🚀 Crypto Price Forecast: SUI, MYX Finance & Ethereum Set to Explode — Asian Market Wrap September 18

Asian markets wake up to crypto fireworks as three major players signal explosive moves.

SUI breaks consolidation pattern—technical indicators scream bullish divergence across Asian exchanges. Trading volume spikes 40% as institutional money floods in from Tokyo to Singapore.

MYX Finance defies market gravity with its perpetual DEX innovation. The token rips through resistance levels while traditional finance dinosaurs still debate 'blockchain potential.'

Ethereum maintains dominance as the smart contract king. Network activity hits record highs despite Wall Street analysts calling it 'overvalued' at current levels—same guys who missed Bitcoin at $100.

These assets don't just track markets—they rewrite the rules. While traditional finance plays checkers, crypto plays 4D chess with algorithmic precision.

Sui Price Forecast: SUI bulls target double-digit gains with $4.44 in sight

Sui (SUI) price trades in green, above $3.80 on Thursday after rebounding from its key support level earlier in the week. The bullish view is further supported by rising Decentralized Exchange (DEX) activity and favorable funding rates. The technical indicators project sui for further upside, with bulls eyeing the $4.44 resistance level as the next major target.

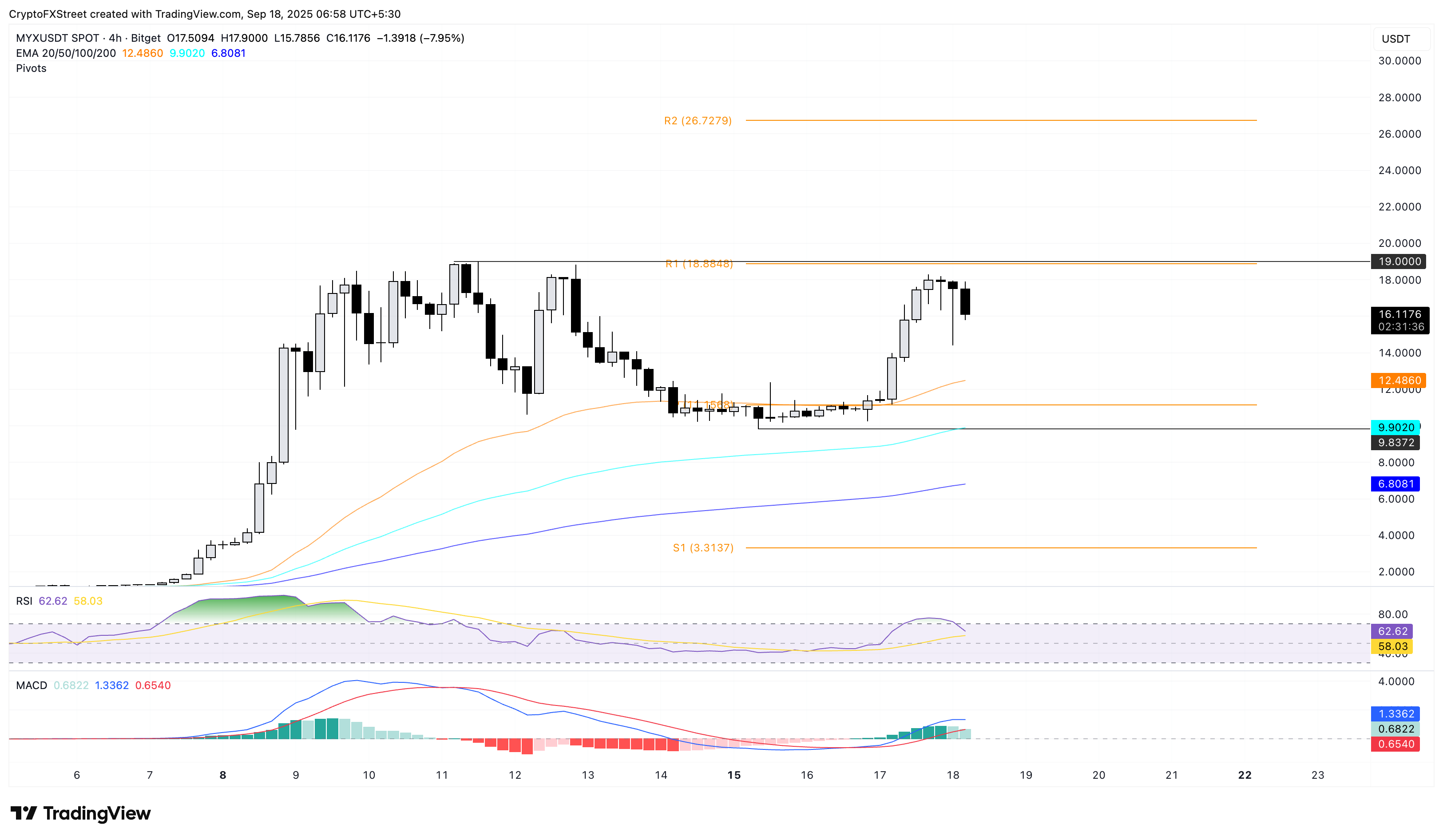

MYX Finance sustains rally as meme coins MemeCore, Fartcoin rebound

MYX Finance trades above $16, retracing nearly 6% at press time on Thursday following the 52% gains from the previous day. The intraday pullback reflects a reversal from an area close to the all-time high of $19.00 on the 4-hour chart. If the pullback intensifies, MYX could test the 50-period Exponential Moving Average (EMA) at $12.48, followed by the $9.83 support level marked on Monday.

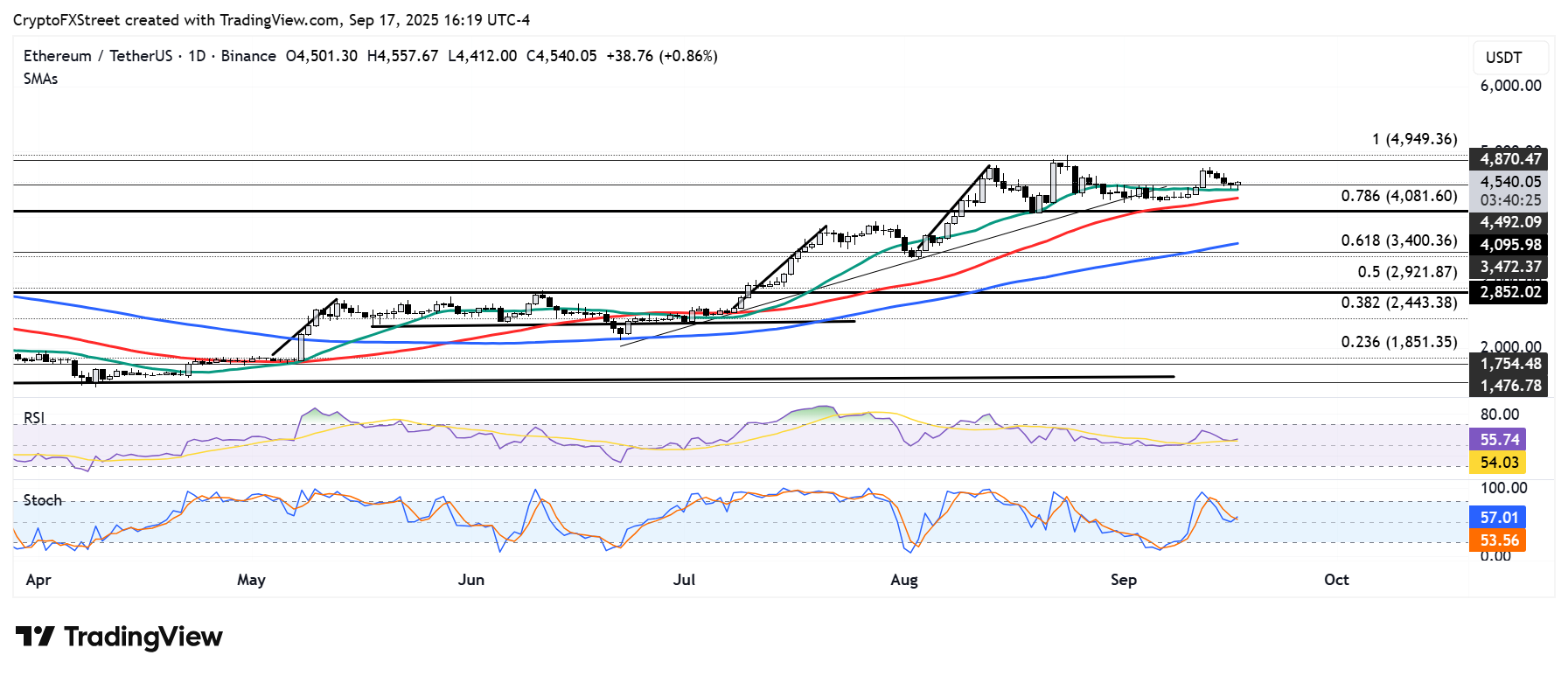

Ethereum Price Forecast: ETH on-chain data shows bullish signs as Fed cut rates

Ethereum (ETH) on-chain data shows bullish signs as the Federal Reserve (Fed) reduced its interest rate by a quarter percentage point on Wednesday. ethereum investors may be leaning toward a potential uptrend with the resumption of a Fed pivot, following rising whale demand, low selling pressure, network activity recovery, and an increasing stablecoin supply, according to CryptoQuant data.