Solana Price Forecast: SOL Tests Breakout Zone as DeFi TVL Surges $1.8 Billion in a Month

Solana's momentum hits a critical inflection point as institutional money floods its ecosystem.

Defi's Sleeping Giant Awakens

Solana's total value locked just rocketed by $1.8 billion in thirty days—traders are scrambling to position themselves before the next leg up. The network's scaling solutions are finally delivering where others promised but failed.

Technical Breakout Imminent

SOL tests key resistance levels that could trigger a massive bullish wave. Market sentiment shifted from cautious optimism to outright FOMO as institutional players pile into SOL-based derivatives.

Meanwhile, traditional finance still can't decide whether to regulate crypto or just pretend it doesn't exist—typical bureaucratic paralysis while real innovation charges ahead.

Solana DeFi TVL near record highs

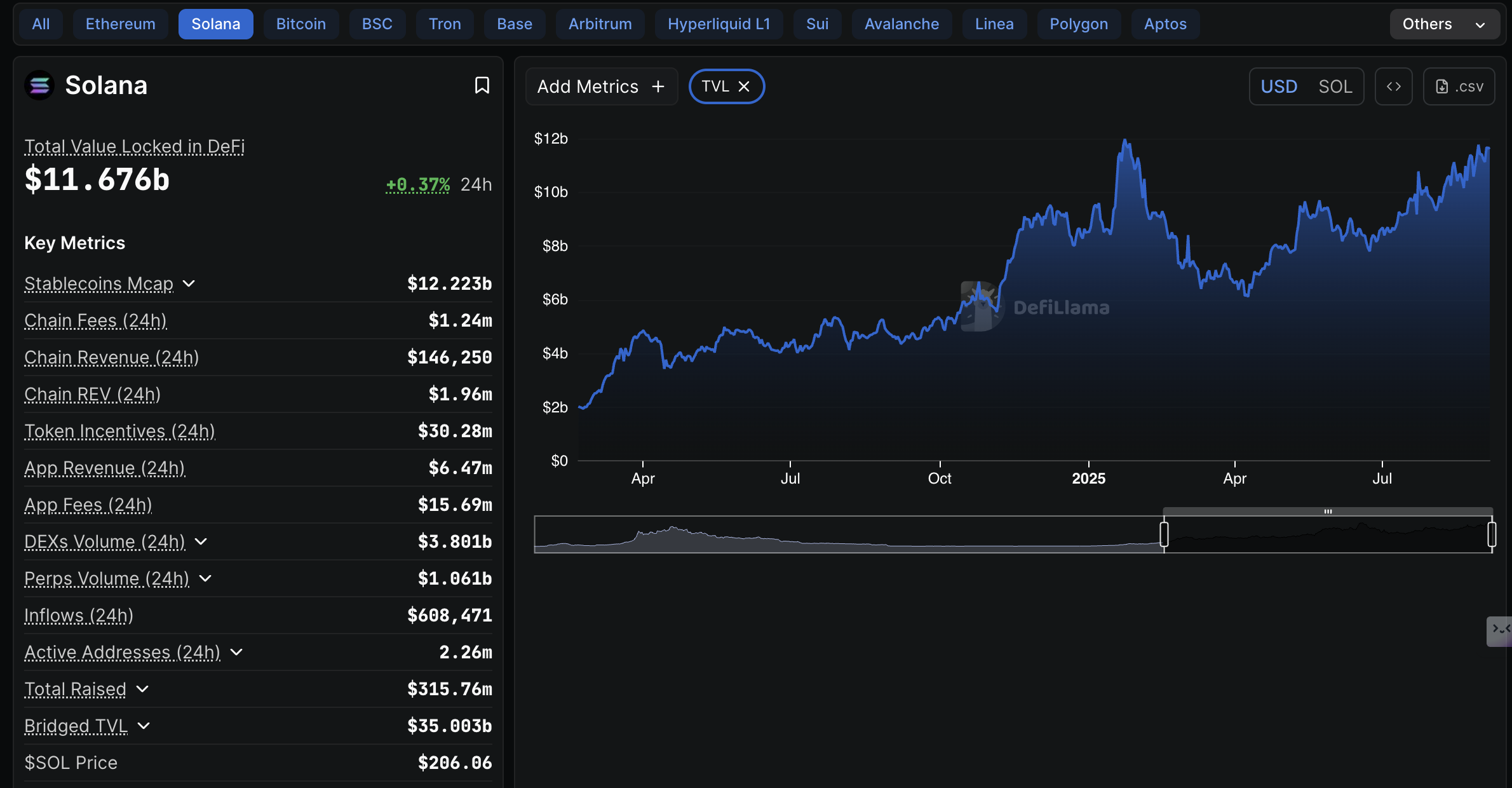

The Solana Decentralized Finance (DeFi) Total Value Locked (TVL), which tracks the cumulative value of all coins held in smart contracts across protocols on the chain, has sustained an overall uptrend since April.

DefiLlama data shows that the Solana blockchain has a TVL of $11.67 billion, up from $9.86 billion posted on August 8. In other words, investors have locked over $1.8 billion across smart contracts on the protocol in a month, underlining their conviction in SOL's ability to extend the uptrend.

