Bitwise Leads the Charge: First to File for Spot Chainlink ETF

Wall Street's crypto embrace accelerates as Bitwise positions itself at the forefront of the Chainlink ETF race.

The Institutional Gateway

Bitwise's filing signals a strategic move to bridge decentralized oracle networks with traditional finance—creating a regulated pathway for institutional exposure to LINK's real-world data infrastructure.

Market Implications

Expect ripple effects across crypto ETFs as competitors scramble to match Bitwise's play. The filing isn't just about Chainlink—it's a bet on the entire blockchain data economy.

Because nothing says 'mainstream adoption' like wrapping decentralized tech in a layer of Wall Street bureaucracy.

LINK gains on ETF filing

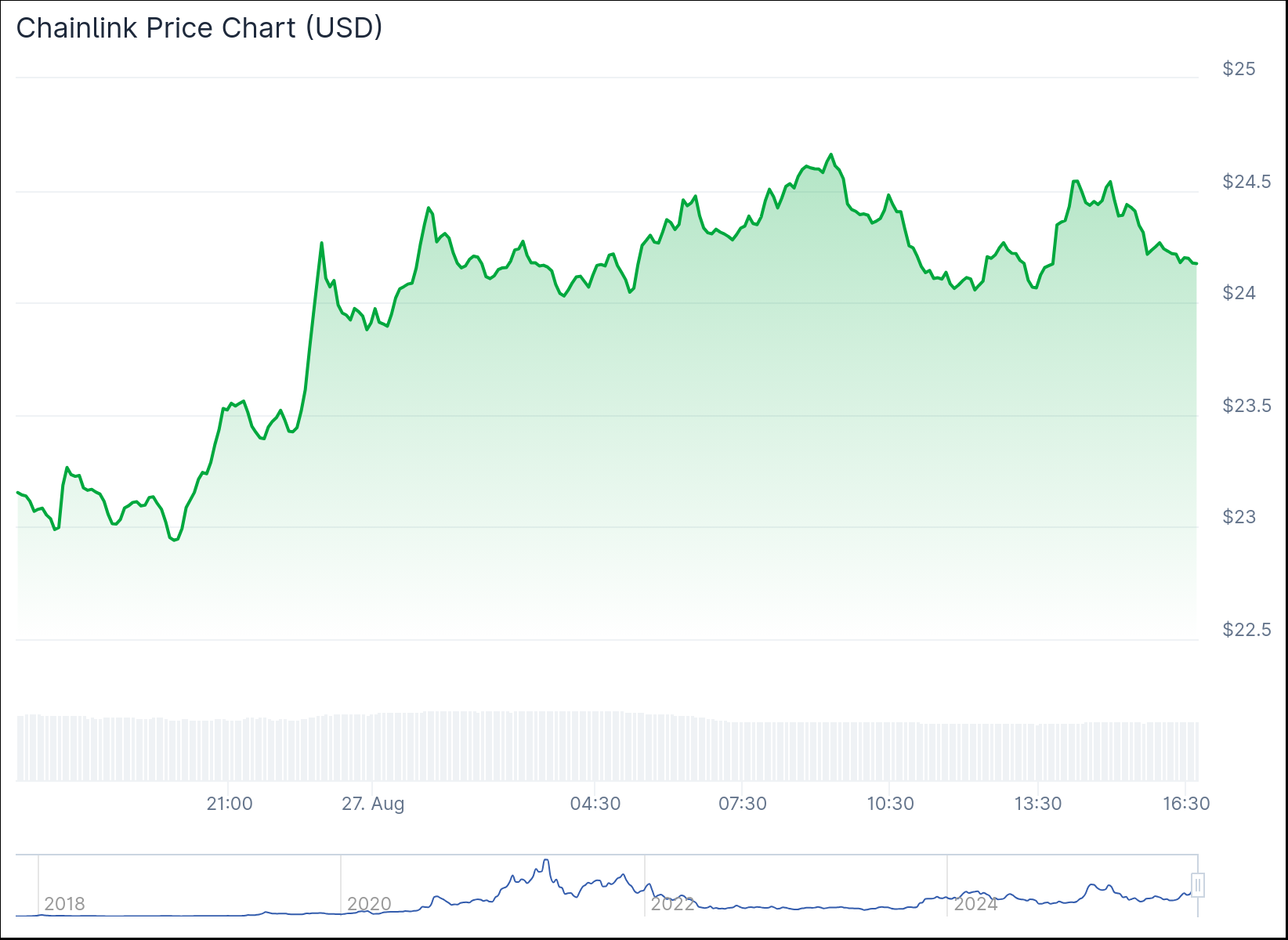

The price of LINK was up 4.2% to $24.18 in the last 24 hours amid Bitwise’s filing and a wider market gain, according to CoinGecko.

LINK has gained over 4% in the last day amid Bitwise’s ETF filing. Source: CoinGecko

LINK has gained more than 26% in the past 30 days, but is still over halfway down from its peak of nearly $53 in May 2021.

Focus on altcoin ETFs grows

The TRUMP administration has taken a friendlier tone toward crypto, leading fund issuers to flood the SEC with filings for a variety of crypto-linked ETFs.

Bitwise has seen success with its ETFs tracking Bitcoin (BTC) and Ether (ETH), which have respective assets under management of $2.26 billion and $460 million, according to Farside Investors.

On Saturday, asset manager VanEck filed with the SEC to offer an ETF based on JitoSOL, a liquid staking token that provides staking rewards. If approved, this would be the first ETF in the US to offer investors the ability to invest in digital assets that provide staking rewards.

On Friday, Grayscale Investments sought the SEC’s approval to convert its existing trust based on Avalanche (AVAX) into an ETF.

Meanwhile, Canary Capital has filed two ETF product offerings this month, with its filing on Tuesday looking to launch an ETF that holds OFFICIAL TRUMP (TRUMP), which US President Donald Trump launched days before his inauguration.

Its second ETF filing made on Friday was for the Canary American-Made Crypto ETF (MRCA), which would offer exposure to a basket of cryptocurrencies that were created, mined or operate in the US.