Pump.fun Token Surges Toward All-Time High as Bullish Momentum Ignites on Explosive Revenue Growth

Pump.fun's native token rockets toward unprecedented territory—fueled by staggering revenue figures that defy traditional market skepticism.

Revenue Engine Ignites Rally

The platform's revenue metrics aren't just growing—they're exploding. While legacy finance scrambles to understand the model, Pump.fun's tokenomics demonstrate that in crypto, traction often trumps tradition. No fancy prospectus needed when the numbers do the talking.

Market Momentum Builds

Traders flock to the token as bullish signals multiply. The climb toward all-time highs reflects more than speculation—it's a validation of the platform's revenue-driven approach. Forget waiting for quarterly reports; here, performance updates in real-time.

Another day, another crypto project making traditional VCs question their spreadsheets—but who needs dividends when you've got momentum like this?

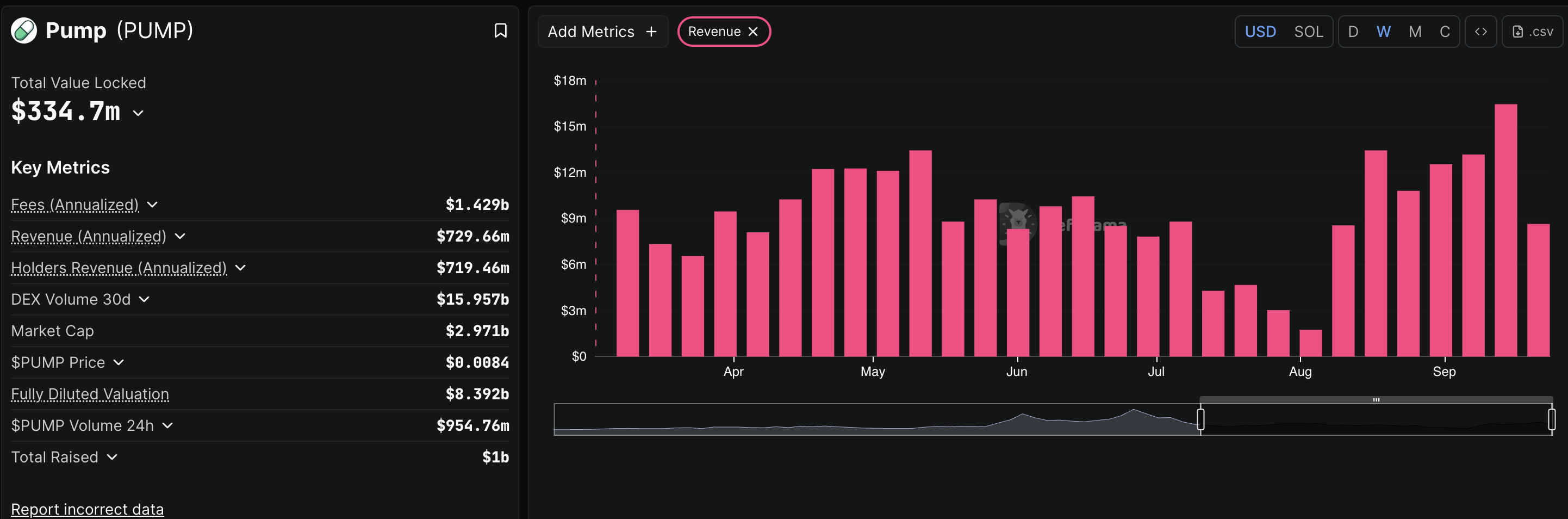

Pump.fun records strong revenues

A streamlined inflow of revenue suggests a steady demand for a protocol. The weekly revenues for Pump.fun have stayed over $10 million in the previous four straight weeks, suggesting a high demand for token generation in the cryptocurrency market. The revenue has reached $8.65 million so far this week, and it is likely to continue the streak.

Pump.fun weekly revenues. Source: DeFiLlama

Amid the heightened interest, Pump.fun recently paid out over $4 million in creator rewards, mainly to first-time creators, as posted on the official X account on Monday. This indicates increased adoption of the platform.

