Ethereum’s Rally to $6,000+ Just Got Its Next Major Catalyst

Ethereum's momentum is building—and the push toward $6,000 looks more inevitable than ever.

Why the surge? Market sentiment is shifting. Institutional interest is climbing. And the tech? It’s not just holding up—it’s accelerating.

No fluff, no hype. Just raw, actionable momentum. Forget waiting for the 'right time.' The runway is clear.

And let’s be real—if traditional finance had moved this fast, we’d all be retired by now.

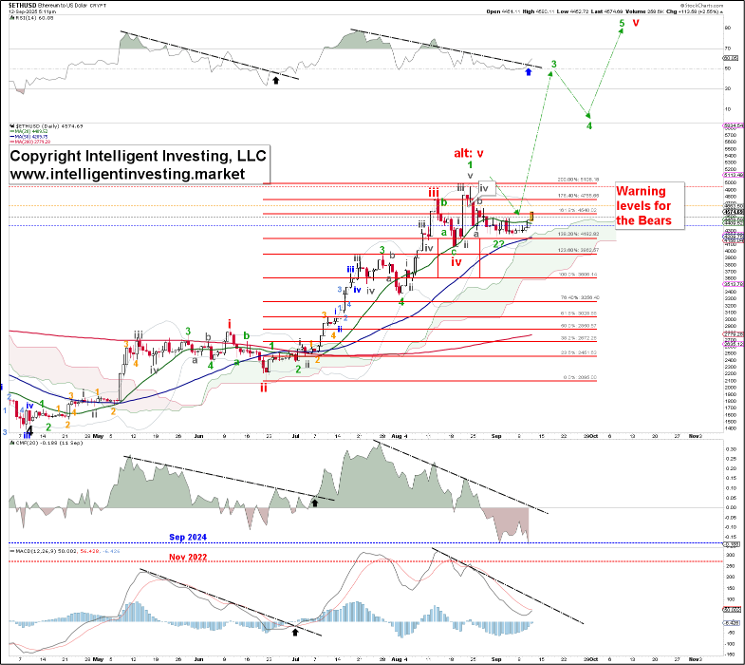

However, now we need to focus on the “we may see an extended fifth wave, which is quite common for cryptocurrencies,” part.

Specifically, the rally from the red W-iv low to the $4955 high was probably (green) W-1 of W-v. The fifth wave seems to be setting up for a subdividing extension. That indicates the September 1 low at $4212 was green W-2, and now the green W-3, aiming for $5655+, is in progress. Furthermore, to validate our Bullish EWP thesis, we require an additional objective tool. We added black dotted downtrend lines to the following technical indicators: the RSI14, CMF, and MACD. In June-July, these indicators then broke above their downtrend lines, marked by black arrows, signifying the start of a new uptrend. Once the CMF broke higher in early July, Ethereum gained nearly 100%.

Today, the RSI14 broke above its current downtrend line, marked by a blue arrow, and we are waiting for the MACD and CMF to follow suit. When they do, we expect the red W-v to be in full swing, targeting at least $6000 (the 200.0% extension of the green W-1), but more likely closer to $6140, possibly as high as $9000. See Figure 2 below.