Chainlink Forges Game-Changing Partnership with Japan’s SBI Group to Revolutionize DeFi Landscape

Chainlink just shook the traditional finance world by locking arms with Japan's financial titan SBI Group—this isn't just another partnership; it's a seismic shift toward institutional DeFi adoption.

Why This Matters

SBI Group, one of Japan's largest financial conglomerates, doesn't play around with blockchain experiments. Their collaboration with Chainlink targets real-world DeFi applications that could bridge trillion-dollar markets with on-chain liquidity. Think cross-chain settlements, institutional-grade oracles, and regulatory-compliant smart contracts—all backed by SBI's massive influence in Asian markets.

The Oracle Problem—Solved

Chainlink's oracle network eliminates the single point of failure that's haunted DeFi for years. By feeding tamper-proof data directly into smart contracts, they're creating financial instruments that actually work without begging banks for permission. Finally, derivatives, loans, and insurance products can operate at global scale—without middlemen taking their cut.

Institutional Money Meets DeFi

This partnership screams one thing: traditional finance is done watching from the sidelines. SBI's move signals that major players are ready to dive into DeFi—provided the infrastructure meets their ruthlessly high standards. Chainlink’s tech just became the golden bridge for institutional capital flowing into crypto.

Of course, bankers will still call it 'risky' right up until they start charging clients 2% management fees for exposure to the same protocols. Some things never change—even in a revolution.

Chainlink and SBI Group in new venture

Chainlink and SBI Group have entered into a new partnership, following the successful delivery of an automated fund administration and transfer agency solution for the Monetary Authority of Singapore's (MAS) Project Guardian, alongside UBS Asset Management.

The Oracle network-financial firm partnership will focus on DeFi use cases, including stablecoins and tokenized stocks, funds, and other real-world assets (RWAs), such as bonds and real estate. To tap into the DeFi world, SBI Group will leverage Chainlink’s Cross-Chain Interoperability Protocol (CCIP), SmartData (NAV), and Proof of Reserve to unlock secondary market liquidity.

Yoshitaka Kitao, Representative Director, Chairman, President & CEO of SBI Holdings, stated:

“Chainlink is a natural partner for SBI, complementing our financial footprint with their market-leading interoperability and reliability on-chain. With our combined strengths, we are delighted to be working together on developing groundbreaking, secure, compliance-focused solutions, including powering compliant cross-border transactions using stablecoins, that accelerate the widespread adoption of digital assets in Japan and the region.”

Chainlink on-chain data reflect optimism

Santiment data shows the supply of LINK token in profit (bought at a price lower than the current market value) is at 95.04%, up from 80.57% on August 1. Typically, elevated levels of supply in profit indicate increased investor confidence and an uptrend in motion.

