🚀 Crypto Price Forecast: Pi, Bitcoin & Polkadot – European Market Wrap 19 September

Digital assets defy gravity as Europe's trading session closes—Pi Network's speculative surge continues while Bitcoin flirts with historic resistance levels.

Polkadot's interoperability narrative gains traction among institutional players seeking blockchain bridges.

Traditional finance pundits scramble to explain the momentum—apparently 'digital gold' now outperforms actual gold while requiring zero vault maintenance.

Meanwhile, regulatory watchdogs draft yet another warning bulletin—because nothing says 'progress' like three agencies governing the same decentralized protocol.

September's volatility reminds everyone: in crypto, even the 'stable' coins enjoy an occasional rollercoaster ride.

Pi Network Price Forecast: Whales buy the dip as PI consolidates

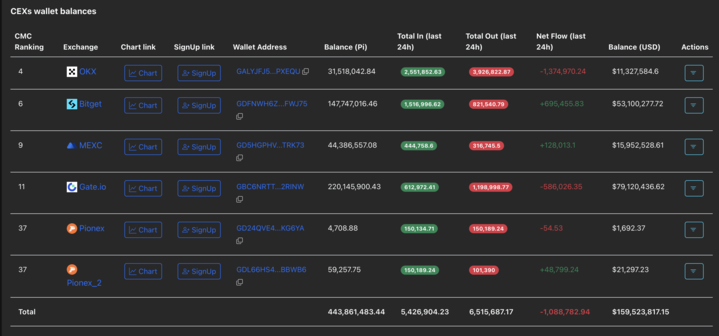

Pi Network (PI) consolidates above $0.3500 for the fifth consecutive day, as the recently launched AI-powered Know Your Customer (KYC) fails to uplift investors' sentiment. Still, a decline in Centralized Exchanges (CEXs) wallet balances and the moves from whales suggest that large-wallet investors are buying the dip.

Bitcoin Weekly Forecast: BTC steadies above $116,000 as FOMC dovish stance boosts risk-on sentiment

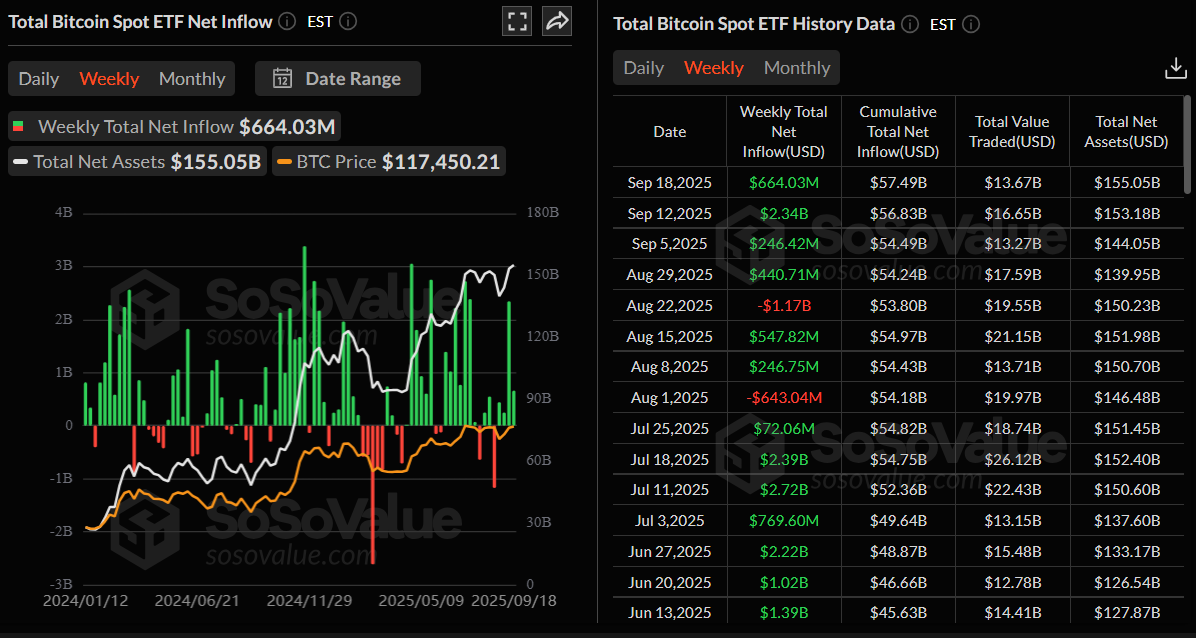

Bitcoin (BTC) shows strength, continuing its three consecutive weeks of recovery and holding steady above $116,000 at the time of writing on Friday. The recovery extends following the dovish Federal Reserve (Fed) stance, highlighted by a 25 basis points (bps) interest rate cut and expectations of further easing in 2025, which has fueled risk-on sentiment. Additionally, institutional and corporate demand adds further strength to BTC’s bullish outlook.

Polkadot Price Forecast: DOT extends gains as bullish pattern points to $6.52 target

Polkadot (DOT) extends its gains, trading above $4.65 at the time of writing on Friday after successfully retesting a key breakout point earlier this week. A bullish outlook emerges, with scarcity reinforced by DOT’s fixed supply of 2.1 billion, which was announced on Sunday, along with rising open interest and trading volumes. On the technical side, a continuation of the rally is favored, targeting $6.52.