Ripple Price Forecast: XRP Bulls Regain Control as Ripple Launches Revolutionary Tokenized Money Market Funds

XRP bulls are back in the driver's seat—Ripple just dropped a game-changing tokenized money market fund that's shaking up traditional finance.

The New Digital Gold Rush

Ripple's latest move catapults XRP into the institutional investment arena, creating bridges between crypto and conventional assets that even traditional banks can't ignore. The timing couldn't be more perfect—just as Wall Street finally admits digital assets aren't going anywhere.

Market Mechanics Unleashed

Tokenization eliminates the usual friction—no more waiting days for settlements or paying outrageous intermediary fees. It's instant, transparent, and cuts out the middlemen who've been skimming profits for decades. Suddenly, money market funds operate at crypto speed.

The Institutional Floodgates

This isn't just another crypto product—it's a Trojan horse for mass adoption. Pension funds, asset managers, and conservative investors now have a compliant pathway into digital assets, all while pretending they're just doing 'normal' finance things.

Price Trajectory Recalibration

XRP's resurgence isn't accidental—it's structural. With real utility driving demand instead of mere speculation, the token's finding support levels that make short-sellers nervous. The charts are painting a picture that even traditional analysts can't dismiss.

Because nothing disrupts outdated financial systems like making them obsolete—one tokenized asset at a time.

Ripple, DBS and Franklin Templeton collaborate on tokenized MMF trading

Ripple, DBS Bank and Franklin Templeton have signed a memorandum of understanding that sets the stage for the development and launch of trading and solutions backed by tokenized money market funds (MMFs) and stablecoins.

The collaboration taps key players in the banking system, investment management sector, enterprise blockchain and related cryptocurrency solutions. It also builds on the expansion of tokenized assets globally and growing institutional interest. Ripple stated that “some 87% of institutional investors expect to make investments into digital assets in 2025.”

As part of the project, DBS Digital Exchange (DDEx) will list sgBENJI – the token of Franklin Templeton’s tokenized MMF, Franklin Onchain US Dollar Short-Term Money Market Fund, alongside Ripple USD (RLUSD).

The setup would enable eligible clients to trade RLUSD for sgBENJI tokens, ensuring portfolio rebalancing within minutes while maintaining yield during volatile periods.

“Leveraging Franklin Templeton’s expertise in blockchain technologies and digital assets, we are excited to partner with DBS and Ripple to introduce cutting-edge trading and lending solutions for investors,” Roger Bayston, head of digital assets at Franklin Templeton, stated.

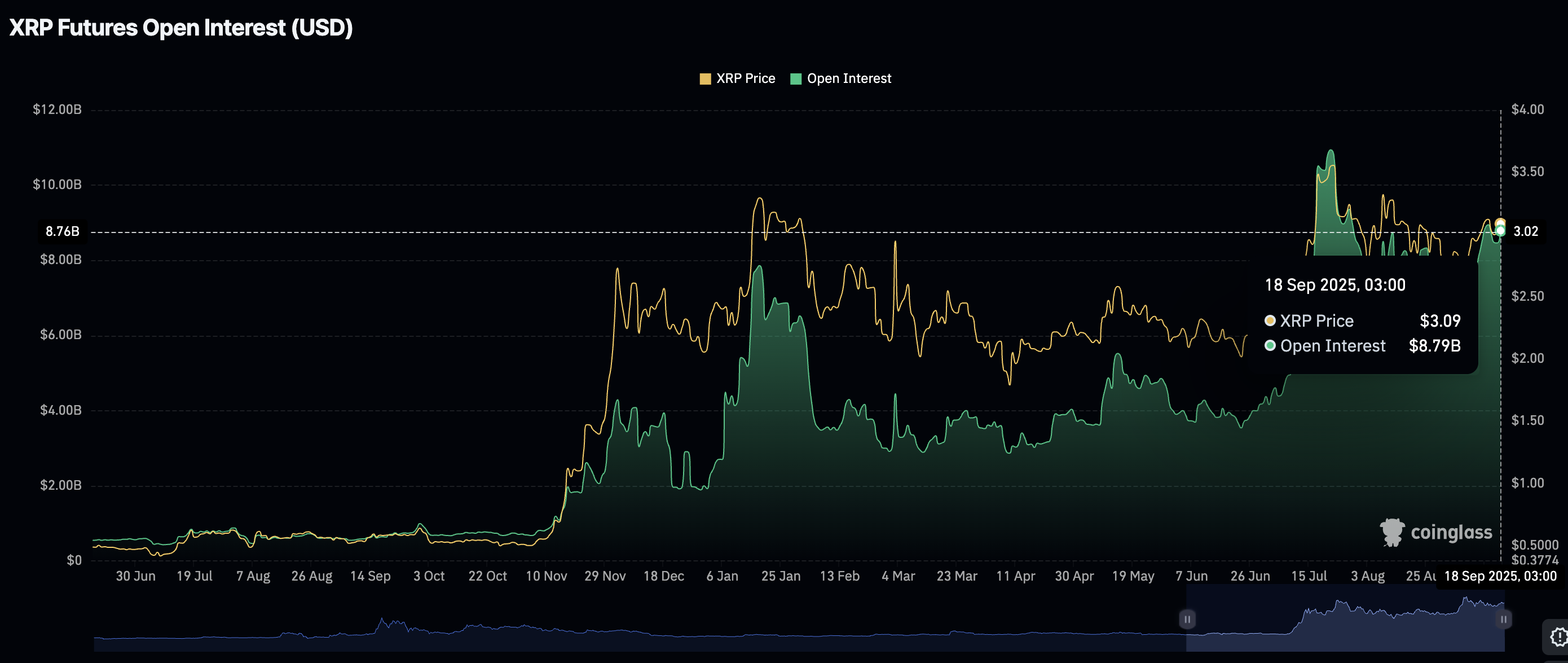

In the meantime, retail demand for XRP is growing, with the futures Open Interest (OI) averaging at $8.79 billion on Thursday, up from $7.37 billion on September 7.

If the OI, referring to the notional value of outstanding futures contracts, steadily rises in the coming days, it will indicate that more traders are betting on short-term price increases in XRP.

A higher risk-on sentiment supports a recovery in the XRP price, as the path of least resistance remains upward.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP gains bullish momentum

XRP remains above $3.12 at the time of writing on Thursday, supported by a strong technical structure. The dovish macro outlook presented by the Fed on Wednesday has led to an improvement in risk-on sentiment, resulting in steady demand for XRP.

Bulls have the upper hand based on the position of the Relative Strength Index (RSI) at 60 and rising. Higher RSI readings approaching overbought territory WOULD indicate growth in bullish momentum, as bulls look toward the record high of $3.66.

XRP/USDT daily chart

Key areas of interest for traders are the short-term hurdle at $3.18, which was previously tested on Saturday, the supply area around $3.35, tested in mid-August and the record high of $3.66. On the other hand, if profit-taking takes centre stage, price corrections would meet support provided by the 50-day Exponential Moving Average (EMA) at $2.95 and the 100-day EMA at $2.82.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.