Hyperliquid Price Forecast: HYPE Skyrockets as TVL Smashes Records, Chain Fees Outpace Ethereum and Tron

Hyperliquid's HYPE token stages a massive comeback as protocol metrics hit unprecedented heights.

Total Value Locked Reaches Historic Peak

The protocol's TVL just shattered all previous records—no small feat in today's competitive landscape. This surge signals massive capital inflow while traditional finance struggles with paperwork.

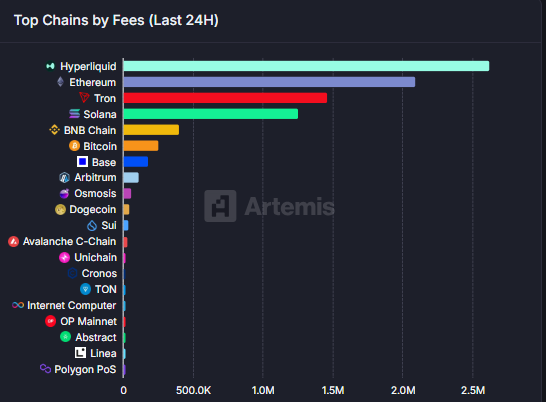

Fee Generation Exceeds Major Blockchains

Hyperliquid's chain fees now outstrip both Ethereum and Tron. That's right—this relative newcomer generates more fee revenue than two of crypto's heaviest hitters. The network's economic activity isn't just growing—it's dominating.

Market Momentum Builds

Traders flock to HYPE as performance metrics scream bullish. The token's rebound showcases DeFi's relentless innovation—while Wall Street still debates whether crypto is 'a real asset class.'

HYPE fees collection surpasses ETH and TRX

According to Artemis Terminal data, Hyperliquid’s 24-hour chain fees collection is $2.6 million, topping the list of other networks such as Ethereum and Tron, indicating a growing interest among traders and liquidity in the HYPE chain.

Additionally, Artemis Terminal data shows that Hyperliquid’s TVL has increased to a new all-time high of $2.3 billion on Tuesday. Rising TVL indicates growing activity and interest within HYPE’s ecosystem, suggesting that more users are depositing or utilizing assets within HYPE-based protocols.

-1756193137733-1756193137735.jpeg)

HYPE TVL chart. Source: Artemis Terminal

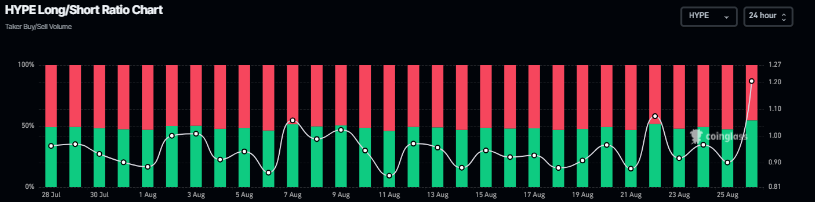

Coinglass’s long-to-short ratio of HYPE further supports the bullish outlook. The ratio currently stands at 1.20, the highest level over a month, indicating traders are betting on the asset price to rally.

Hyperliquid long-to-short ratio chart. Source: Coinglass

Hyperliquid Price Forecast: Bulls aiming for record highs

Hyperliquid price found support around the ascending trendline (drawn by connecting multiple lows since early April) on Thursday and ROSE 13.88% over the next three days, closing above its 50-day Exponential Moving Average (EMA) at $42.44. However, on Monday, it faced a correction of 6.6% and retested the 50-day EMA. At the time of writing on Tuesday, it rebounded over 4% trading around $44.87.

If the 50-day EMA at $42.44 continues to hold as support, HYPE could extend the rally toward its all-time high of $49.88.

The Relative Strength Index (RSI) on the daily chart reads 52, rebounding from its neutral level of 50 on Monday and points upwards, indicating bullish momentum gaining traction. The Moving Average Convergence Divergence (MACD) indicator lines coil against each other, suggesting indecisiveness among traders.

HYPE/USDT daily chart

However, if HYPE closes below its 50-day EMA at $42.44, it could extend the decline toward its daily support at $39.11.