Pi Network Holds Steady as AI-Powered KYC Launch and First Community Meetup Ignite Momentum

Pi Network just dropped its AI-driven KYC system—right before its inaugural global gathering. The timing isn't just smart; it's strategic.

Why This KYC Upgrade Matters

Manual verification? Out. AI speed and precision? In. This upgrade slashes wait times and supercharges onboarding—exactly what a scaling crypto project needs.

Community Energy Meets Real-World Utility

The first-ever Pi meetup isn’t just a party. It’s a signal: this network is building in public, fast, and with purpose. No vague roadmaps—just features rolling out.

Where’s the Price Action?

Pi’s holding steady—no dramatic pumps or dumps. In a world where most altcoins swing on hype, that’s almost a flex. Real progress over empty speculation? Refreshing. Almost suspiciously so—like a trader who actually reads whitepapers.

Bottom line: Pi keeps building while others just talk. Maybe that’s the real alpha.

Pi Network releases fast-track KYC feature

Pi Network has announced a faster KYC FLOW with more AI features, which will allow network users, commonly referred to as Pioneers, to activate the mainnet wallet before completing the 30 mining sessions.

This feature is currently reserved for eligible users with fewer than the previously required sessions. The faster KYC only allows mainnet wallet activation and not mainnet migration of the Pi tokens.

Sign collaborates with the Pi Network community for a get-together in Seoul

Sign protocol, an Ethereum-based digital verification protocol, announced an upcoming collaboration with PI Network through a community meetup in Seoul on Monday. The meetup will begin at 10:30 hours GMT on Monday, featuring a chat between Sign Xin Yan's CEO and one of the Pi Network’s co-founders, whose name hasn't yet been confirmed.

Whales continue to accumulate as PI coin consolidates

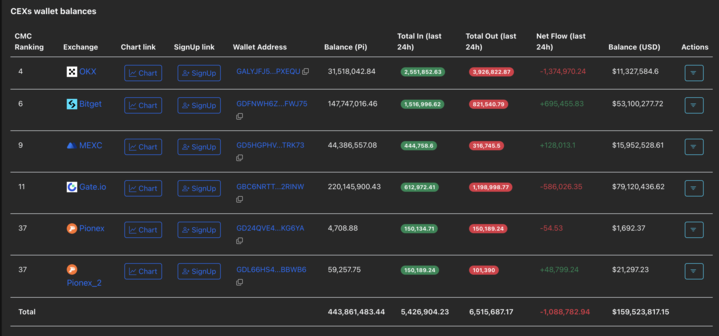

PiScan data indicates a net outflow of 1.08 million PI coins from the CEX's wallet balances, as investors accumulate at lower prices. Generally, a decline in exchange reserves often translates to lowered selling pressure, which could support prices.

CEXs wallet balances. Source: PiScan

Validating a rise in demand, PiScan data shows that four out of the five highest volume transactions on the network are from large wallet investors, popularly known as whales, withdrawing over 3.40 million PI coins. Typically, an increase in whale activity also serves as an early signal of a trend reversal.

Largest transaction on Pi Network. Source: PiScan

Selling pressure declines as PI extends consolidation

Pi Network above $0.3500 in a larger consolidation range between the $0.3220 support floor and the $0.4000 ceiling. A potential close above the $0.4000 could extend the rally to the $0.5032 level, marked by the June 22 close.

The momentum indicators on the daily chart remain unchanged as the Keltner channels sustain a sideways move, indicating lowered volatility. At the same time, the Relative Strength Index (RSI) remains flat at 50, suggesting that trend momentum is dampened.

Still, the Accumulation/Distribution line at -283 million, up slightly from -289 million on Thursday, indicates a decline in selling pressure.

PI/USDT daily price chart.

If PI slips below $0.3200, the $0.3000 round figure could act as the immediate support.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.