Bitcoin’s September Slump: Will Fed Policy Seal Its Fate?

Bitcoin teeters on the edge as September volatility looms—all eyes turn to the Federal Reserve's next move.

The Fed's Tightrope Walk

Interest rate decisions could make or break crypto's momentum. Hawkish signals might trigger sell-offs, while dovish tones could fuel another rally.

Market Psychology at Play

Traders brace for traditional September weakness—a pattern that's haunted markets for decades. Crypto isn't immune to seasonal sentiment shifts.

Institutional Waiting Game

Big money stays sidelined until regulatory clarity emerges. Because nothing says 'mature asset class' like watching central bankers for directional cues.

The Ultimate Irony? A decentralized asset dancing to the Fed's tune. September won't just test prices—it'll test crypto's entire narrative.

Source: Coinglass

Why September often follows the same script

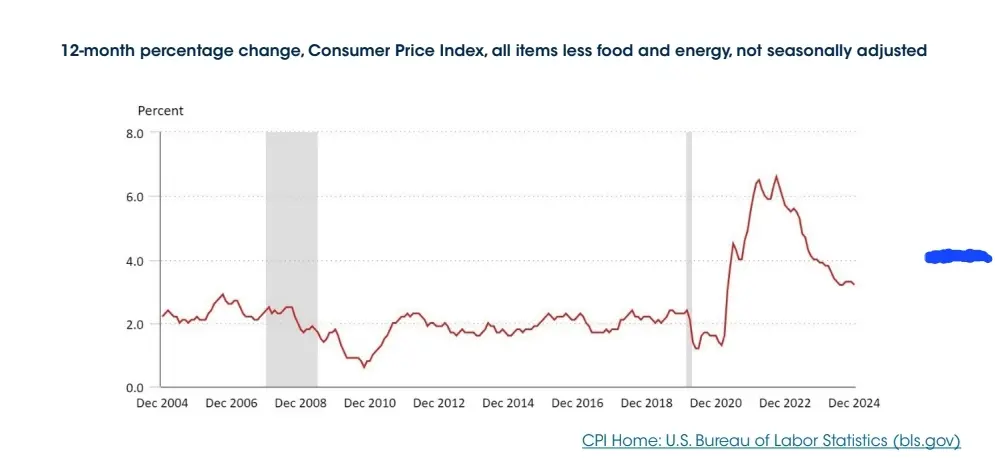

Macro data tends to set the tone for crypto in September. Inflation readings, in particular, have proven to be important. Softer consumer price index (CPI) figures often lift Bitcoin. For instance:

- In July 2024, a CPI dip from 3.5% to 3.4% fueled a 7% rally in Bitcoin within a day.

- A similar reading in December 2024 pushed BTC above $98,500.

- On January 15, 2025, fresh CPI data sent Bitcoin into the $98,500–$100,000 range within hours, with a 2–4% intraday surge.

But the reverse is just as clear. When inflation data beats forecasts, markets recoil. Research suggests bitcoin typically loses 0.24% for every surprise uptick in CPI, underscoring how sensitive crypto remains to policy expectations.

Source: U.S Bureau of Labor Statistic

That same dynamic now hangs over September 2025, with U.S. jobs data due Friday. Earlier this year, strong employment figures dragged BTC back to $97,000 by tempering rate-cut hopes, while softer readings sparked rallies.

Traders face a similar setup now: weak jobs data could reinforce expectations for cuts, but robust numbers may leave crypto stuck in retreat.

Can the Fed break crypto’s September curse?

The spotlight now shifts to the Federal Reserve’s September 16–17 policy meeting. According to the CME FedWatch Tool, markets currently assign an 87% chance of a quarter-point rate cut. A cut WOULD loosen financial conditions, inject liquidity, and potentially rekindle appetite for risk assets like Bitcoin.

History suggests such shifts matter. During the 2024 rate-cut cycle, Bitcoin surged more than 120% as liquidity expanded. In 2025, each dovish signal has produced quick rallies:

- January and March Fed moves lifted BTC sharply.

- May’s meeting drove prices past $96,000.

- Even June’s brief dip below $99,000 reversed as the coin regained ground above $105,000.

This time, if labor data softens and the Fed delivers, crypto could buck its bearish reputation and stage a rare green September.