REX Shares Launches First US Spot ETFs for XRP and Dogecoin - Crypto Mainstream Breakthrough

Wall Street just opened its doors to two of crypto's most controversial assets—and the market's responding with bullish fervor.

REX Shares shatters regulatory barriers with groundbreaking XRP and Dogecoin ETFs, giving institutional investors direct exposure to two assets that traditional finance once dismissed as memes or legal liabilities.

The launch signals a seismic shift in institutional adoption—proving that even the most unconventional digital assets can find legitimacy when there's profit to be made. Because nothing accelerates regulatory approval faster than the prospect of management fees.

XRP's legal clarity post-SEC battle and Dogecoin's relentless retail appeal finally get their Wall Street debut—because if hedge funds can short volatility, why shouldn't they long the dog?

REX Shares launches first-ever US spot XRP and DOGE ETFs

REX Shares and Osprey Funds announced the launch of the REX-Osprey Doge ETF and REX-Osprey XRP ETF, the first US-listed products offering spot exposure to the price of DOGE and XRP, according to a statement on Thursday.

XRPR and DOJE are designed to provide seamless access through traditional brokerage accounts, holding the underlying assets directly or through related products.

The firms had filed a prospectus for the funds last week, alongside several other crypto-focused applications. The prospectus included ETFs tied to BTC, ETH, SOL, BONK and TRUMP.

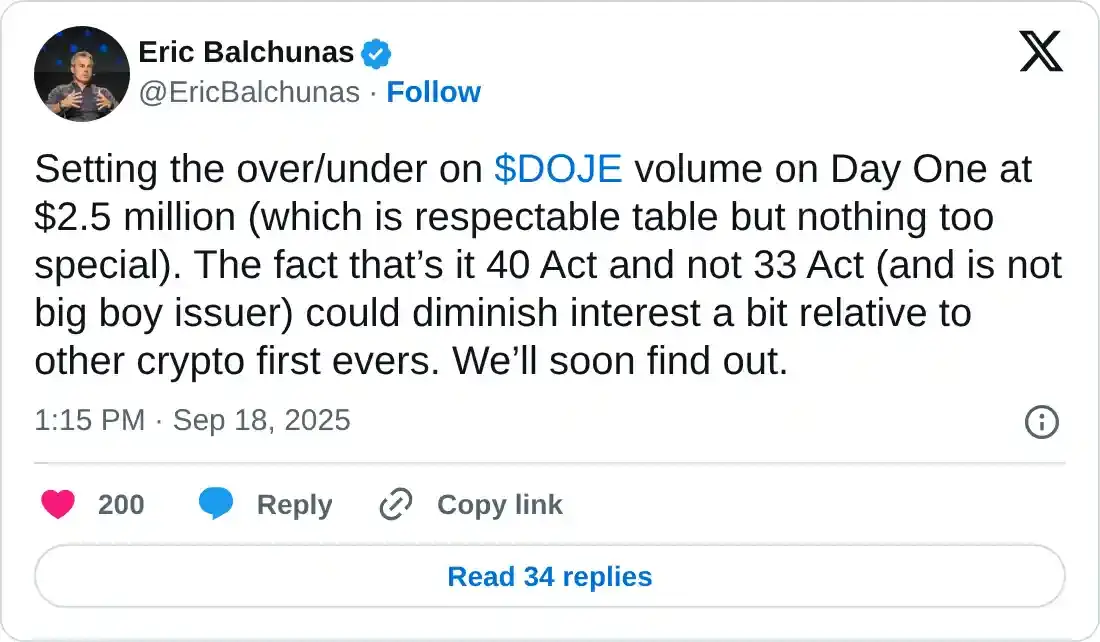

Bloomberg senior ETF analyst Eric Balchunas projected that the DOJE ETF could see up to $2.5 million in first-day trading volume, a modest debut by industry standards.

REX-Osprey previously launched a solana staking ETF (SSK) in July, marking the first time such a product was introduced to US investors. Unlike most ETF applicants that file under the Securities Act of 1933, REX-Osprey submitted its funds under the Investment Company Act of 1940.

Other firms seeking approval for dogecoin and XRP ETFs include Grayscale, 21Shares, Bitwise, WisdomTree, Franklin Templeton, Canary, CoinShares, and ProShares.

The SEC has postponed decisions on several ETF applications in the past month. However, it approved generic listing standards for spot commodity-based trust shares and ETFs, allowing exchanges to list products that meet the required criteria without needing to file a FORM 19b-4 application.

The new standards could also lower approval timelines from 240 days under the previous process to 75 days.

XRP and DOGE are trading at $3.10 and $0.282, up over 2% and 3% in the past 24 hours, respectively.