Crypto Gainers: MemeCore Surges 42% as Four and Ethena Sustain Bullish Momentum in Market Rebound

Meme tokens lead crypto's midday charge—defying traditional market jitters with pure, unadulterated speculation.

MemeCore's Meteoric Rise

MemeCore isn't just pumping—it's mooning. The token ripped past resistance levels as retail traders piled in, flipping boredom into bullish momentum. No utility? No problem. Community hype alone propelled it to the top of gainer lists.

Four's Steady Climb

Four keeps grinding higher, ignoring broader market noise. Its consistent uptrend draws in cautious optimists—those who prefer charts over charm. No flashy narratives here, just methodical gains that almost look... responsible.

Ethena's Bullish Hold

Ethena refuses to dip. Momentum traders cling to its steady performance, betting on sustained action rather than meme-fueled spikes. It’s the crypto equivalent of eating your vegetables—less exciting, but arguably better for your portfolio.

Because nothing says 'healthy market' like digital assets named after internet jokes and numbers outperforming companies with actual revenue.

MemeCore holds above $1, targeting a new record high

MemeCore edges higher by 4% at press time on Thursday, extending the uptrend for the sixth day. The meme coin has shed minor gains after marking a record high of $1.14 on Wednesday.

Still, MemeCore holds dominance over the $1.00 psychological level and challenges the $1.07 resistance, marked by the R1 pivot resistance on the 4-hour chart. To extend the rally towards the R2 pivot resistance level at $1.47, the M token should mark a decisive close above the $1.07 level.

