XRP Price Surge: Gemini’s New Mastercard Fuels $3.00 Breakout Prediction for Ripple

Gemini just dropped a crypto bombshell—launching an XRP-focused Mastercard that's sending shockwaves through the digital asset space.

Market Momentum Builds

Traders are piling into XRP positions as the announcement triggers bullish technical formations. The $3.00 resistance level now appears vulnerable—a breakthrough could ignite a full-scale rally.

Institutional Adoption Accelerates

Gemini's move signals growing mainstream acceptance of XRP as a payment solution. The card enables seamless crypto-to-fiat conversions—bypassing traditional banking bottlenecks that have long plagued cross-border transactions.

Market analysts note the timing couldn't be better—regulatory clarity finally emerges just as real-world use cases multiply. Though let's be honest—watching traditional finance scramble to catch up with crypto innovation never gets old.

Price action suggests this isn't just another pump. Sustained volume and breaking key resistance levels indicate genuine institutional interest—not just retail speculation. The path to $3.00 looks increasingly probable barring any broader market meltdown.

Because nothing says financial revolution like putting your volatile crypto assets on a payment card tied to the very banking system you're trying to disrupt.

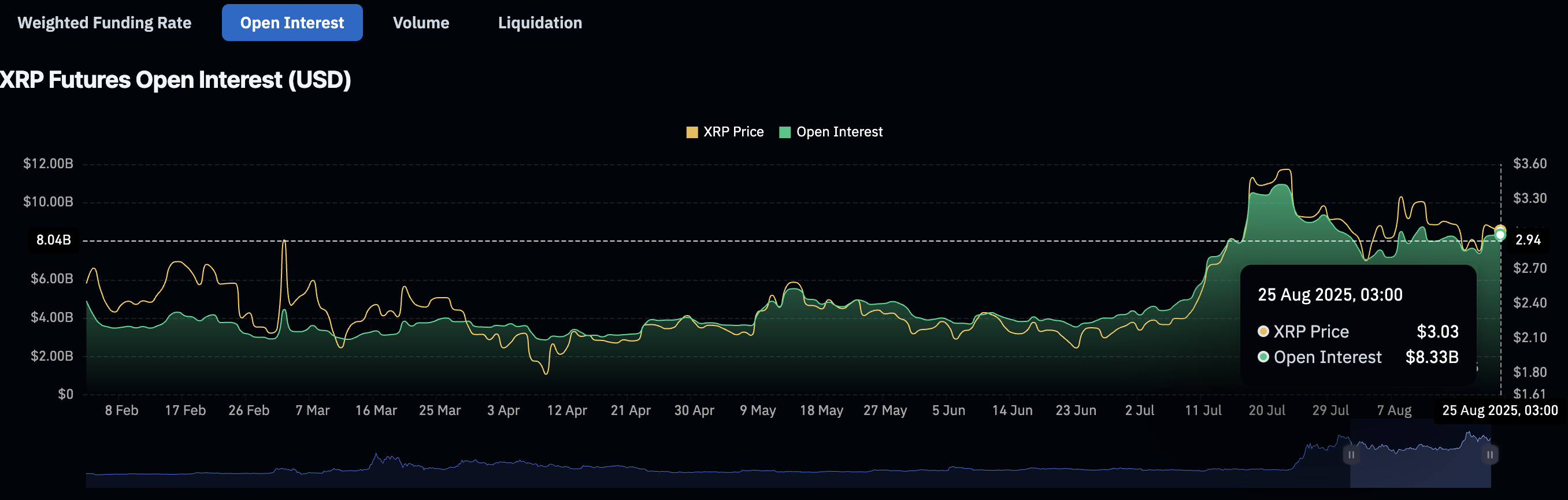

XRP Futures Open Interest | Source: CoinGlass

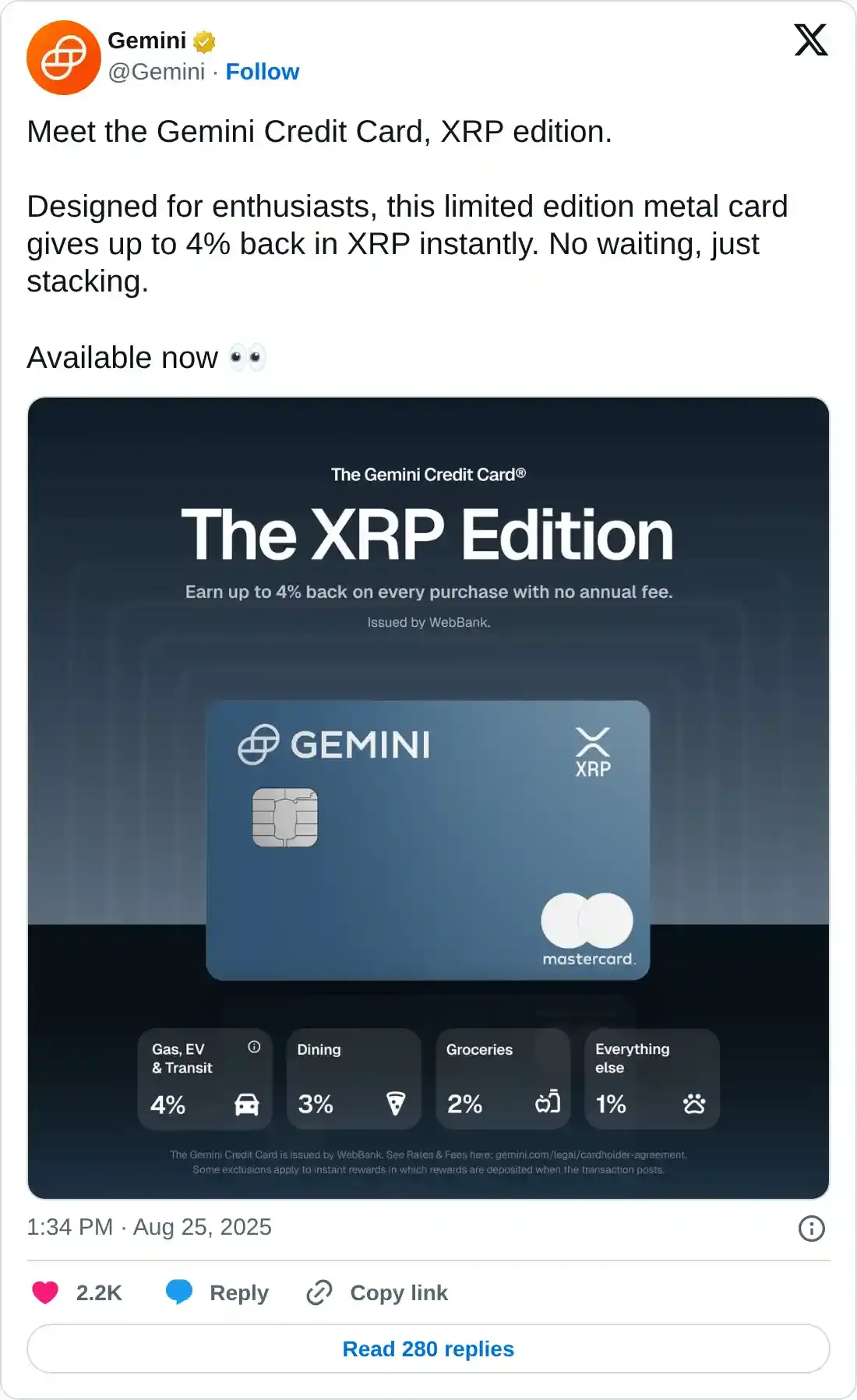

Gemini launches XRP-focused credit card

Gemini, the cryptocurrency exchange founded by billionaire twins Cameron and Tyler Winklevoss, has launched an XRP credit card in collaboration with Ripple. According to CoinDesk, the card is issued by WebBank and resembles other Gemini cash back cards. Holders of the card are eligible for rewards of up to 4% in XRP on select purchases such as fuel, electric vehicle (EV) charging and rideshare services.

A 3% cashback will be extended to users who use the card for dining services, 2% on groceries and 1% on other services. Gemini is working on more collaborations with merchants, which could see users earn a reward of up to 10% on eligible purchases.

In addition to the XRP edition of its credit cards, Gemini is also expanding the use of Ripple USD (RLUSD) to customers in the United States (US). RLUSD, the dollar-backed stablecoin issued by Ripple, is now available as a base currency for all spot trading on the exchange.

