MYX Finance’s Rally Continues as MemeCore and Fartcoin Stage Impressive Rebound

Meme coins defy gravity—again. MYX Finance's sustained rally pairs with surprise rebounds from MemeCore and Fartcoin, proving once more that in crypto, even the jokes have serious momentum.

Market Mania or Calculated Moves?

Traders pile into volatile assets as MYX maintains its upward trajectory. MemeCore's sudden surge catches skeptics off-guard while Fartcoin—yes, Fartcoin—quietly doubles in a week. No fundamental news, no major partnerships—just pure, unadulterated speculative fever.

The Institutional Wink

Behind the meme madness, MYX's infrastructure gains quiet backing from mid-tier funds looking for leverage plays. Their platform's tokenomics somehow justify holding through the turbulence, even as cartoon dog coins and flatulence-themed tokens steal headlines.

When the Dust Settles

This isn't investment advice—it's market anthropology. Meme coins pump, serious projects build, and everyone pretends they knew it all along. Another day in digital finance, where the only thing more inflated than token valuations are the egos of those who guess right.

Renewed interest in meme coins

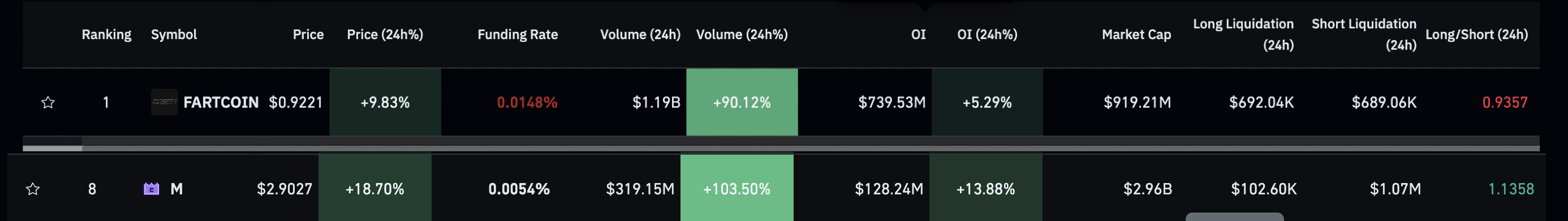

Typically, a reduction in interest rates fuels the risk-on sentiment among traders due to easy access to liquidity, which could increase the exposure to risk assets such as high-risk cryptocurrencies like meme coins. CoinGlass data shows a similar trend as the Open Interest (OI) of MemeCore and Fartcoin surge 5% and 13% reaching $739 million and $128 million, respectively, over the last 24 hours. This spark in OI reflects increased capital inflow in the derivatives market, as traders gain confidence.

Meme coins Open Interest. Source: Coinglass

On the other hand, MYX Finance's OI remains broadly steady at $216 million, indicating that the interest could have peaked out.

MYX Open Interest. Source: Coinglass

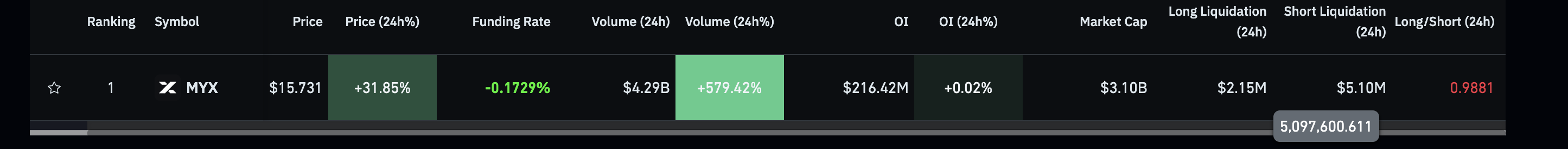

MYX Finance rally takes a breather

MYX Finance trades above $16, retracing nearly 6% at press time on Thursday following the 52% gains from the previous day. The intraday pullback reflects a reversal from an area close to the all-time high of $19.00 on the 4-hour chart.

If the pullback intensifies, MYX could test the 50-period Exponential Moving Average (EMA) at $12.48, followed by the $9.83 support level marked on Monday.

The momentum indicators on the 4-hour chart indicate a cooldown in the uptrend as the Relative Strength Index (RSI) curves down from the overbought zone to 62, with further space on the downside before reaching the halfway line. Additionally, the Moving Average Convergence Divergence (MACD) and its signal line maintain a steady rise, but the decline in green histogram bars suggests lowered bullish momentum.

MYX/USDT 4-hour price chart.

Looking up, if MYX crosses above the $19.00 peak, it could extend the rally to the R2 pivot level at $26.72.

