Chainlink Targets $30 Breakout as Bitwise Files for Revolutionary LINK ETF

Chainlink's oracle network just got Wall Street's ultimate validation signal—an ETF filing that could send institutional capital flooding into the LINK ecosystem.

Bitwise's Bold Move

The crypto asset manager dropped regulatory paperwork that could make LINK the next tradable ETF, positioning Chainlink as critical infrastructure rather than just another altcoin. This isn't just speculation—it's recognition that decentralized oracles form the backbone of real-world asset tokenization.

The $30 Threshold

Traders are watching that key resistance level like hawks. Previous cycles saw LINK smash through psychological barriers once institutional products launched. The ETF narrative amplifies what was already brewing—massive open interest building in derivatives markets.

Why Oracles Matter

While speculators chase shiny new tokens, Chainlink quietly powers trillion-dollar markets. Its oracles feed price data to DeFi protocols, insurance products, and even commodity trading networks. The real story isn't the price pump—it's that traditional finance finally understands what crypto natives knew years ago.

Wall Street's latest 'discovery' of infrastructure plays feels ironically late—but hey, better late than never when their capital starts flowing. The real question isn't if LINK hits $30, but how many traditional finance firms will still be calling it 'just a cryptocurrency' when it's feeding data to their own trading desks.

Bitwise files to launch LINK ETF

Bitwise has filed with the United States Securities and Exchange Commission (SEC), seeking approval to offer a LINK ETF. An ETF is a regulated financial product tracking the price of an underlying asset and is accessible directly on stock exchanges like NASDAQ.

According to the S-1 Form, Bitwise intends to track LINK's value, with Coinbase Custody Trust Company providing custody services. If approved, Coinbase will serve as the prime execution agent. Details of the exact listing venue remain unknown, although Bitwise expects the shares to list on a US exchange.

The filing adds that it will offer standard creation and redemption to ensure customers have access to both in-kind and cash transactions supported by a Trust-Directed-Trade process executed by Coinbase.

Bitwise's application adds to the industry-wide push for the adoption of digital assets in traditional finance systems. The SEC, under its 'Crypto Project,' is working to establish clear regulations for the crypto industry, which will support innovation, inclusivity and ensure customer protection.

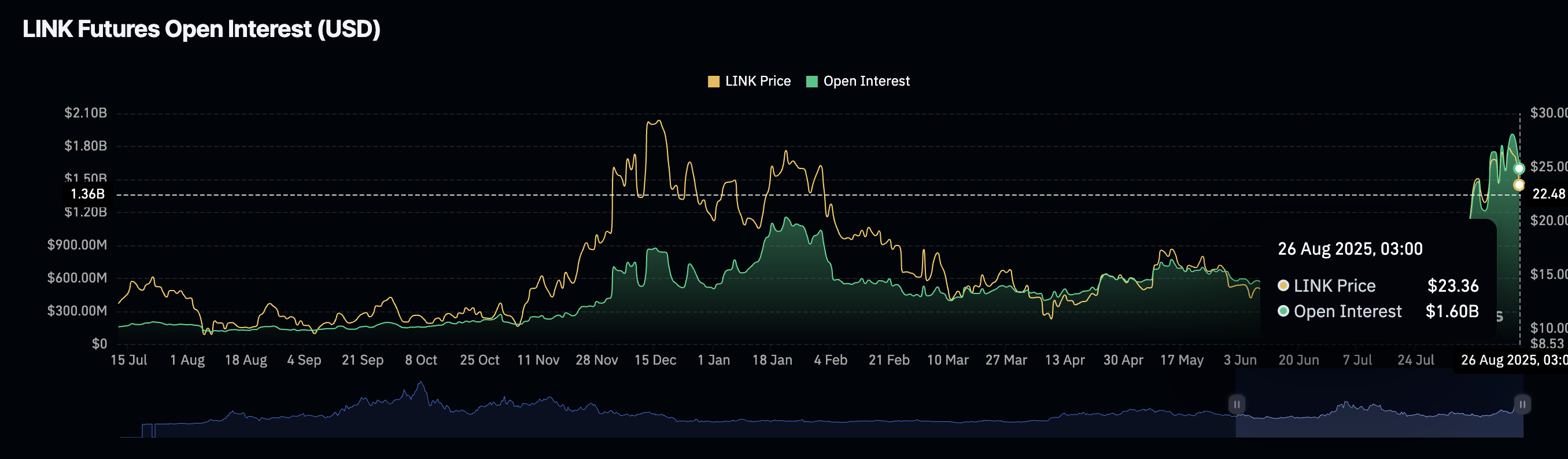

Meanwhile, interest in chainlink has fallen over the last few days, according to CoinGlass derivatives data. LINK's Open Interest (OI), representing the value of outstanding futures or options contracts, averages at $1.6 billion, down from $1.8 billion.

Chainlink Futures Open Interest | Source: CoinGlass

The decline implies weak market sentiment and reduced trading activity. Upholding the downtrend could hinder Chainlink's recovery, which is aiming for a breakout above $30.00.

Technical outlook: Upholds key support level

Chainlink price is trading above $23.00 after a knee-jerk bounce from support at $22.00. Its technical picture on the daily chart affirms the short-term bearish outlook, underpinned by the Moving Average Convergence Divergence (MACD) indicator's sell signal.

Should investors reduce exposure citing the MACD line crossing below the red signal line, the decline could extend to test the 50-day Exponential Moving Average (EMA) support at $20.40. The 100-day EMA at $18.28 and the 200-day EMA at $17.10 will serve as tentative support levels if headwinds overwhelm demand.

LINK/USDT daily chart

The Relative Strength Index (RSI) holds above the midline while stabilizing at 54. A continued correction toward overbought territory above 70 WOULD reinforce the bullish grip, paving the way for the $30.00-bound breakout.

A buy signal flaunted by the SuperTrend indicator backs Chainlink's short-term bullish outlook. This trend-following tool functions as dynamic support as long as it trails the LINK price, suggesting that sentiment remains bullish despite price fluctuations.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.