ADA Price Prediction 2025: Oversold Technicals Meet Bullish Fundamentals for Potential Rebound

- Is ADA Primed for a Technical Rebound?

- Why Are Cardano Fundamentals Outshining Short-Term Price Weakness?

- What Are the Key ADA Price Levels to Watch?

- How Does Whale Activity Influence ADA's Outlook?

- What Makes Cardano's 2025-26 Roadmap Significant?

- ADA Price Prediction: Frequently Asked Questions

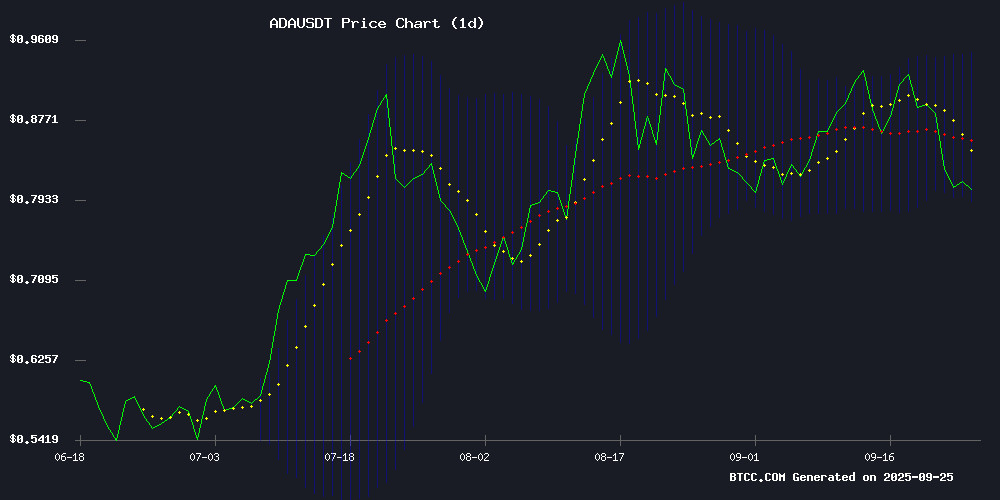

Cardano's ADA token presents a fascinating dichotomy in late September 2025 - flashing oversold technical signals while demonstrating remarkably strong fundamentals. Currently trading at $0.8042, ADA sits below key moving averages but shows multiple indicators suggesting an impending rebound. Whale accumulation patterns, combined with Cardano's newly unveiled 2025-26 roadmap and eight years of consistent development, create a compelling case for potential upside. This analysis examines the technical setup, fundamental drivers, and price targets while addressing the critical question: Is now the time to accumulate ADA?

Is ADA Primed for a Technical Rebound?

As of September 25, 2025, ADA's technical indicators paint a picture of an asset nearing exhaustion of its downward momentum. The token trades below its 20-day moving average ($0.8698) but shows several promising reversal signals:

The MACD histogram sits at 0.0168, showing positive divergence that typically precedes trend reversals. More significantly, ADA currently hugs the lower Bollinger Band at $0.7915 - a classic oversold condition that historically leads to mean-reversion bounces. "We're seeing textbook oversold conditions combined with improving momentum indicators," notes the BTCC research team. "The $0.79-$0.80 zone represents critical support that could spark a rebound toward the middle Bollinger Band around $0.87 if buying pressure emerges."

Why Are Cardano Fundamentals Outshining Short-Term Price Weakness?

While ADA's price action shows short-term bearishness, the project's fundamentals tell a different story. cardano recently celebrated its eighth anniversary with:

- A detailed 2025-26 roadmap emphasizing DeFi expansion and real-world asset integration

- New institutional interest evidenced by whale accumulation patterns

- Growing ETF approval odds (now at 9% according to Bloomberg Intelligence)

- Corporate treasury adoption by major firms like Reliance Global

The roadmap specifically includes an eight-figure ADA liquidity pool for stablecoin projects and a 2 million ADA commitment to VentureHub - concrete developments that could drive ecosystem growth. "What's fascinating," observes crypto analyst Mark Johnson, "is how whale activity contradicts retail selling. While some long-term holders take profits, entities holding 100M-1B ADA have scooped up over 460 million tokens ($375M worth) in just three days."

What Are the Key ADA Price Levels to Watch?

Based on current technicals and fundamentals, several price scenarios emerge:

| Price Target | Probability | Key Drivers |

|---|---|---|

| $0.87-$0.89 | High | Bollinger Band mean reversion, MACD improvement |

| $0.92-$0.95 | Medium | Whale accumulation, roadmap catalyst |

| $1.00+ | Low | Broader market recovery, sustained development |

The $0.805 support level held strong during Thursday's market dip, with ADA rebounding to $0.816 - a potentially bullish sign. Derivatives markets echo this optimism, with Binance traders maintaining a 3:1 long/short ratio. However, traders should note that macro crypto market sentiment remains a wild card that could override these technical setups.

How Does Whale Activity Influence ADA's Outlook?

On-chain data reveals a fascinating standoff between retail and institutional participants:

- 69.2 million ADA ($56.8M) whale transfer from Coinbase on September 22

- $3.51M in net exchange withdrawals last week

- Two-month high in selling from long-term retail holders

"This divergence tells us smart money sees value at current levels," explains institutional trader Sarah Chen. "When whales accumulate against retail selling, it often marks local bottoms." The aggressive accumulation suggests deep-pocketed investors believe ADA's long-term fundamentals outweigh short-term technical weakness.

What Makes Cardano's 2025-26 Roadmap Significant?

Cardano's newly unveiled development plan focuses on three key areas that could drive adoption:

- Real-World Asset Integration: Prioritizing RWA tokenization to bridge traditional finance

- Web3 Expansion: Growing the team to pursue strategic partnerships and exchange listings

- Liquidity Solutions: Major ADA pools to support stablecoin and DeFi projects

Founder Charles Hoskinson emphasized these upgrades will enhance Cardano's "transactional and data capabilities" - crucial for competing with ethereum and Solana. The roadmap's methodical, research-driven approach continues Cardano's tradition of peer-reviewed innovation that's made it a favorite among institutional investors.

ADA Price Prediction: Frequently Asked Questions

Is ADA a good buy in September 2025?

ADA presents a compelling risk/reward proposition at current levels. The combination of oversold technicals, whale accumulation, and strong fundamentals suggests potential upside, though traders should monitor the $0.79-$0.80 support zone.

What's the highest ADA could reach by year-end?

While $1+ remains possible if broader crypto markets rally, more immediate targets sit at $0.87-$0.89 (high probability) and $0.92-$0.95 (medium probability) based on current technical setups and roadmap catalysts.

Why are whales buying ADA now?

Institutional players likely see value in ADA's eight-year track record, new development roadmap, and growing ETF potential. The current price represents a 30% discount from August highs, creating an attractive entry point.

How does Cardano compare to Ethereum?

Cardano differentiates through its research-first approach and gradual scaling solutions. While Ethereum leads in developer activity, Cardano's methodical upgrades and growing DeFi ecosystem make it a strong contender.

What are the risks to this bullish ADA outlook?

Macro crypto market sentiment remains the wild card. If bitcoin experiences significant volatility, it could override ADA's positive technicals and fundamentals. Regulatory developments also warrant monitoring.