ARK Invest’s Bullish Holdings Near $130M with Latest $8.2M Crypto Scoop

ARK Invest just dropped another $8.2 million into crypto—pushing their total holdings toward that $130 million mark. Because why diversify when you can just double down?

Building the digital gold rush

They're not just buying—they're accumulating. While traditional funds hedge and hesitate, ARK's charging ahead with conviction. That latest scoop isn't just a trade—it's a statement.

Wall Street's watching—and sweating

Mainstream finance still can't decide if crypto's the future or a fad. Meanwhile, ARK's stacking assets like they're getting paid in volatility—wait, they are. Guess someone forgot to tell them that 'prudent investing' means keeping 80% in bonds that yield less than inflation.

This isn't speculation—it's strategy. While the old guard debates regulatory risks, the new school's already counting gains. Sometimes the boldest move isn't a complex algorithm—it's recognizing that digital assets aren't going anywhere but up.

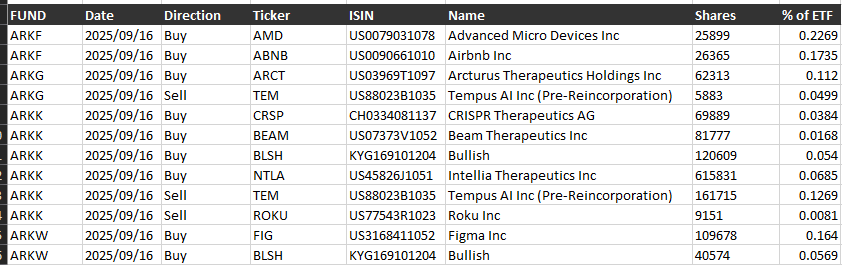

ARK Invest bought more than 160,000 shares in Bullish across ARKK and ARKW. Source: ARK Invest.

ARK has backed Bullish since its debut on the New York Stock Exchange last month, when it acquired 2.53 million shares, worth $172 million at the time.

ARK’s latest buy aims to rebuild bullish position

The investment firm bought $7.5 million shares in Bullish earlier this month, and had acquired $21 million worth of Bullish stock on Aug. 20.

Despite the recent buys, Ark’s total Bullish holdings across all three of its ETFs currently stand at 2.52 million shares, indicating that the firm has booked some partial profits and is now reacquiring the stock after it fell heavily since its debut.

Bullish stock declines post-IPO

Shares in Bullish (BLSH) soared on its listing day, as the stock touched an intraday high of $118, registering a gain of 218% from its IPO price of $37.

However, since its debut on Aug. 13, the stock has shed most of its gains and closed trading on Tuesday flat at $51.36, down nearly 57% from its all-time high, according to Google Finance.

The firm reported its revenue dropped 0.2% year-over-year as of the quarter ending March, while its operating income was down 270% during the same period.

Bullish is set to release its second-quarter results on Thursday, its first since its debut.

Analysts are mixed on the exchange, with some neutral, while others are optimistic that it can outperform.

Last week, Jefferies initiated a “hold” rating on Bullish, while JP Morgan and Bernstein assigned a “neutral” rating, according to Yahoo Finance.

Conversely, Cantor Fitzgerald had an “overweight” rating, meaning it thinks Bullish will outperform.

Ark has been accumulating other crypto-related stocks in recent months.

It acquired $4.4 million in BitMine on Sept. 9, which increased its total stack to 6.7 million BitMine shares worth $284 million.

The firm also bought shares of Jack Dorsey-backed financial services company Block, and held $193 million worth of Block shares on Aug. 12.