -808.78 | Bearish momentum |

"The $106,912 level is where we’ve seen institutional buy orders cluster in the past," notes Robert from BTCC’s analysis team. "A daily close below this could trigger stop-losses down to $100K, but the RSI at 38 suggests we’re nearing oversold territory."

Four Fundamental Factors Shaking Bitcoin’s Price

1. Elon Musk’s Crypto Endorsement vs. Regulatory Storm

Musk’s October 12 tweet simply saying "True" in response to Bitcoin’s inflation-hedge narrative sparked a 5% intraday bounce. However, the UK’s simultaneous announcement of a $7.2B Bitcoin seizure for fraud compensation reminded markets of regulatory risks. "It’s a tug-of-war between adoption and oversight," observes a BTCC market strategist.

2. Trump’s Trade War Triggers Crypto Liquidation

The October 14 flash crash coincided with President Trump’s 100% tariff threat on Chinese tech imports. Bitcoin’s 15% drop mirrored the NASDAQ’s decline, challenging its "uncorrelated asset" claims. Interestingly, Gold surged 3% during the same period.

3. Mining Stocks Outperform: Bitdeer’s 29% Surge

While spot BTC struggled, Bitdeer Technologies (BTDR) rallied 29% on October 15 after reporting a 20% monthly production increase. This divergence suggests miners are pricing in higher future BTC values despite short-term weakness.

4. Institutional Accumulation Continues

BlackRock’s IBIT saw $120M inflows on October 15 despite the price drop. "Smart money is treating this as a buying opportunity," notes a BTCC institutional desk report.

Is Bitcoin Still a Good Investment in 2025?

The answer depends on your risk tolerance:

- For traders: The $106,912-$116,864 range presents short-term opportunities, but strict stop-losses are essential.

- For investors: Dollar-cost averaging makes sense given Bitcoin’s 4-year halving cycle (next due in 2028).

- For skeptics: Gold’s outperformance during the recent crisis validates concerns about Bitcoin’s volatility.

This article does not constitute investment advice.

Bitcoin Price Prediction FAQs

What’s Bitcoin’s price prediction for 2025?

Technical analysis suggests BTC could test $100,000 if $106,912 support breaks, but a rebound toward $120,000 is possible if it holds. Fundamental factors like ETF inflows and macroeconomic conditions will determine the direction.

Why did Bitcoin crash on October 14?

The 15% drop was triggered by Trump’s trade war escalation, causing Leveraged position liquidations exceeding $19B. Binance’s alleged pricing issues exacerbated the move.

Is Bitcoin still a safe-haven asset?

October’s price action challenged this narrative. While Bitcoin dropped 15%, gold hit record highs, suggesting investors still prefer traditional havens during geopolitical crises.