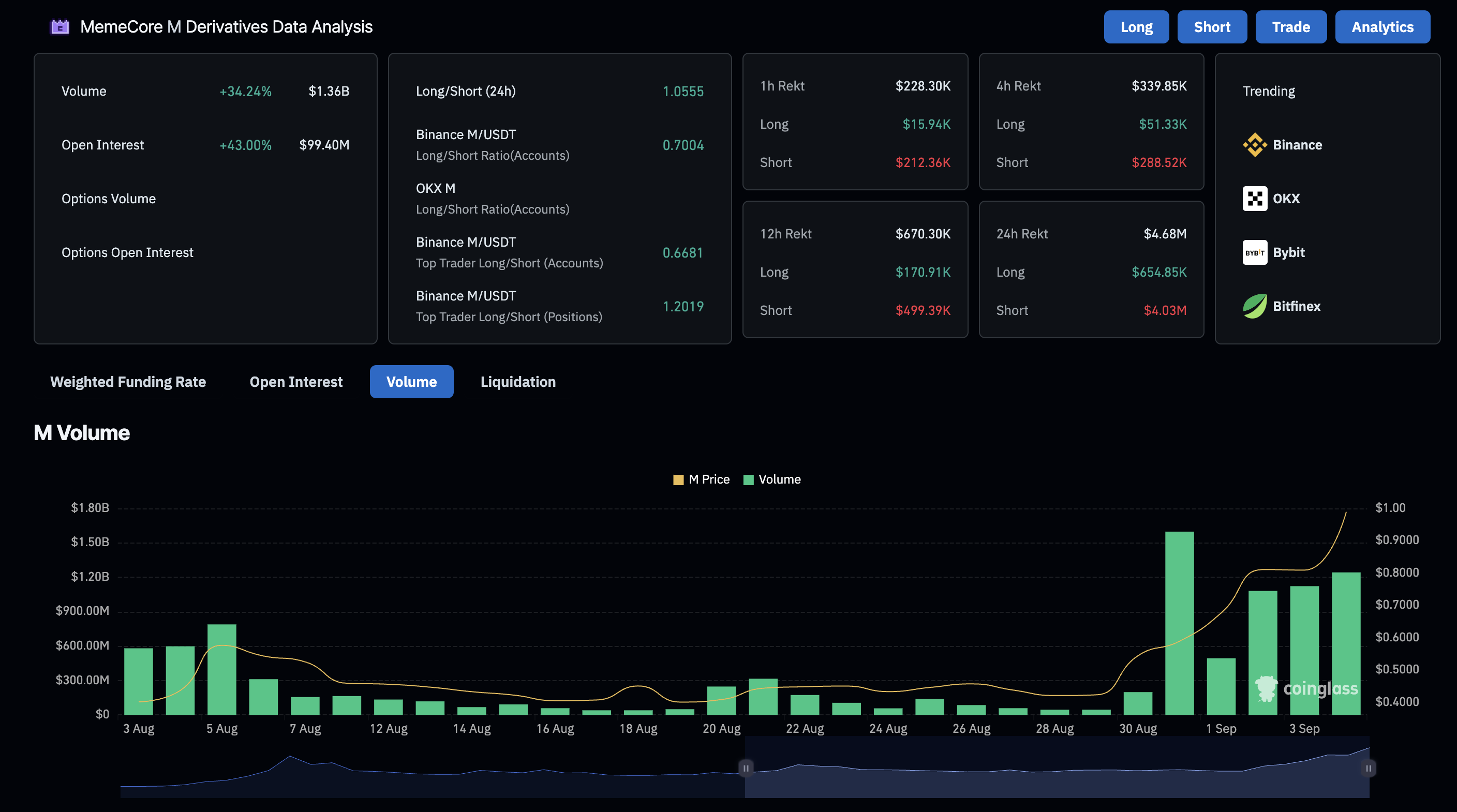

Adding to the optimism, the CoinGlass data reflected that MemeCore's Open Interest showed a 43% rise in the last 24 hours, reaching a record high of $99.4 million. The trading volume of the meme coin at above $1 billion for three consecutive days, indicating increased interest.

MemeCore derivatives. Source: CoinGlass

The momentum indicators on the 4-hour chart suggest elevated buying pressure as the Moving Average Convergence Divergence (MACD) and its signal line extend the uptrend. Additionally, the Relative Strength Index (RSI) at 77 hovers above the overbought boundary, pointing upwards, signaling heightened bullish momentum.

M/USDT daily price chart.

Looking down, a potential drop below the $1.00 level could test the $0.89 support level, which acted as a short-term resistance earlier this week.

Four recovery rally targets the $4 level

Four trades above the $3.50 level, extending the uptrend for the fourth consecutive day with a 2% rise, at the time of writing on Thursday. The GameFi token exhibits a V-shaped recovery run after the 18% drop on Sunday.

A clean push above $3.75 to recover from Sunday’s loss could extend the rally to $4.00 round figure.

The RSI at 53 on the daily chart has crossed above the midpoint line, indicating an increase in buying pressure. Additionally, the MACD line converges with its signal line, reflecting a bullish shift in trend momentum.

FORM/USDT daily price chart.

On the flip side, a potential flip before recovering Sunday’s loss could result in a retest of the $3.42 level, marked by the August 25 close.

Ethena struggles to uphold the bullish trend

Ethena edges lower by 2% at press time on Thursday, after the 6% rise from the previous day. The synthetic dollar token dampens the two-day recovery as bulls struggle to hold ground above the $0.7000 level.

If the bearish reversal extends, it could target the $0.6911 level, which previously acted as a resistance on Wednesday on the 4-hour chart.

