Cardano’s 2025 Surge: 4 Key Catalysts Set to Ignite ADA’s Rally

Cardano's poised for a breakout—technical upgrades, institutional adoption, and ecosystem growth converge to fuel its ascent.

Smart Contract Revolution

Enhanced scalability solutions go live, processing transactions faster than traditional banking networks—while costing pennies.

Institutional Inflows

Major funds quietly accumulate ADA positions, recognizing its proof-of-stake efficiency over energy-guzzling alternatives.

DeFi Ecosystem Expansion

Native projects launch innovative financial instruments—staking yields outperform Treasury bonds without the paperwork nightmare.

Regulatory Tailwinds

Clear frameworks emerge, giving Cardano's scientifically-backed approach an edge over meme coin speculation. Because nothing says 'serious investment' like peer-reviewed code.

Watch for ADA to capitalize on these fundamentals while other chains struggle with congestion fees—sometimes the boring choice delivers explosive returns.

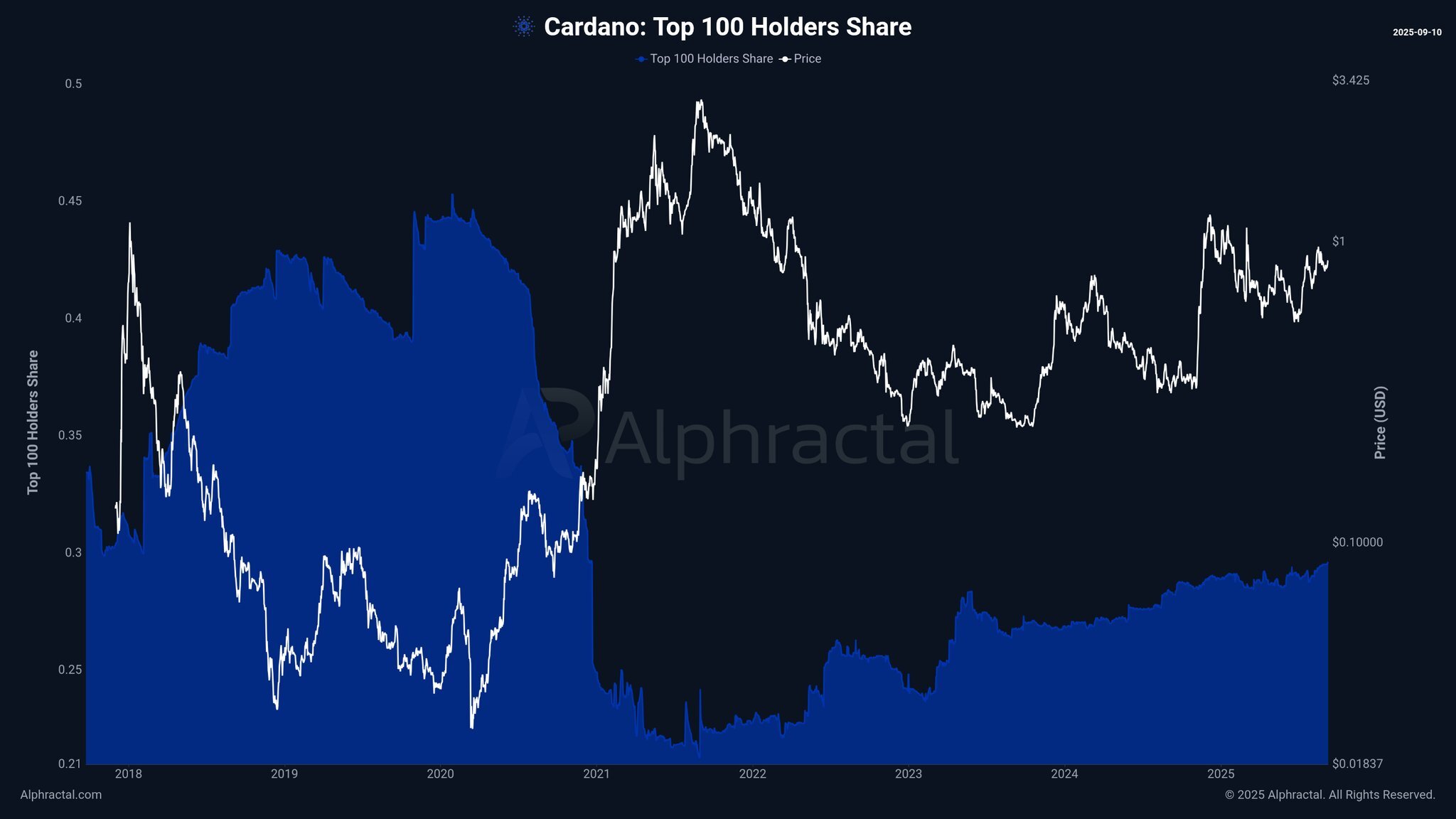

1. Large addresses continue accumulating ADA, showing long-term confidence

According to the latest data from Alphractal, 29.6% of ADA’s total supply is held by the top 100 addresses, the highest level since 2021. These whales are still buying more, as shown in a steady upward trend on-chain despite ADA’s lackluster price.

ADA TOP 100 Holders Share. Source: Alphractal

In addition, around 19 billion ADA, or 54% of the circulating supply, belongs to long-term holders who have kept their coins across multiple market cycles.

ADA Supply Held LTH. Source: Alphractal

In crypto history, whale accumulation often precedes powerful rallies, as seen with ADA in 2021. These on-chain signals highlight strong conviction from both large investors and long-term holders in the Cardano ecosystem.

In other words, it seems that major investors in the cardano ecosystem remain confident in the project's future,” Joao Wedson, founder of Alphractal, commented.

2. Grayscale plans to stake all ADA in Its ETF, boosting fund value

