Crypto Today: Bitcoin, Ethereum, XRP Slip as Coinbase Reserves Surge to $112 Billion

Crypto markets take a breather as major tokens retreat from recent highs.

Bitcoin leads the decline, shedding gains after failing to hold key resistance levels. Ethereum follows suit, dropping alongside broader market sentiment. XRP continues its volatile dance, unable to break free from regulatory overhangs.

Meanwhile, Coinbase reports staggering $112 billion in reserves—proving once again that exchanges make money whether markets go up, down, or sideways. The platform's growing war chest highlights institutional adoption, even as retail traders nurse losses.

Traditional finance pundits will call this a 'correction.' Crypto natives know it's just Tuesday.

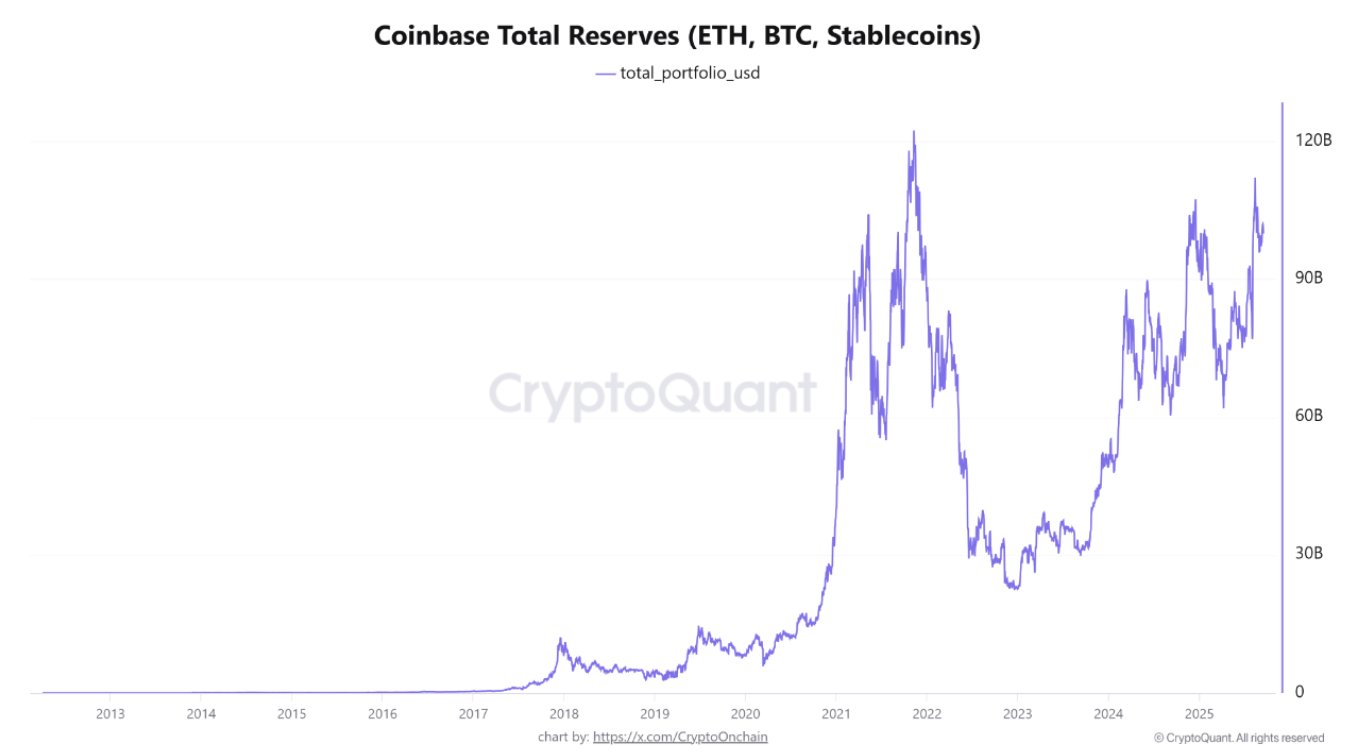

Data spotlight: Coinbase reserves hit $112 billion

Coinbase's reserves in US dollars, comprising Bitcoin, ethereum (ETH) and ERC-20-based stablecoins, have reached $112 billion, the highest level since November 2021, which marked the peak of the previous bull cycle.

The growth in the exchange reserves indicates confidence in the crypto market from both institutional and retail investors. According to CryptoOnchain's post on CryptoQuant, the uptick in reserves signals that the market is ushering in a new phase of demand and accumulation – key factors that often precede major breakouts.

"In past cycles, rising reserves on major exchanges like Coinbase have often coincided with higher market liquidity and bullish price momentum. Therefore, reaching this four-year high could indicate sustained market strength and preparation for the next major move," CryptoOnchain stated.

Coinbase reserves (USD) | Source: CryptoQuant

Meanwhile, Ethereum spot Exchange Traded Funds (ETFs) in the US resumed inflows on Thursday, with $163 million in net volume. The uptick marked a major turnaround after outflows of $57 million on Wednesday. Institutional interest in ETH ETFs has been relatively stable apart from a few days of outflows, reflecting price fluctuations and the lock-step recovery toward the $4,956 record high.

Still, Ethereum loses more than 1% on Friday, with the $4,500 round number holding as support at the time of writing.

