Aethir Price Forecast: ATH Soars as Compute Hours Explode to 340 Million in Q3

Aethir's native token rockets to unprecedented heights—fueled by staggering infrastructure adoption that's rewriting cloud computing economics.

Infrastructure Goes Supernova

340 million compute hours deployed last quarter alone. That's not growth—that's vertical takeoff. Enterprises and developers are voting with their code, abandoning legacy cloud providers for decentralized alternatives that actually scale.

Market Mechanics Shift

Every compute hour burns tokens. Every transaction locks liquidity. Traditional valuation models can't capture this flywheel effect—analysts are playing catch-up while the network effect accelerates.

Wall Street's Blind Spot

Meanwhile, traditional finance still thinks cloud computing means buying more AWS credits. They're measuring uptime while missing the paradigm shift—decentralized infrastructure isn't just cheaper, it's fundamentally smarter.

Price discovery becomes inevitable when utility reaches escape velocity. The numbers don't lie—even if some fund managers still do.

Aethir surges as “oil of the AI era,” compute demand fuels growth

Aethir price has surged more than 90% so far this week, reaching a four-month high, with its market capitalization climbing past $683.92 million on Friday, according to CoinGecko data, shown below.

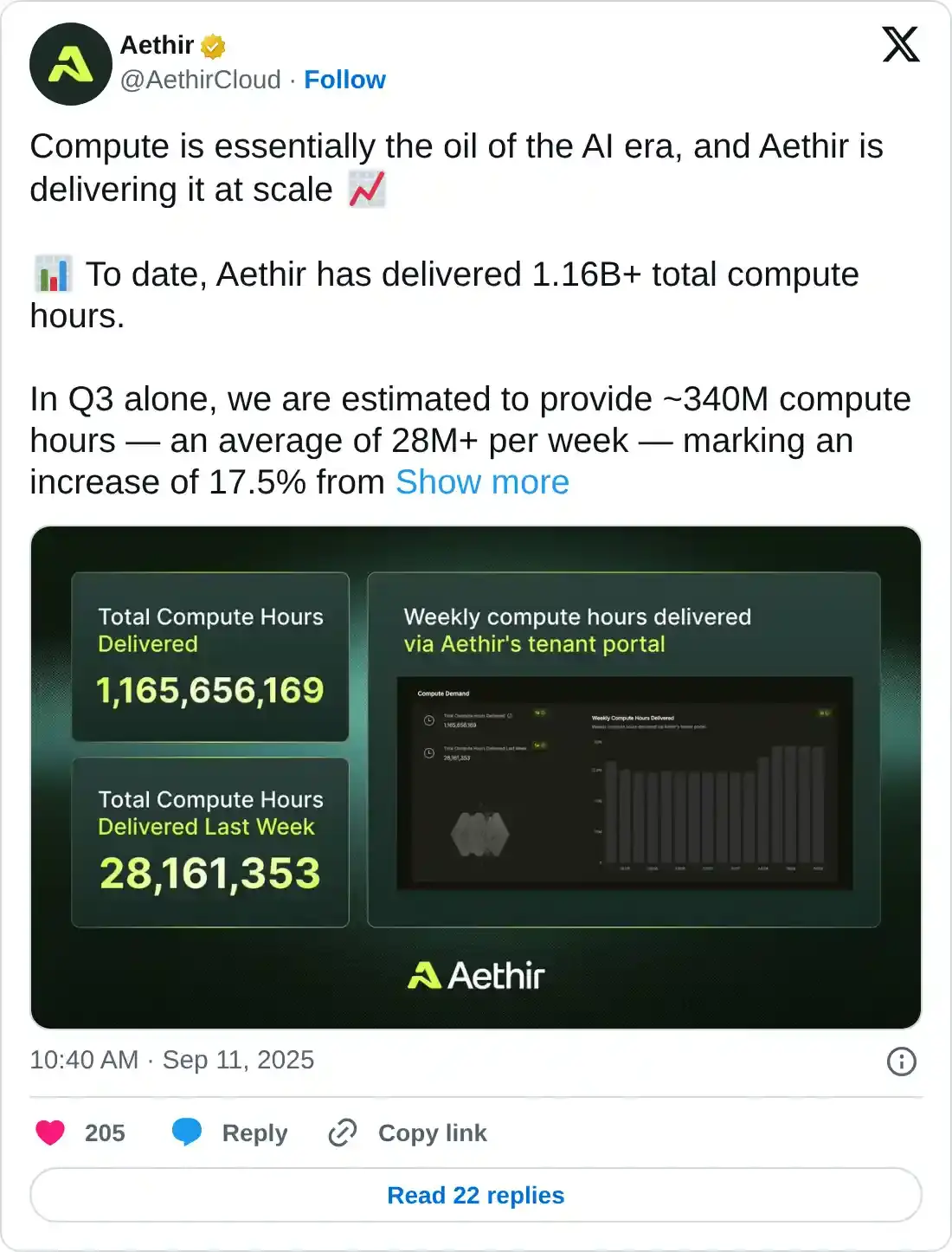

This rally comes as demand for compute—often described as the oil of the AI era—continues to grow, with Aethir delivering it at scale. In Q3, ATH provided 340 million compute hours, with an average of over 28 million per week, representing a 17.5% increase from the previous quarter. Moreover, since its launch, Aethir’s Decentralized Physical Infrastructure Network (DePIN) has delivered more than 1.16 billion total compute hours.