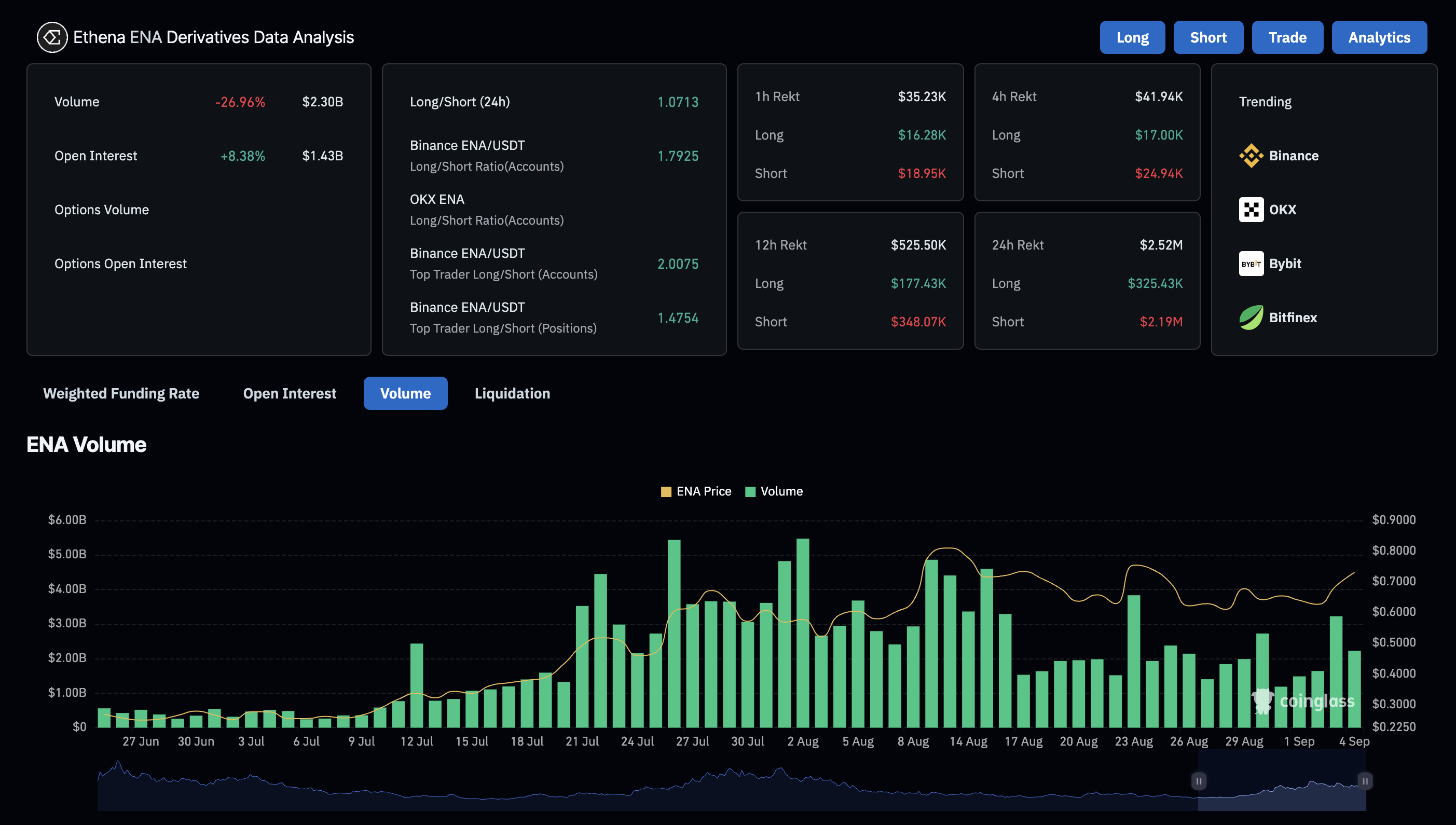

Adding mixed signals, CoinGlass data indicates that the ENA Open Interest gained over 8% in the last 24 hours, reaching $1.43 billion. However, the volumes are on a declining trend with lower spikes since last month. This indicates a slow buildup among traders, as Optimism remains lukewarm.

Ethena derivatives. Source: CoinGlass

The RSI on the same chart at 56 holds at neutral levels, pointing downwards, indicating an underlying weakness in buying pressure. If the RSI drops below the halfway line, the correction spree in Ethena could extend.

Still, the convergence in the MACD and signal lines indicates a significant decline in bearish momentum. A potential green histogram bar resurfacing above the zero line WOULD mark a bullish turnaround, which would flash a buy signal for a sidelined investor.

ENA/USDT daily price chart.

Looking up, a potential upswing in ENA could target the $0.8555 level if buyers could reclaim the $0.7533 resistance, last tested on August 23.