Solana DeFi TVL | Source: DefiLlama

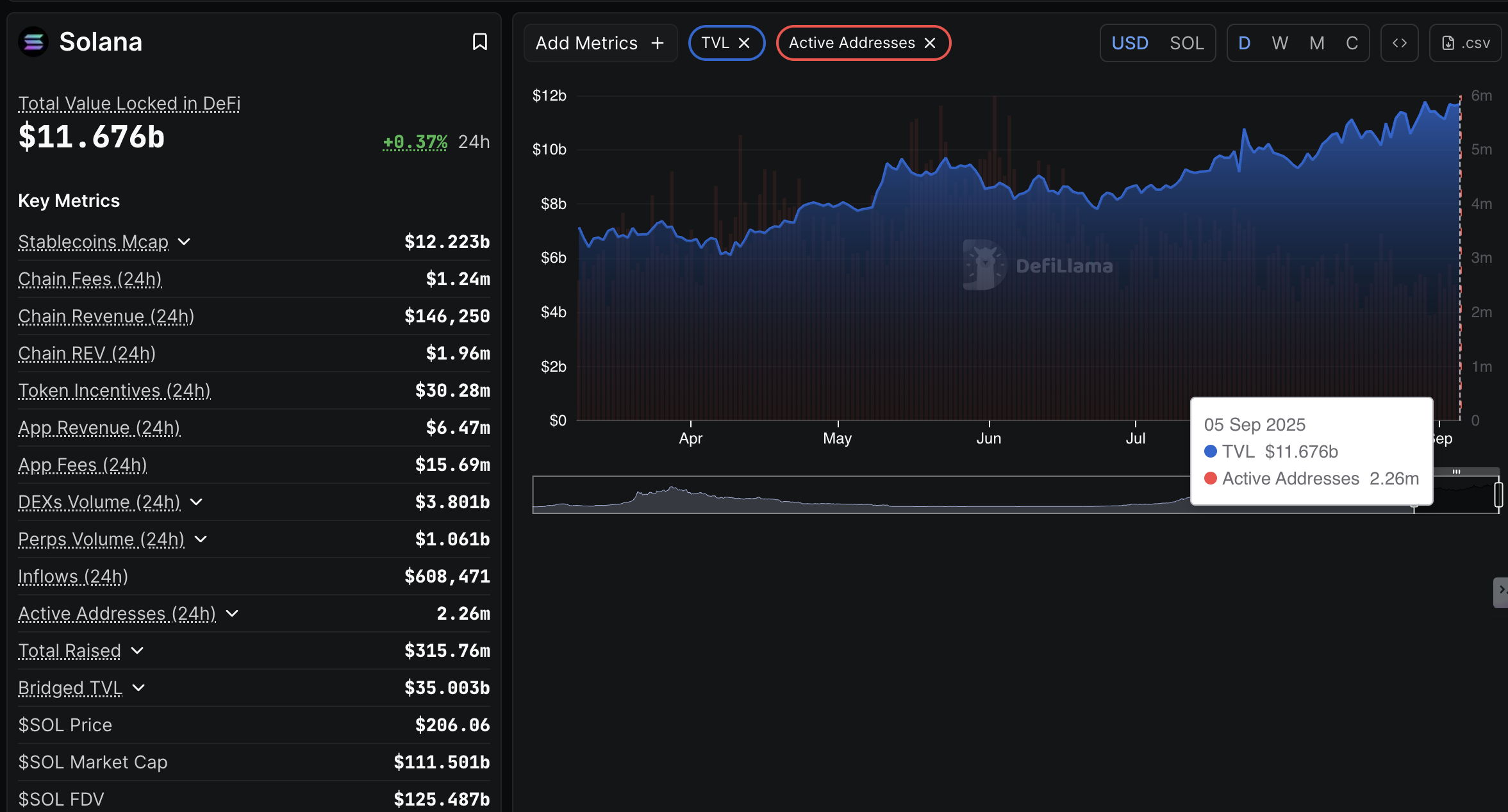

Despite the bullish outlook regarding staking on Solana, the protocol faces a significant reduction in on-chain activity. Active addresses on the network have decreased by over 62% to 2.26 million, down from 6 million in early June.

The slump in active addresses signals reduced user engagement amid low transaction activity on the protocol. Active addresses refer to wallets interacting with the Solana blockchain by sending or receiving assets. It is a measure of network health, adoption and overall interest in the ecosystem.

Solana Active Addresses | Source: DefiLlama

Technical outlook: Solana builds bullish momentum

Solana price shows signs of steadying the uptrend toward the $220 level as part of the bulls' mission to push for gains above $250 in the medium term. SOL's short-term bullish outlook is supported by the Relative Strength Index (RSI) at 56 that is pointing toward overbought territory.

The smart contracts token is also positioned above the upward-facing 50-day Exponential Moving Average (EMA) at $187, the 100-day EMA at $177 and the 200-day EMA at $171, underpinning the bullish sentiment.

SOL/USDT daily chart

Key levels of interest for traders are the resistance at $250, the medium-term at $250 and SOL's record high of $295. Still, a correction below the $200 level cannot be ruled out yet, especially with the macro uncertainty hanging in the balance of the Fed's September interest rate decision.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.