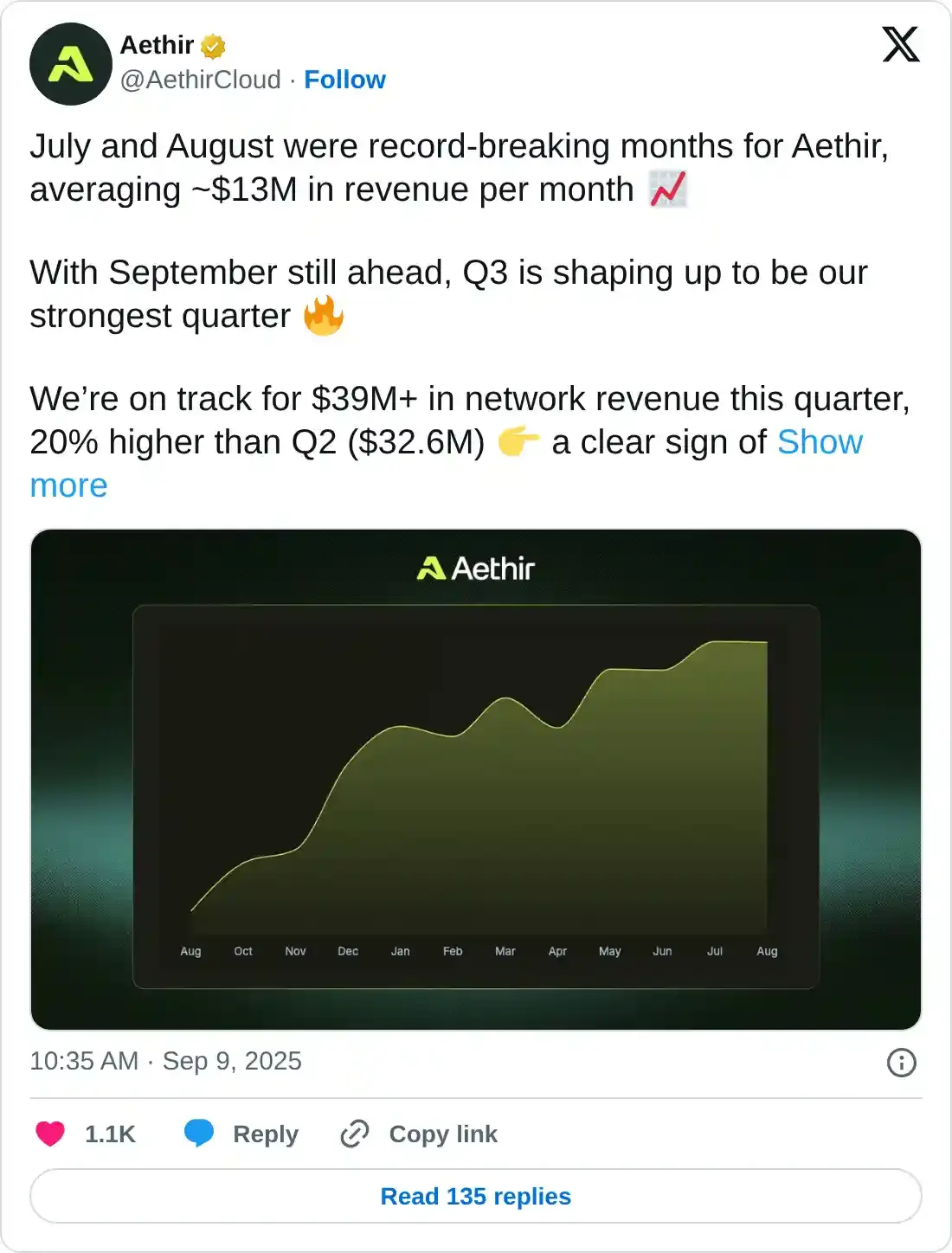

In addition to rising compute demand, Aethir generated an average of $13 million in monthly revenue during July and August, highlighting the protocol’s growing financial momentum.

Moreover, earlier this month, Aethir broadened its ecosystem with key partnerships. Teaming up with AR.IO to join the AI Unbundled Alliance, supporting Everlyn’s video AI model, and enabling Clore.ai to deliver global, scalable, and affordable access to enterprise-grade GPUs through its infrastructure.

Aethir Price Forecast: ATH bulls aiming for $0.065 mark

Aethir price broke above the descending trendline (drawn by joining multiple highs with a trendline since December) and its consolidating range between $0.028 and $0.037 on Monday, rallying nearly 50% that day. ATH continued its gains for the next three days, soaring over 8%. At the time of writing on Friday, it continues to trade higher by 14% reaching a four-month high at $0.056.

If ATH continues its upward momentum, it could extend its gains toward its weekly resistance at $0.065.

The Relative Strength Index (RSI) on the daily chart read 82, above its overbought conditions, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bullish crossover on Monday, giving buy signals. Moreover, the rising green histogram bars above the neutral value further support the bullish thesis.

ATH/USDT daily chart

However, if ATH faces a correction, it could extend the decline toward its daily support at $0.040.