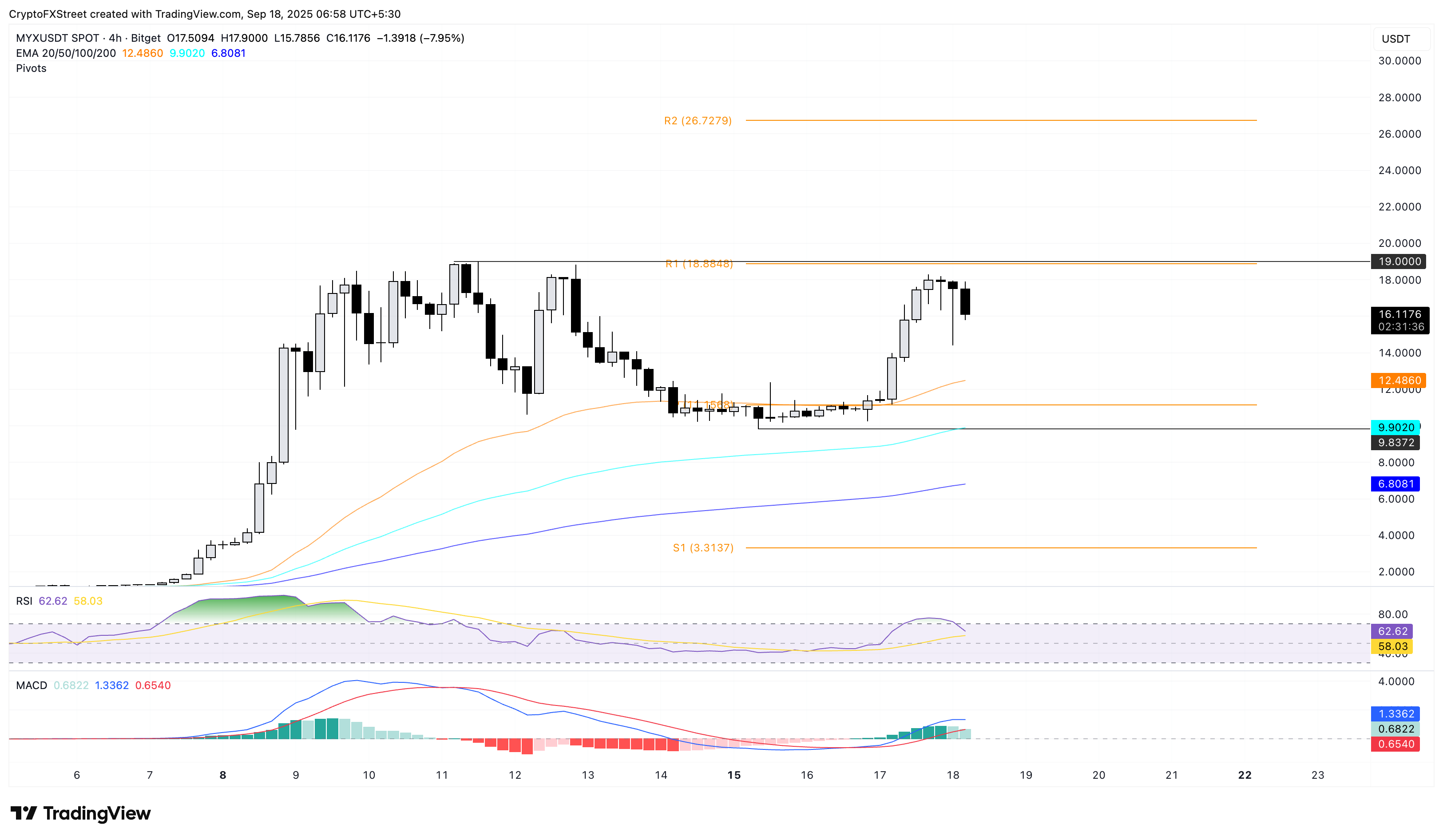

MemeCore eyes further gains above $3.00

MemeCore edges higher by 3% at the time of writing on Thursday, extending the 15% rise from Wednesday. The bulls anticipate this meme coin to surpass the $3.00 milestone as it reached a record high of $2.99 on the previous day.

A decisive close above the $3.00 mark could target the $3.19 level, aligning with the R2 pivot level.

The momentum indicators on the 4-hour chart uphold a buy signal as RSI remains overbought at 75, suggesting heightened buying pressure, while the MACD crosses above its signal line, indicating a bullish shift in trend.

M/USDT 4-hour price chart.

On the downside, if MemeCore flips before reaching the $3.00 mark, the 50-period EMA at $2.31 could act as the immediate support level.