“Fifty-five million Americans own crypto and that number is only increasing as more people look for easier ways to access and use it in their daily lives. With Gemini, we’re making everyday spending a chance to earn and connect with both XRP and RLUSD,” Ripple CEO Brad Garlinghouse said in a statement.

Whales increase exposure as XRP struggles

XRP price has not been able to retest its record high of $3.66 reached on July 18, reflecting suppressed sentiment in the broader cryptocurrency market. Despite the price fluctuations between resistance at $3.38, tested on August 8, and support at $2.72, large-volume holders continue to increase exposure to the cross-border money remittance token.

According to Santiment’s data, addresses holding between 1 million and 10 million XRP have grown to hold approximately 10.6% of the total supply from 9.8% in early July and 9.14% in early March.

%20%5B16-1756133439537-1756133439537.28.48,%2025%20Aug,%202025%5D.png)

XRP Supply Distribution metric | Source: Santiment

If whales keep buying the dip, demand will eventually overwhelm supply, allowing bulls to curve out a recovery path above the immediate $3.00 resistance. Risk-on sentiment could strengthen in the upcoming weeks, backed by possible interest rate cuts in September.

Technical outlook: Bulls eye $3.00 breakout

XRP is trading above its short-term support at $2.96 while printing another 4-hour green candle. A recovery above $3.00 could open the door for gains toward XRP’s record high of $3.66.

The Relative Strength Index (RSI), which is stable above 40 but below the midline on the 4-hour chart below, backs the bullish outlook and the potential increase in buying pressure.

Key areas of interest for traders include a break above the $3.00 pivotal level, the 50-period Exponential Moving Average (EMA), the 100-period and the 200-period EMAs, which could serve as tentative support levels.

XRP/USDT 4-hour chart

Still, with the Moving Average Convergence Divergence (MACD) displaying a sell signal, triggered earlier in the day, influence from sellers should not be shrugged off. Traders may consider de-risking from XRP as long as the blue MACD line remains below the red signal line.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.