Ethereum ETF stats | Source: SoSoValue

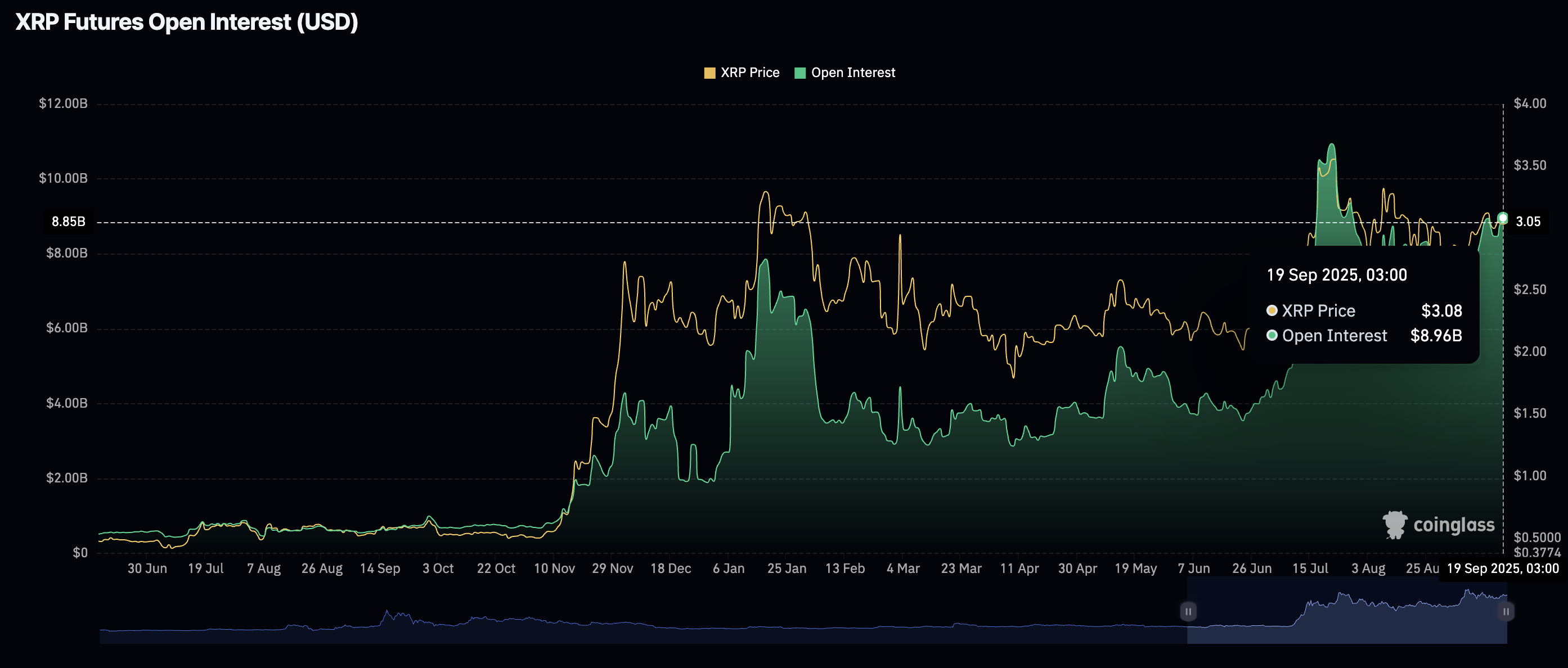

On the other hand, retail interest in XRP is elevated compared to last week. According to CoinGlass data, the XRP futures Open Interest (OI) averages at $8.96 billion on Friday, up from $7.37 billion on Sunday. The growing interest isn't reflected in spot prices, as XRP falls 1.5% on the day, hovering right above $3.00.

Still, the steady uptrend in OI, which refers to the notional value of outstanding futures contracts, indicates that investors are increasingly betting on XRP's ability to sustain its recovery, aiming for the record high of $3.66 reached on July 18.

XRP Futures Open Interest | Source: CoinGlass

Chart of the day: Bitcoin takes a breather

Bitcoin falls below $117,000, but its technical structure remains solid. A buy signal from the Moving Average Convergence Divergence (MACD) indicator on the daily chart has been retained since September 7, when the blue line crossed above the red signal line.

Investors are likely to remain bullish and seek to increase their exposure, especially if the Relative Strength Index (RSI) continues to move toward overbought territory. For now, the BTC price is trading broadly sideways, and this trend could extend as the RSI stabilizes at 60.

Traders will look out for a daily close above $117,000 level to ascertain Bitcoin's recovery potential above $120,000. If market dynamics change from bullish to bearish and investors widely take profits, attention will shift to the 50-day Exponential Moving Average (EMA) at $113,921 and the 100-day EMA at $111,715.

BTC/USDT daily chart

Altcoins update: What's next as Ethereum, XRP delay breakout

Ethereum posts losses on Friday, but remains above the $4,500 level, reflecting a decline in retail interest in the broader cryptocurrency market following a minor mid-week uptrend triggered by the Fed's dovish outlook for the fourth quarter.

The RSI is positioned at 54 on the daily chart and falling toward the midline, which backs the short-term risk-off sentiment. Lower RSI readings into the bearish region below the midline indicate fading bullish momentum.

A correction below the $4,500 short-term support brings the 50-day EMA at $4,241 within reach, with aggressive selling likely to push the ETH price below the $4,000 level, potentially targeting the 100-day EMA at $3,800.

ETH/USDT daily chart

As for XRP, bears are largely in control, pushing the price closer to breaking below the $3.00 short-term support. With the RSI at 52 on the daily chart and declining, overhead pressure overwhelms demand for XRP. Lower RSI readings could signal the path of least resistance downward, increasing the chances of XRP retesting the 50-day EMA at $2.95 and the 100-day EMA at $2.83.

XRP/USDT daily chart

Still, with the MACD indicator sustaining a buy signal from September 8, also on the daily chart, XRP has the potential to steady the recovery toward resistance at $3.35, which was previously tested in mid-August. An extended uptrend WOULD drive XRP closer to its record high of $3.66.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.