Pi Network Price Plunge: PI Hits Record Low as Bearish Momentum Intensifies

Pi Network's native token tanks to unprecedented depths as selling pressure overwhelms the market.

Technical Breakdown: What's Driving the Collapse

PI's descent accelerates as key support levels crumble beneath relentless bearish pressure. The token's chart paints a grim picture—each bounce meeting stronger resistance than the last. Trading volume spikes suggest panic selling rather than strategic accumulation.

Market Psychology: Fear Dominates Rationality

Traders abandon ship as sentiment turns decisively negative. The 'buy the dip' mentality vanishes faster than a crypto influencer's credibility during a bear market. Social metrics show engagement shifting from optimistic speculation to damage control discussions.

Broader Crypto Context: Not Just a PI Problem

While PI suffers disproportionately, the entire altcoin complex faces headwinds. Regulatory uncertainty and macroeconomic pressures create the perfect storm for risk assets. Traditional finance veterans smugly note this looks familiar—just with blockchain buzzwords.

Outlook: Recovery or Further Pain?

The path forward depends on whether Pi Network's fundamentals can override technical damage. Development progress and adoption metrics need to impress immediately to counter chart-driven selling. Otherwise, this could become another cautionary tale in crypto's volatile history—where 'disruption' mostly disrupts portfolio values.

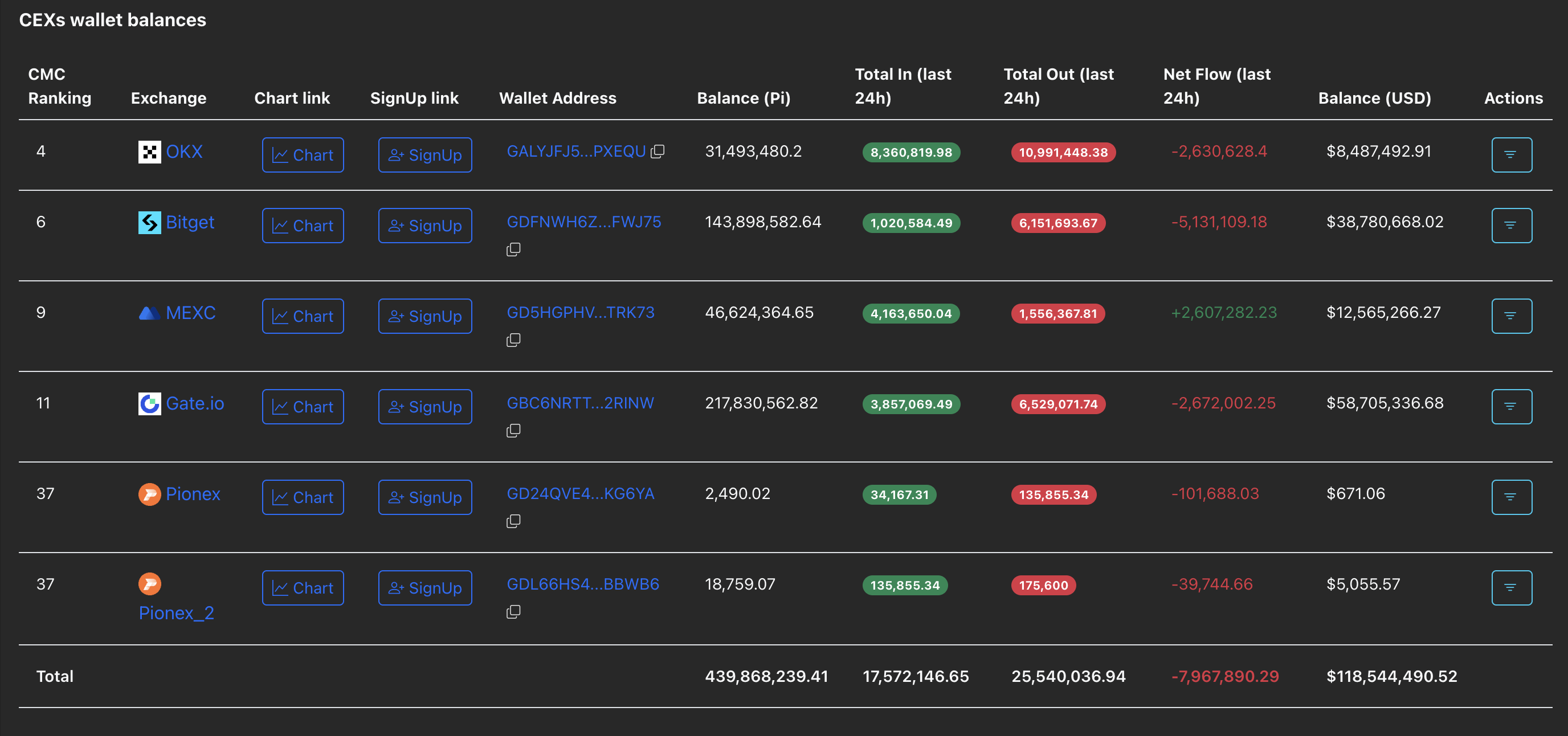

CEXs wallet reserve declines as PI rebounds from record low

Nicolas Kokkalis and Chengdiao Fan, founders of PI Network, attended the community meetup in collaboration with Sign in Seoul on Monday. The founders shared a presentation on smart contract development on Pi Network, highlighting the upcoming protocol upgrade and AI-driven KYC features for faster user onboarding. However, the meetup failed to lift the investors' mood as the PI token reached a record low of $0.1842 on Monday, before closing the day at $0.2860.