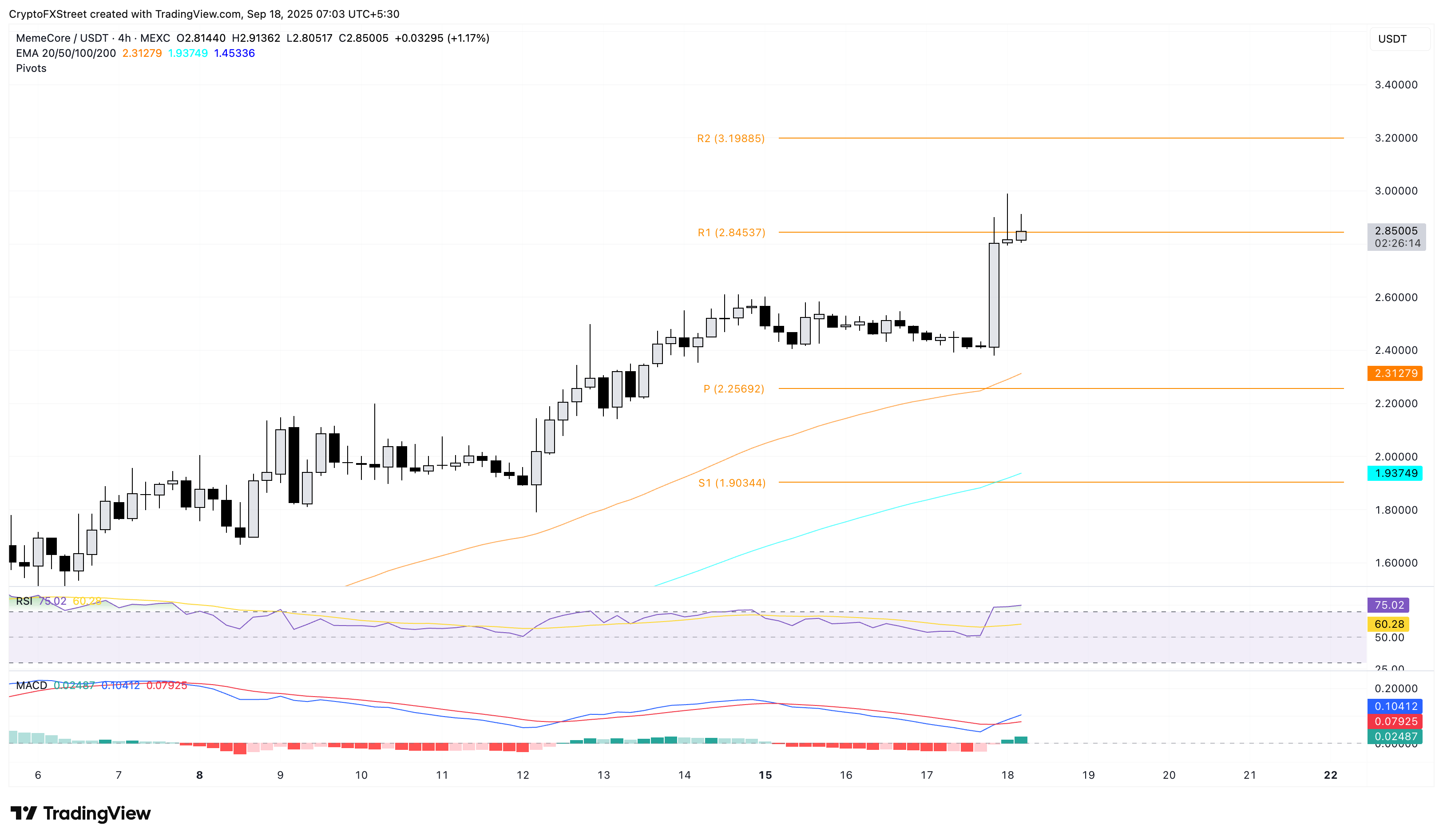

Fartcoin struggles at the 200-day EMA

Fartcoin edges lower by 1% from the 200-day EMA at $0.9309 at press time on Thursday, struggling to extend the 6.76% gains from the previous day. The intraday pullback halts the two straight days of recovery, reflecting a slowdown in the falling wedge breakout rally on the daily chart.

If FARTCOIN exceeds the 200-day EMA at $0.9309, it could extend the rally to the 50% retracement level, which is drawn from the July 22 peak at $1.6900 to the September 2 low of $0.6835, at $1.0748.

The RSI holds a steady MOVE above the halfway line at 54, suggesting a bullish incline. At the same time, the MACD hits the zero line as the signal line follows, indicating a rise in bullish momentum.

Fartcoin/USDT daily price chart.

Looking down, if Fartcoin extends the intraday pullback, it could retest the $0.6839 support floor.