Avalanche Price Forecast: AVAX Bulls Defy Market Downturn with Unwavering Strength

Avalanche bulls dig in as crypto markets wobble.

The Defiance Play

While red dominates crypto charts, AVAX holders reinforce positions. Market weakness fails to shake their conviction.

Technical Fortitude

The token demonstrates remarkable resilience against broader sell-off pressures. Trading volumes suggest institutional interest persists.

Ecosystem Momentum

Developer activity continues unabated across the network. New deployments signal long-term confidence in Avalanche's architecture.

The Contrarian Bet

Traditional finance analysts scratch their heads—again—as crypto fundamentals defy conventional wisdom. Maybe quarterly reports aren't the only metrics that matter.

AVAX proves some bulls don't need Wall Street's permission to charge.

On-chain and derivatives data continue to strengthen AVAX’s outlook

Avalanche price climbs above $34 during the Asian trading session on Tuesday, extending its sharp recovery from Monday. AVAX is showing resilience despite broader market weakness, with Bitcoin (BTC) slipping below $112,000 and ethereum (ETH) dropping toward the $4,000 mark as the week begins.

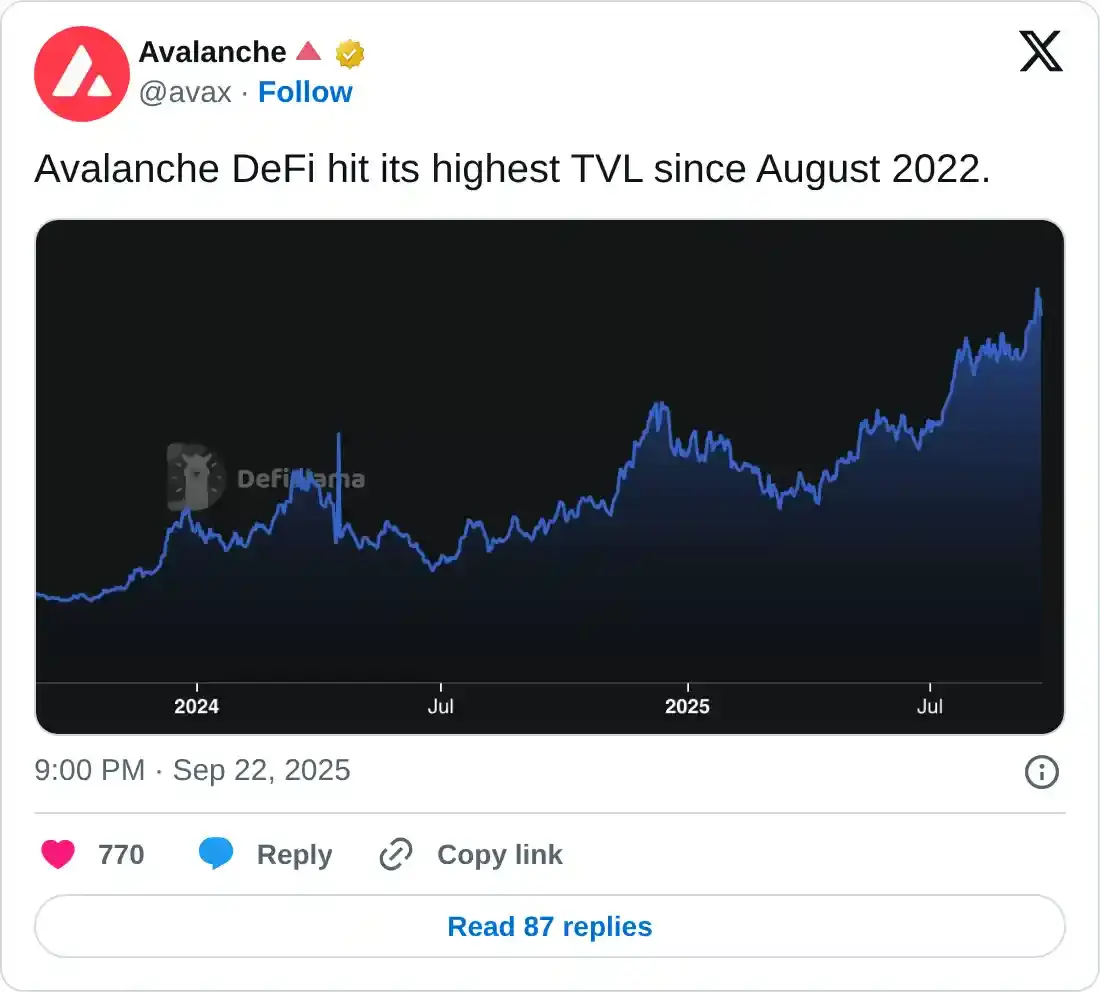

On-chain data indicate that the Avalanche Total Value Locked (TVL) has reached its highest level since August 2022. Rising TVL indicates growing activity and interest within AVAX’s ecosystem, suggesting that more users are depositing or utilizing assets within AVAX-based protocols.

On the derivatives side, the Avalanche’s futures’ Open Interest (OI) at exchanges stands at $1.79 billion on Tuesday, nearing its record highs. Rising OI represents new or additional money entering the market and new buying, which could fuel the current AVAX price rally.

Avalanche open interest chart. Source: Coinglass

Avalanche treasury reserves

Institutional demand for Avalanche also strengthens as the week begins. On Monday, AgriFORCE Growing Systems announced plans to rebrand as AVAX One, becoming the first Nasdaq-listed company dedicated to holding the Layer-1 token.

“The goal of the Company’s capital raising strategy is to own more than $700 million worth of AVAX tokens, making it a foundational partner in the growing ecosystem,” said AgriFORCE in the press release.

The company seeks to raise $550 million from a private investment in public equity (PIPE) deal worth $300 million, combined with an additional near-term funding of up to $250 million.

The news boosted the AVAX price on Monday, fueling a sharp recovery from its recent dip and closing above $33.80. Moreover, in the long term, the development is bullish for the Avalanche ecosystem, as it reduces the circulating supply, increases demand, and supports higher prices. Meanwhile, growing institutional interest further strengthens its credibility and adoption.

Avalanche Price Forecast: AVAX bulls aiming for $39 mark

Avalanche price broke above the ascending channel pattern on Thursday but faced a pullback over the next three days. At the start of the week on Monday, AVAX corrected sharply during the first half but recovered sharply after retesting the $30 psychological support during the second half of the day, closing above $33.80. At the time of writing on Tuesday, it continues to trade higher at around $34.45.

If AVAX continues its upward momentum, it could extend the rally toward the technical target of the channel pattern at $39.61, based on the distance between the channel range from the breakout point.

The Relative Strength Index (RSI) on the daily chart reads 71, indicating that it is above its overbought levels and pointing upward, which suggests strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also displayed a bullish crossover in mid-September, which remains in effect and supports the bullish view.

AVAX/USDT daily chart

However, if AVAX faces a correction, it could extend the decline to retest its key support at $30.