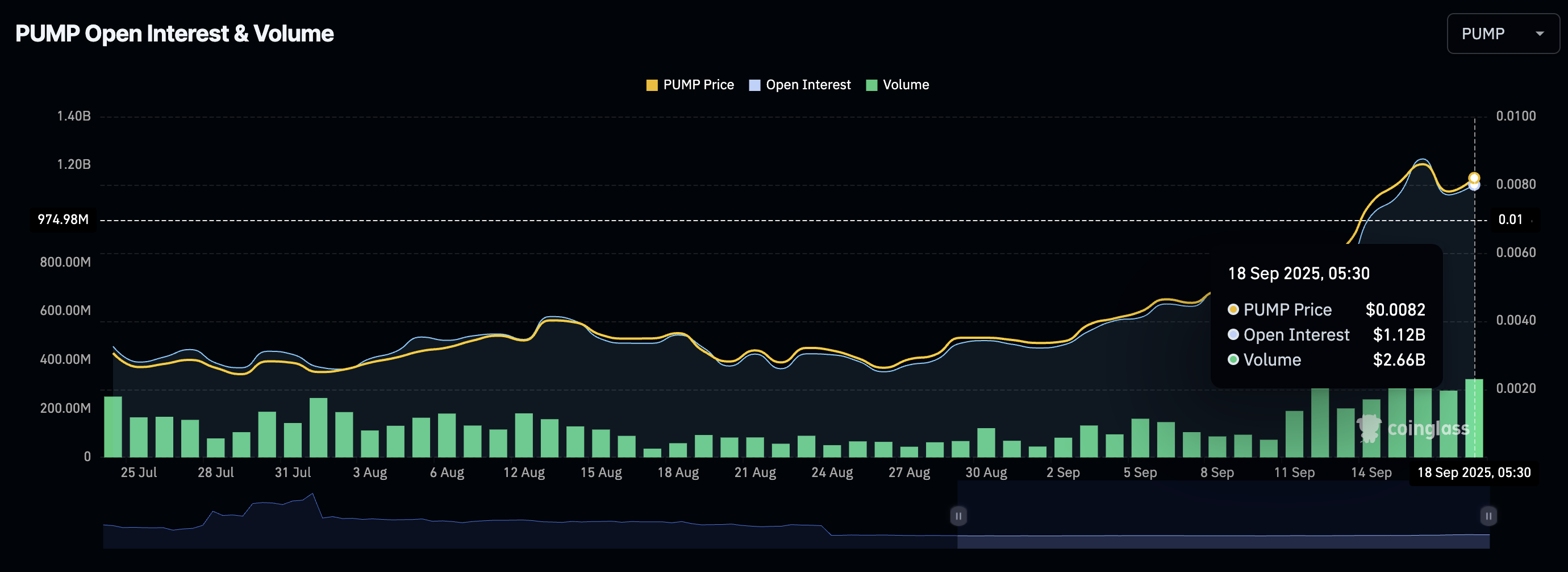

Bullish bets on the rise

CoinGlass data shows that the PUMP Open Interest stands at $1.22 billion, up from $1.08 billion on Wednesday. This sudden capital inflow in the PUMP derivatives indicates increased interest of traders, signaling a risk-on sentiment.

PUMP Open Interest. Source: CoinGlass

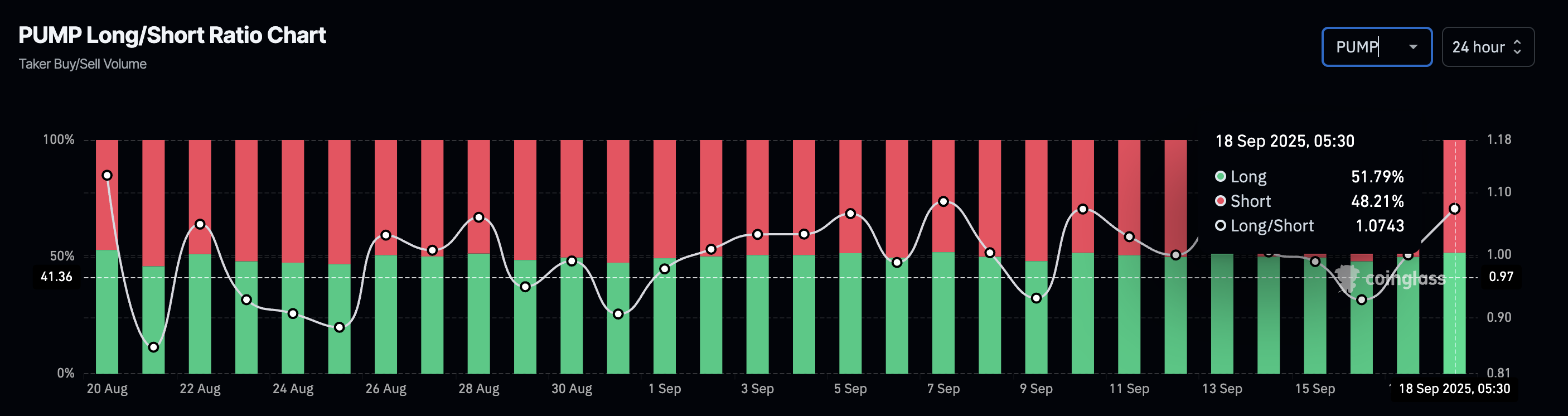

Adding to the optimism, an increase in the Taker Buy/Sell Volume indicator shows that long positions have surged to 51.79%, from 50.01% in the last 24 hours.

PUMP Long/Short Ratio. Source: CoinGlass

PUMP prepares for further recovery

PUMP edges higher by 1% at press time on Thursday, surpassing a short-term resistance trendline that marks a bullish flag pattern breakout on the 4-hour chart. The breakout rally targets the R1 pivot level at $0.009793, which acts as the immediate resistance.

Adding to the upward trend, the Moving Average Convergence Divergence (MACD) rises towards its signal line, hinting at a potential crossover as bearish momentum declines. Furthermore, the Relative Strength Index (RSI) holds steady above the halfway line at 60, suggesting that the buying pressure is heightened.

PUMP/USDT 4-hour price chart.

On the downside, a potential pullback under the 50-period Exponential Moving Average (EMA) at $0.007165 WOULD invalidate the pattern breakout. This could result in a decline to the 100-period EMA at $0.006134.