Another major development comes from Grayscale, a leading crypto asset manager. According to filings with the SEC, Grayscale intends to stake all ADA held in its Cardano ETF (GADA).

Staking rewards will be reinvested into the fund after fees, increasing shareholder value. This move reflects Grayscale’s confidence in ADA and fuels Optimism among ADA holders and new investors alike.

However, the plan still requires SEC approval of the ADA ETF. Currently, Polymarket prices the odds of approval in 2025 at 87%, the highest so far.

Previously, in August, Grayscale filed for a Cardano ETF. The SEC’s final decision is due in October.

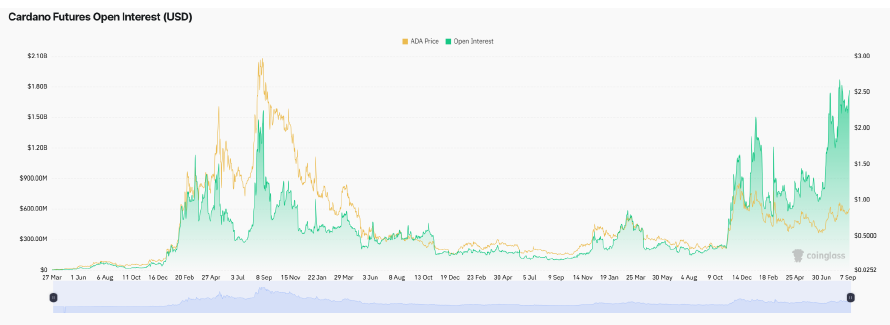

3. ADA futures open interest surpasses 2021 peak, indicating strong speculative interest

The derivatives market is heating up for ADA. Over the past month, ADA's future open interest has stayed above $1.6 billion daily—the highest since 2020, according to Coinglass.

Cardano Futures Open Interest. Source: Coinglass

This sudden surge shows booming Leveraged trading, as speculators rush into long and short positions, betting on major volatility.

On one hand, high leverage creates liquidation risks when markets swing. On the other hand, it reflects traders' increasing exposure to ADA. Historically, surges in open interest have coincided with ADA’s uptrends, such as in 2021.

4. Technical analysis points to a massive symmetrical triangle, breakout imminent

On the charts, ADA is forming a large symmetrical triangle pattern on the weekly timeframe.

According to Sheldon The Sniper, a well-known technical analyst on X, ADA could soon break above the triangle’s resistance and target $2, or even $3.

ADA Symmetrical Triangle. Source: Sheldon The Sniper

Cardano is lining up multiple catalysts for a comeback. Whale accumulation, Grayscale’s support, rising derivatives activity, and technical signals all point in one direction: an explosive breakout.

Still, macroeconomic factors such as interest rates remain powerful forces that could override these trends. If favorable, they could push ADA back to previous highs as projected. If not, ADA and the broader crypto market may face downside risks.