Cardano Price Forecast: ADA Primed for Explosive Breakout Rally

Cardano's native token ADA shows all the classic signs of an impending major price surge—technical indicators align while network fundamentals strengthen behind the scenes.

The Setup

Breaking through key resistance levels with unusual volume momentum, ADA's chart pattern mirrors previous bull runs that caught traditional finance off guard. Trading activity spikes suggest institutional players are positioning themselves ahead of retail FOMO.

Market Dynamics

Unlike legacy assets tied to quarterly earnings reports, Cardano's value proposition hinges on technological milestones and adoption metrics that move faster than Wall Street analysts can update their spreadsheets. The network's recent upgrades create tangible utility rather than speculative hype—a rarity in crypto land.

The Catalyst

DeFi integrations and smart contract deployments accelerate while traditional finance still debates whether blockchain is 'worth the energy.' Meanwhile, ADA's staking yields continue outperforming most savings accounts—not that banks would ever admit it.

Potential Trajectory

Historical patterns suggest breakout moves could propel prices significantly higher, though volatility remains the only constant. Remember: in crypto, 20% dips often precede 200% rallies—something traditional investors still can't stomach without their risk management committees.

Whether this becomes another 'I told you so' moment for crypto advocates or just another false alarm for skeptics, one thing's certain: Cardano isn't waiting for permission to make moves.

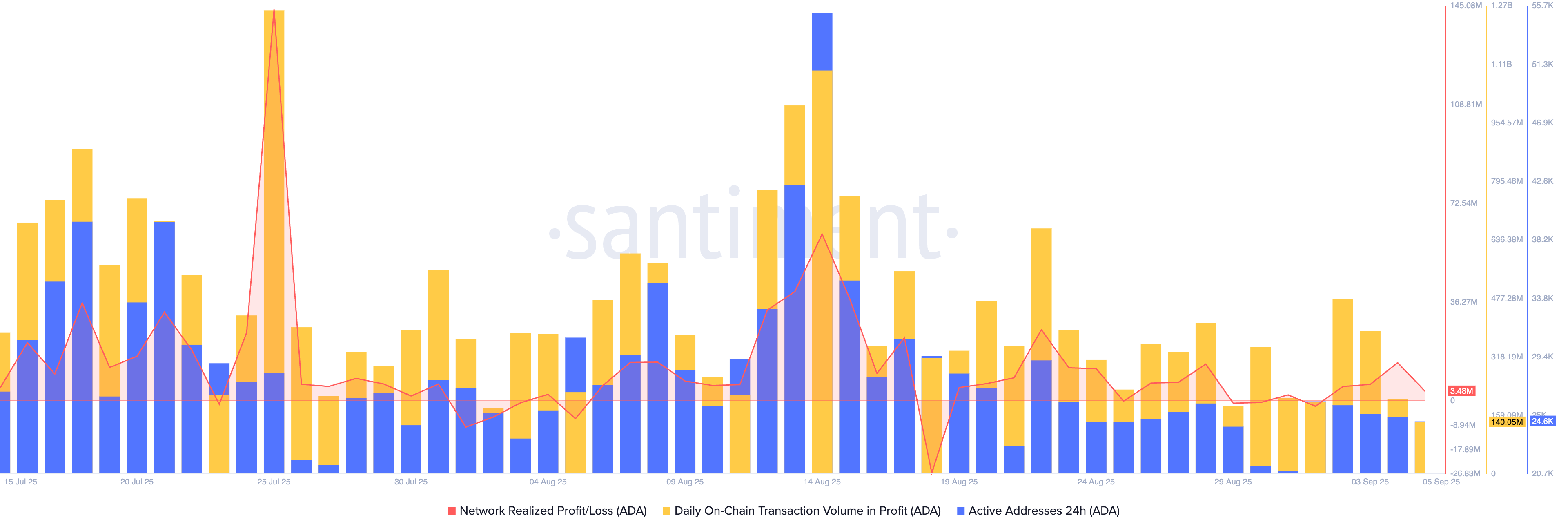

On-chain data reveals underlying weakness

The Network Realized Profit/Loss (NRPL) is used to gauge the net amount of profit or loss realized by token holders after on-chain transactions. Santiment data shows Cardano’s NRPL stands at 3.48 million ADA, down from 13.98 million ADA on Thursday. This indicates a significant decline in the amount of profits booked by ADA holders, suggesting a drop in bullish momentum.

Additionally, the number of active addresses on Cardano dropped to 24,455 on Friday, from 24,955 the previous day, indicating a decline in network activity. Cardano stands on thin ice as on-chain data points to fading bullish momentum and network activity.

Cardano nears a falling wedge pattern breakout

Cardano edges higher by over 2% on the day, challenging an overhead resistance trendline on the 4-hour chart, formed by connecting the highs of August 14 and August 25. This trendline completes a falling wedge pattern with a support trendline connected by the August 20 and September 1 lows.

If cardano marks a decisive close above the 200-period Exponential Moving Average (EMA) at $0.8335, it would confirm the falling wedge pattern breakout. The breakout rally in Cardano could target the R1 pivot level at $0.8913.

Adding to the optimism, Cardano’s Open Interest (OI) holds above $1.570 billion, following the surge in mid-August. This indicates steady optimism among derivative traders.

ADA Open Interest. Source: Coinglass

However, the technical indicators on the 4-hour chart flash mixed signals after the chaotic decline over the past few days. The Moving Average Convergence Divergence (MACD) approaches its signal line for a crossover, which WOULD indicate a bullish shift, just a day after a bearish turnaround on Thursday.

The Relative Strength Index (RSI) reads 52 on the same chart, surfacing above the halfway mark, which indicates a rise in buying pressure. Even so, the 50-period EMA shows a declining trend and has crossed under the 200-period EMA, signaling a Death Cross pattern.

Looking down, a reversal from the 200-period EMA could result in a renewed downcycle within the falling wedge pattern. If so, ADA could extend the decline to the lower support trendline NEAR $0.7788.