Bitcoin Price Forecast: BTC Eyes $120,000 Following FOMC Dovish Stance - Here’s Why It Could Happen Sooner Than You Think

Bitcoin's bull run just got a major boost from the Fed's unexpected dovish pivot—and $120,000 is now firmly in sight.

The Federal Open Market Committee's latest stance signals lower rates for longer, sending traditional investors scrambling for inflation-resistant assets. Bitcoin, with its fixed supply and decentralized nature, stands to benefit big time.

Why $120,000? It’s not just hopium. Market structure, institutional inflows, and macro conditions align like never before. Plus, let's be real—after years of 'to the moon' predictions, even Wall Street analysts are finally catching on.

Of course, nothing’s guaranteed in crypto. Volatility remains the name of the game. But with the Fed playing nice and adoption accelerating, this rally has legs.

Just remember—while Bitcoin’s heading north, your bank’s savings account is still paying 0.5%. Some things never change.

Bitcoin trades above $117,000 following the Fed's 25 bps rate cut

Bitcoin price holds above $117,000 in Thursday’s European session, after rebounding from the $116,000 support level following the Federal Open Market Committee’s (FOMC) 25 bps rate cut on Wednesday, which fueled risk appetite across crypto markets.

Market participants largely anticipated the 25 bps rate cut as explained in the previous report, but attention centered on the FOMC’s latest Summary of Economic Projections (SEP), also known as the dot plot, which indicates that interest rates WOULD average 3.6% by the end of 2025, below the June projection of 3.9%.

If this forecast comes true, the Fed could implement two additional 25 bps rate cuts or a single 50 bps cut in 2025, after trimming the interest rate by 25 bps on Wednesday. Moreover, in 2026, rates are projected to drop to 3.4% from the previous 3.6% and to 3.1% in 2027, below the 3.4% projected in the June DOT plot. The longer-term forecast remains at 3%.

This dovish stance by the Fed triggered a risk-on sentiment, supporting riskier assets such as BTC. Traders now look forward to Thursday's US economic docket, featuring the release of the usual Weekly Initial Jobless Claims and the Philly Fed Manufacturing Survey, for some fresh impetus for Bitcoin later during the North American session.