Regardless of the recent crash, PiScan data shows a net outflow of 7.96 million PI tokens from CEXs' reserves over the last 24 hours, aligning with the rebound from the record low. This suggests that the confident investors are acquiring the mobile mining cryptocurrency at discounted prices.

CEXs wallet balances. Source: PiScan.

Bearish momentum supplements Pi Network’s downside risk

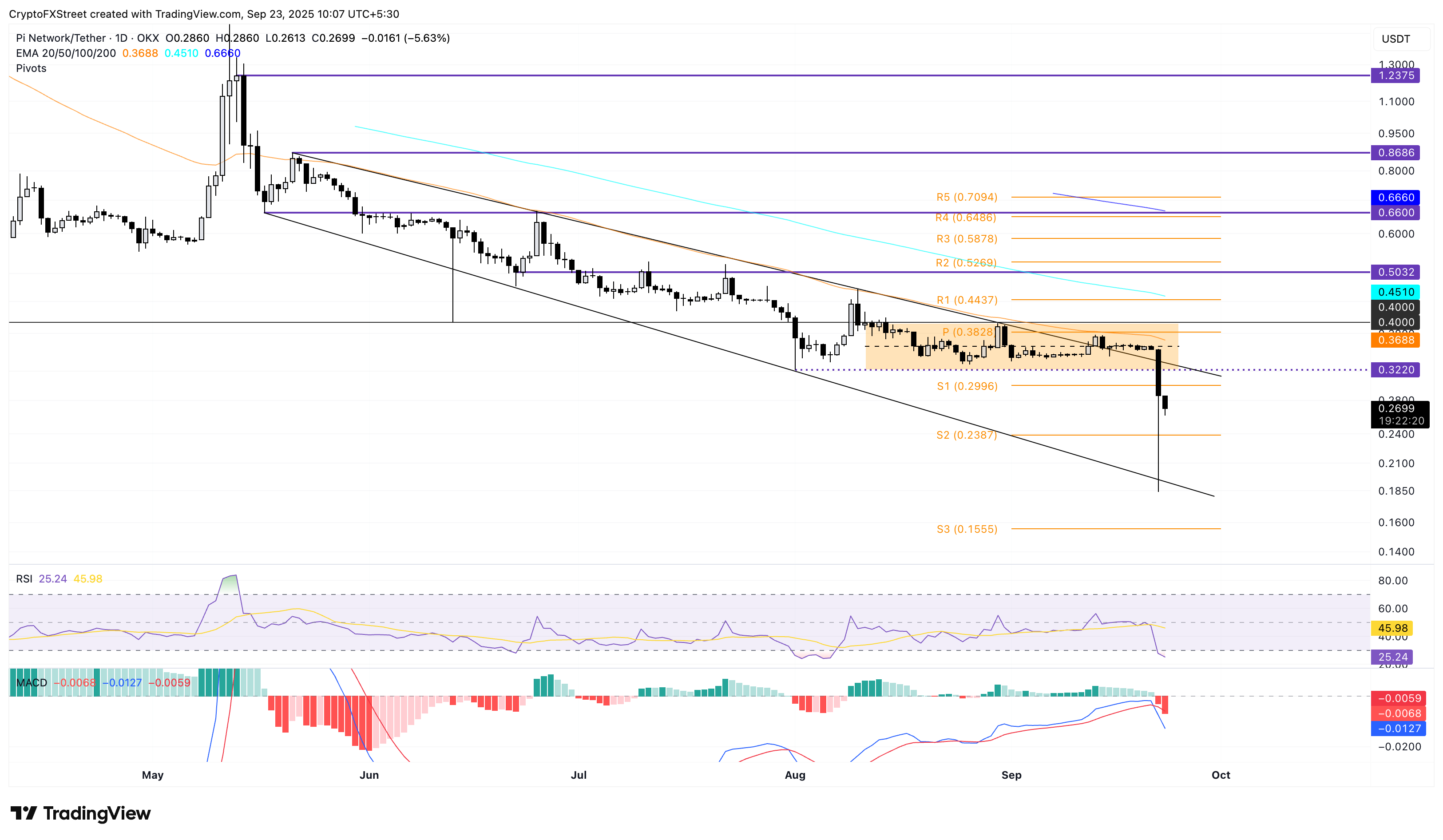

Pi Network trades around $0.2700 at the time of writing on Tuesday, extending the loss for the third straight day. The pullback invalidates the falling channel breakout and targets the S2 pivot level at $0.2387.

A decisive close below the all-time low of $0.1842 WOULD confirm the breakdown of the falling channel pattern. This could result in a further decline to the S3 pivot level at $0.1555.

The momentum indicators on the daily chart suggest a sell-side dominance as the Relative Strength Index (RSI) at 25 drops into the oversold zone. Furthermore, the Moving Average Convergence Divergence (MACD) extends the declining trend after crossing below its signal line on Sunday. This indicates that the bearish momentum is rising.

PI/USDT daily price chart.

Looking up, a potential bounce back above the S1 pivot level, a support-turned resistance, at $0.2996, could challenge the overhead trendline at $0.3220. Beyond this, the centre pivot level $0.2838 could act as the next key resistance.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.