XRP Whales Go on Buying Spree Despite Ripple’s Network Growth Concerns - Price Surge Imminent?

Ripple's big players are loading up while the network faces growth headwinds—classic crypto contradiction.

WHALE WATCHING INTENSIFIES

Major XRP holders aren't waiting for perfect conditions. They're accumulating hard despite lingering questions about Ripple's network expansion pace. When whales move, markets notice—and often follow.

NETWORK GROWTH VS. WHALE APPETITE

While analysts debate adoption metrics, deep-pocketed investors keep stacking XRP. They're betting current concerns are temporary noise against long-term potential. Sometimes the smart money moves before the story gets perfect.

PRICE IMPLICATIONS LOOM

Significant accumulation typically precedes price movements. Whales don't accumulate for charity—they expect returns. When this much capital positions itself, volatility usually follows.

Remember: in crypto, whales eat first—retail gets the scraps. Maybe this time will be different. Or maybe it's just another episode of 'follow the money and hope you're not the exit liquidity.'

XRP whales buy the dip

Large volumes of XRP have remained largely unaffected by recent price fluctuations, increasing their exposure. According to Santiment’s data, addresses holding between 1 million and 10 million XRP now account for approximately 10.6% of the total supply, up from 9.8% in early July and 9.14% in early March.

If whales continue buying the dip, demand could eventually outstrip supply, enabling bulls to carve out a recovery path above the near-term $3.00 resistance. A risk-on sentiment may strengthen in the coming weeks, supported by potential interest rate cuts in September.

%20%5B17-1756222204269-1756222204270.12.06,%2026%20Aug,%202025%5D.png)

XRP Supply Distribution | Source: Santiment

Despite the steady demand from select whale cohorts, a muted network growth could suppress the xrp price recovery in the coming days and weeks. Santiment’s on-chain data highlights a sharp drop to approximately 4,400 newly created addresses. Network growth represents the rate of the protocol’s adoption. Sharp or steady declines indicate a reduction in interest in XRP, which could lead to price stagnation or extend the decline.

%20%5B17-1756222217886-1756222217887.17.51,%2026%20Aug,%202025%5D.png)

XRP Network Growth | Source | Santiment

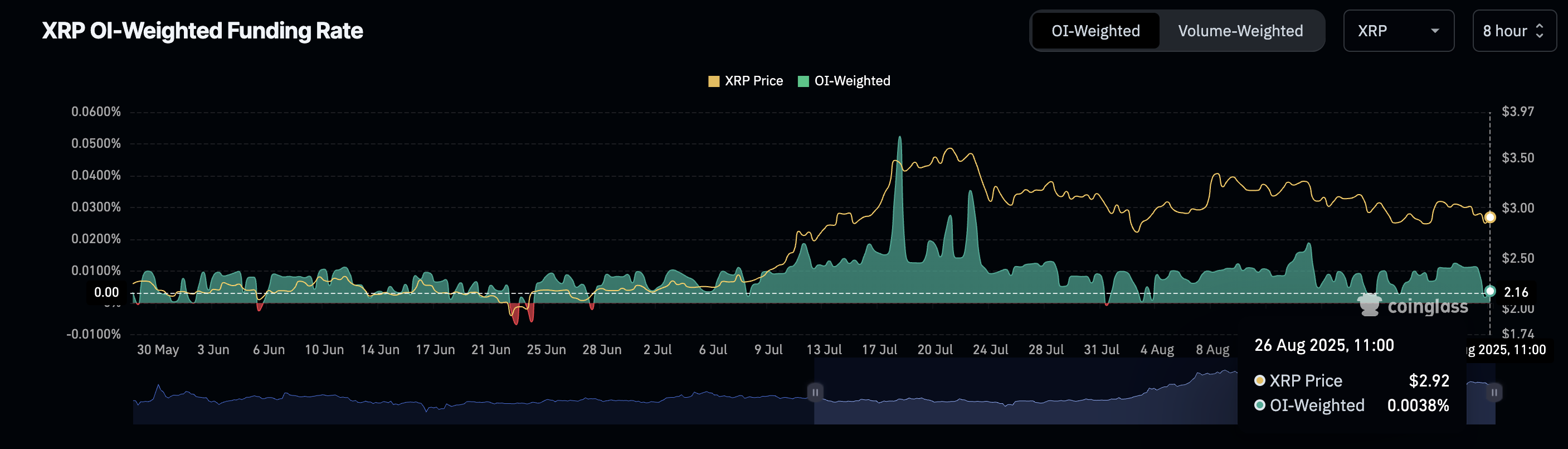

The demand for leverage long positions has decreased amid the price decline, as evidenced by the futures weighted funding rate holding NEAR the mean line. CoinGlass data shows the funding rate at 0.0038% down from the peak in July at 0.0524%. Low funding rates imply that fewer traders are leveraging long positions in XRP, reflecting a lack of conviction in short-term price increases.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Technical Outlook: XRP bulls regain control

XRP price is extending its rebound above support at $2.90, backed by growing positive sentiment. A break is anticipated above the 50-day Exponential Moving Average (EMA) resistance at $2.94 as bulls look forward to breaching the pivotal $3.00 level.

The Relative Strength Index (RSI), which is rebounding toward the midline after declining to 42 in the bearish region, points to increasing demand for XRP.

Still, the Moving Average Convergence Divergence (MACD) indicator must offer a buy signal to affirm the bullish outlook. This signal will manifest with the blue MACD line crossing above the red signal line and the red histogram bars turning green above the mean line.

XRP/USDT daily chart

Key areas of interest for traders are the 50-day EMA resistance at $2.94 and the 100-day EMA support at $2.75. Price action on either side of this range could shape XRP’s direction in the short term. Beyond the crucial $3.00 level, bulls WOULD expand their gaze to the all-time high of $3.66 and later launch XRP into price discovery.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.