Is ’Uptober’ Rally Already Fizzling? Crypto Markets Flash Red for Ninth Straight Day

Crypto's seasonal surge hits a wall—nine consecutive days of red candles have traders questioning the 'Uptober' narrative.

Market Momentum Stalls

Bitcoin and major altcoins bled out relentlessly—no bullish relief in sight. Even the most optimistic charts now show breakdowns rather than breakouts.

Institutional Hesitation

Whales aren’t buying this dip—instead, exchange outflows suggest profit-taking and risk-off sentiment. Classic crypto volatility meets classic human impatience.

Regulatory Shadows Loom

Uncertainty from global regulators adds pressure—just another day where crypto behaves more like a speculative casino than a stable asset class.

So much for historical patterns—this year’s 'Uptober' might need a rebrand to 'Floptober'.

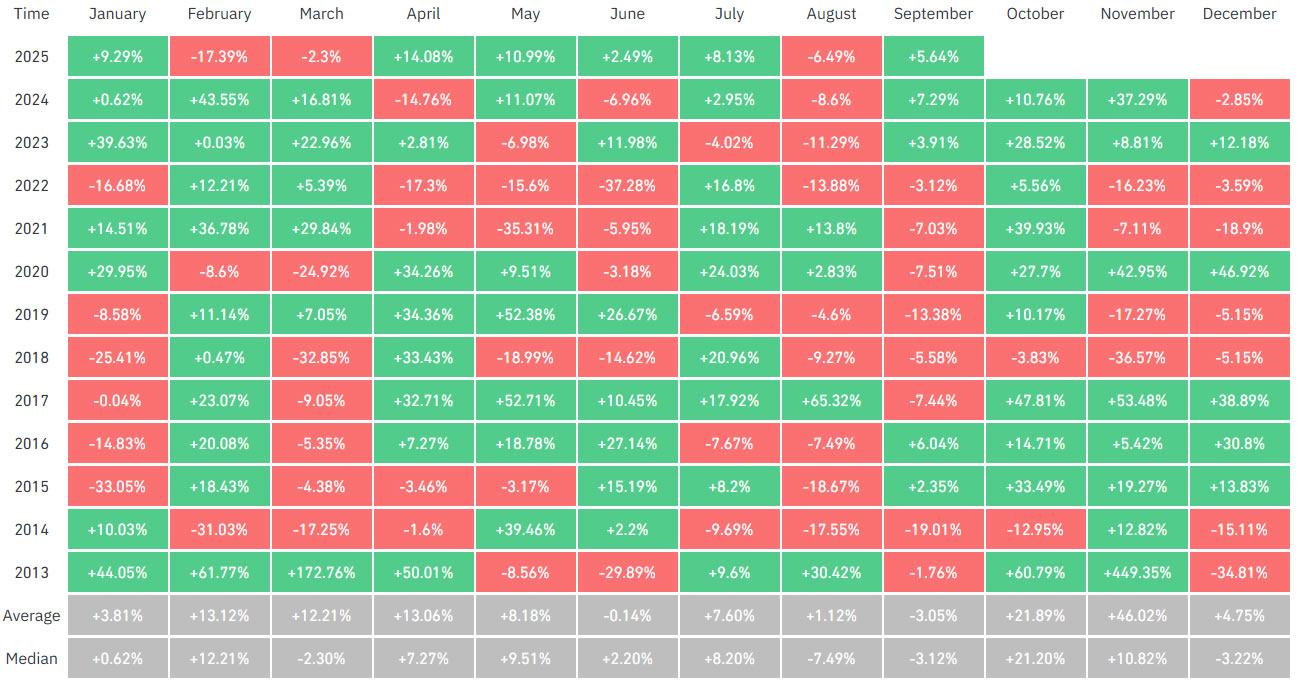

10 out of 12 Octobers have been bullish. Source: CoinGlass

Others see a more muted crypto rally

However, some analysts cautioned against the euphoria.

“We expect any BTC rallies to be relatively muted given the extremely low implied volatility and upside skews, weakening DAT inflow momentum, and presence of profit takers still looking to sell to cap upside,” said Augustine Fan, head of insights at crypto trading software service provider SignalPlus, adding:

“Longer-term investors will have to be more patient before we expect new ATHs to be reached.”

Meanwhile, the chief operating officer at the BTSE exchange, Jeff Mei, said, “We think that the Uptober trend is less likely to occur this year given the macro uncertainty and the fact that September hasn’t seen markets fall.”

If the Fed indicates more aggressive measures to stimulate the economy, however, this could change.

Crypto markets turned red on Monday

The crypto markets started to retreat on Monday morning, with total capitalization sinking by $80 billion over the past few hours as Bitcoin fell to a twelve-day low of $114,270.

Ether (ETH $4,193) also took a hit, dropping more than 4% in a dip below $4,300, its lowest level for a fortnight.