Mantle Price Forecast: MNT Soars 16% After Bybit Listing—Is a Pullback Coming?

Mantle's native token MNT just ripped higher—jumping 16% on news of its Bybit exchange listing. The surge puts traders on high alert: is this sustainable momentum or a classic crypto pump primed for correction?

Exchange listings have long been crypto's version of a short-term adrenaline shot. More visibility, more liquidity, more hype. But they also attract profit-takers—especially after double-digit runs.

Timing the Top

No one rings a bell at the top, but seasoned traders watch volume and momentum divergences. A sharp run like this often cools off—sometimes sharply. If you bought the rumor, maybe consider selling the news. Or don’t—this is crypto, after all, where ‘rational’ is often just another word for ‘missed opportunity’.

Keep an eye on key support levels. A break below could signal the correction is here. And if it drops? Well, there’s always another token, another narrative, another chance to lose money differently.

Mantle eyes record high as Bybit adds support for MNT

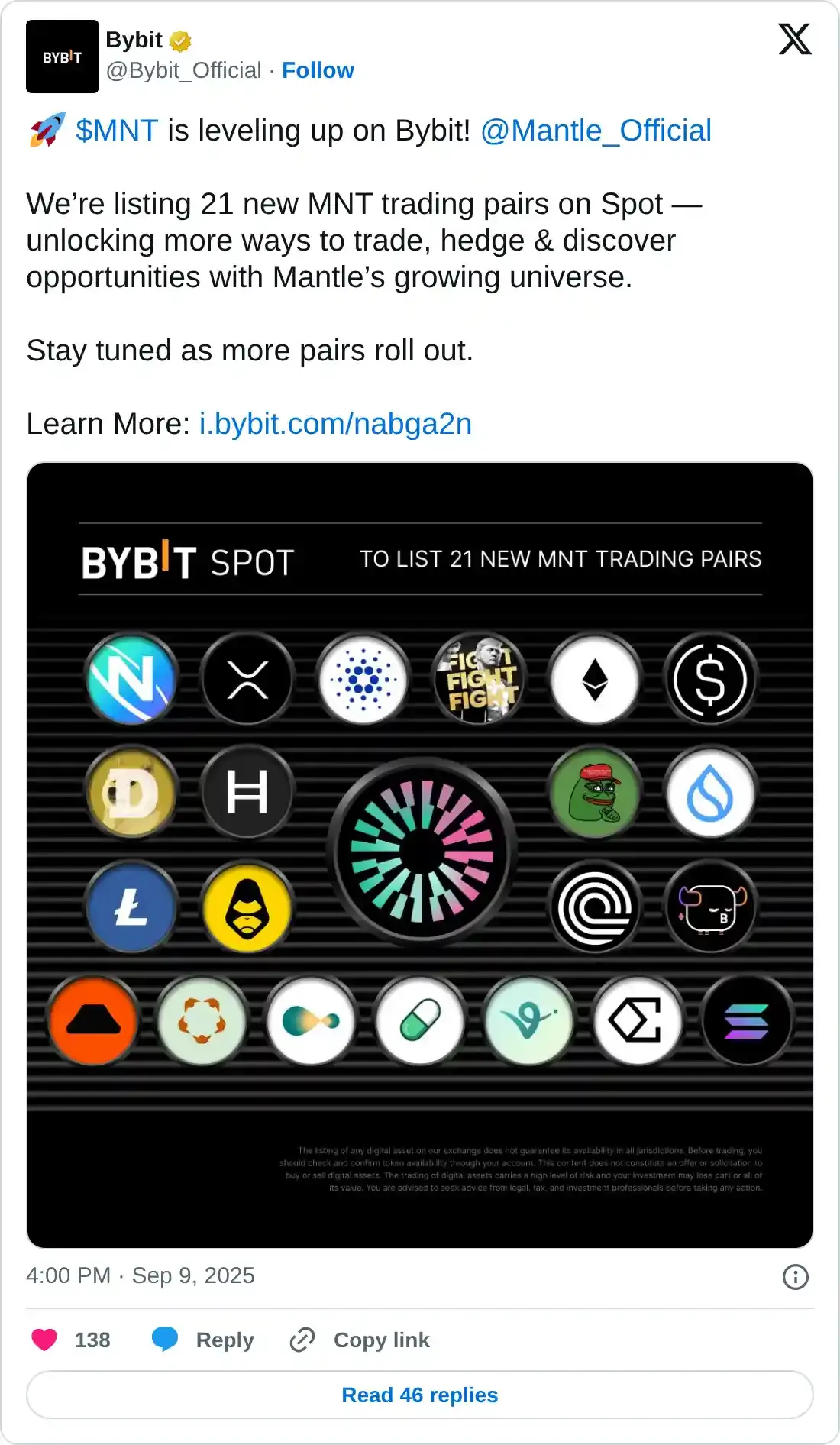

Bybit, the fifth-largest cryptocurrency exchange with an average daily trade volume of $4.5 billion, announced the listing of 21 trading pairs for MNT on Tuesday, sparking interest in the token.

The exchange also announced the launch of the “HOLD & earn Stablecoins” program, which allows investors to hold MNT and the XUSD stablecoin, earning a share of the $60,000 prize pool in return.

Following the announcement, demand for Mantle skyrocketed, triggering a price rally. The token’s market capitalization also hit a new record high, averaging $4.7 billion at the time of writing.

Mantle is currently the 41st-largest cryptocurrency, with a 24-hour trading volume exceeding $573 million, according to CoinGecko.

Retail interest in Mantle has surged significantly over the past few days, underscoring the increase in the futures Open Interest (OI) to $153 million from approximately $99 million on September 3 and $21 million on August 4.

Mantle Futures Open Interest | Source: CoinGlass

As the OI increases, xrp price gains bullish momentum, underpinning investor confidence in the uptrend. Similarly, a higher OI reading as volume rises implies heightened trading activity.

Technical outlook: Mantle bulls aim at $1.54 record high

Mantle holds significantly above the 50-day Exponential Moving Average (EMA) at $1.08, the 100-day EMA at $0.95 and the 200-day EMA at $0.88, backing positive sentiment in the ecosystem.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart reinforces the bullish outlook with a buy signal triggered earlier in the day. Interest in MNT is likely to remain intact as long as the blue MACD line holds above the red signal line.

Key milestones to watch out for include a break and daily close above the short-term resistance at $1.50, as well as the extension of the uptrend past the record high of $1.54.

MNT/USDT daily chart

The Relative Strength Index (RSI) holds above 70, indicating a potentially overheated market. Higher RSI readings above 70 are often a precursor to price corrections. With that in mind, traders searching for new entries should be cautious to avoid being caught up in a bull trap.

Profit-taking and other market dynamics could cause Mantle to trim its gains. The 50-day EMA at $1.08, the $100-day EMA at $0.95 and the 200-day EMA at $0.88 are in line to serve as tentative support levels if a trend correction occurs.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.