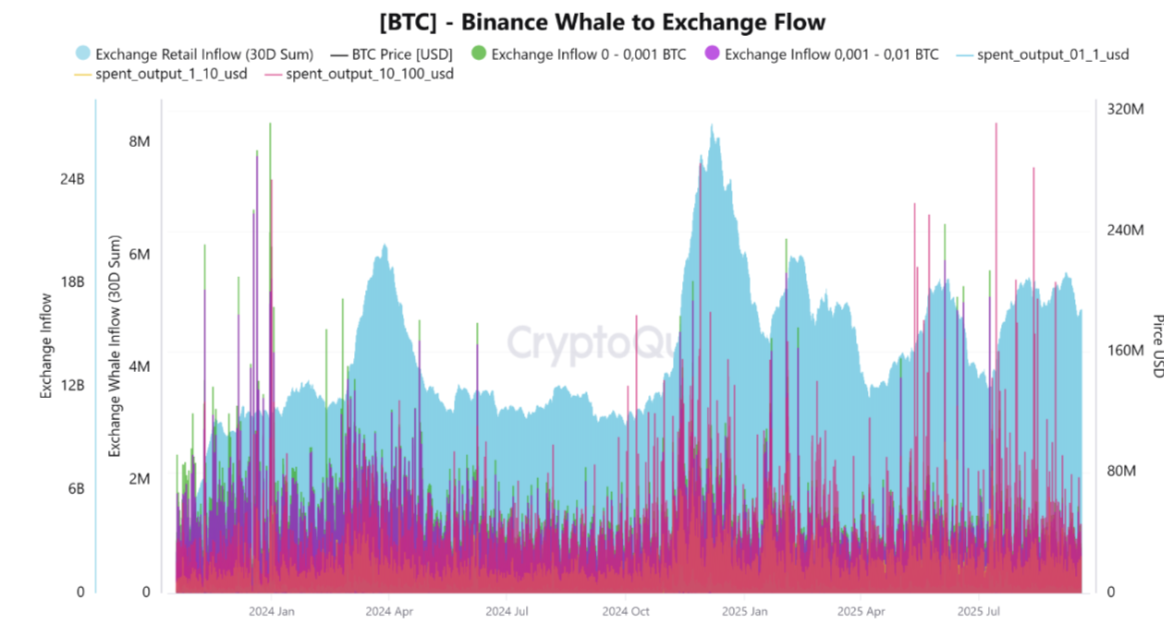

On-chain data show a retail-driven market

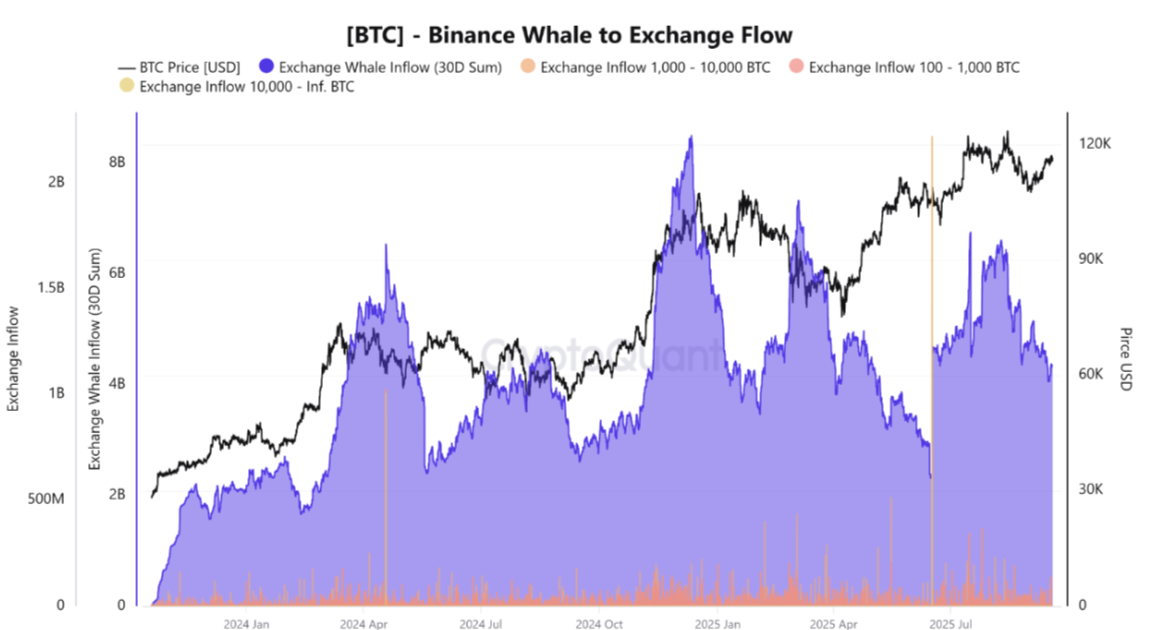

CryptoQuant data indicate that bitcoin trading on the largest exchange, Binance, reveals the absence of large whale inflows, suggesting that the market is currently driven more by individuals than by large wallets.

The graph below shows that the wallets holding (0 to 0.001) BTC recorded approximately 97,000 BTC, while inflows in the (0.001 to 0.01) BTC wallets amounted to about 719,000 BTC.

This accumulation pattern highlights that retail investors are currently driving the market through numerous small-volume transactions, supporting a gradual climb toward $120,000.

Though traders should remain cautious, as a sudden influx of whale activity could swiftly trigger a correction and shift market direction.

Mild dip in institutional inflow

SoSoValue data shows that Bitcoin spot Exchange Traded Funds (ETFs) recorded a mild outflow of $51.28 million on Wednesday, breaking the streak of inflows since September 8.

However, these outflows remained relatively minor, as institutional investors held back from making major moves ahead of the FOMC decision, a development traders should closely monitor.

Bitcoin Price Forecast: BTC finds support around $116,000

Bitcoin price recovered slightly last week but faced resistance around the daily level of $116,000 on Saturday, experiencing a mild rejection the following day. At the start of the week, Bitcoin failed to close above resistance on Monday, but by Tuesday it successfully broke through, later finding support around the same level the next day. At the time of writing on Thursday, BTC trades above $117,000.

If BTC continues its upward momentum, it could extend the rally toward the psychological level at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 61, remaining steady above the midline and reflecting bullish momentum. The Moving Average Convergence (MACD) indicator on the same chart displayed a bullish crossover on September 6, which remains in effect, indicating sustained bullish momentum and an upward trend ahead.

BTC/USDT daily chart

On the contrary, if BTC corrects and closes below the $116,000 support level, it could extend the decline toward the 50-day Exponential Moving Average (EMA) at $113,800.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.