LINK supply in profit. Source: Santiment

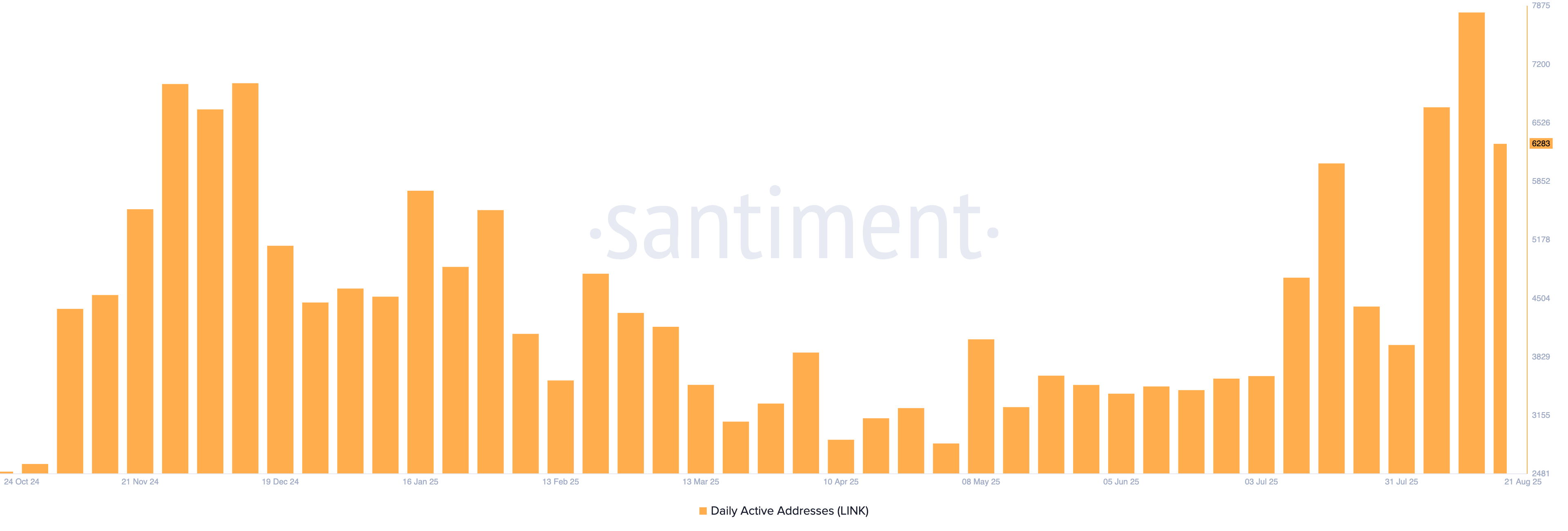

Amid the risk-on sentiment, network activity on Chainlink remains at higher levels compared to the slump from March to July. The daily active addresses maintained an average of 7,797 last week, the highest in 2025.

Daily active addresses. Source: Santiment

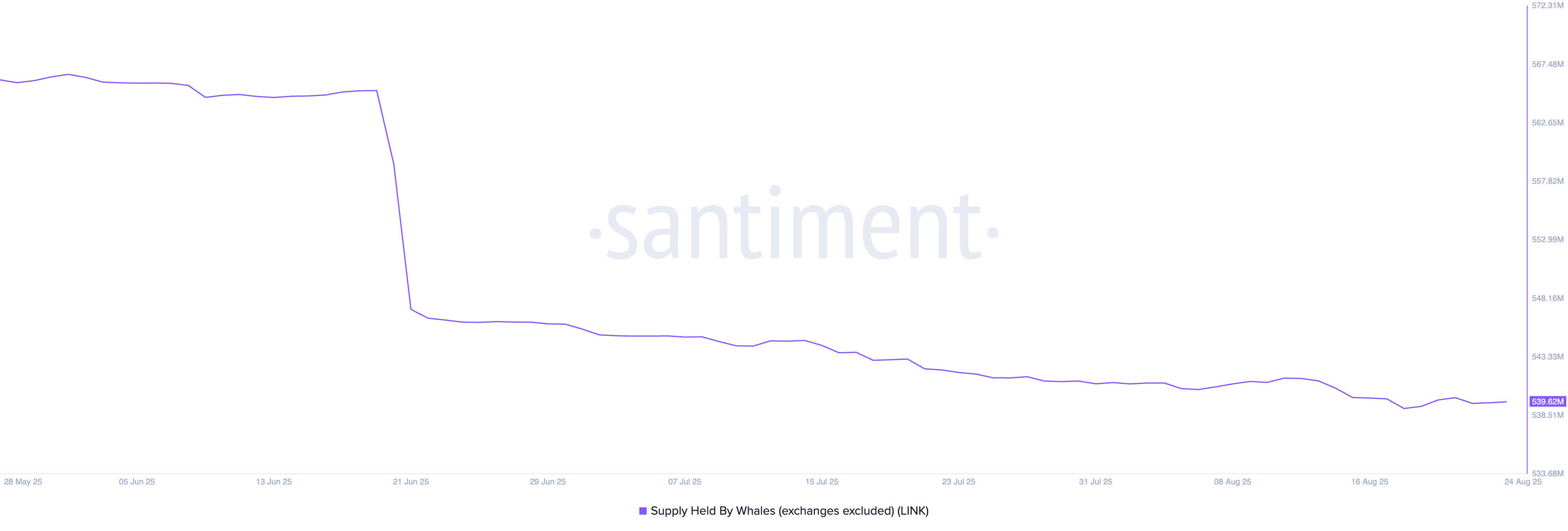

Still, the large-wallet investors, popularly known as whales, offload their holdings, reaching a record low of 539.07 million LINK tokens on August 18. At present, it stands at 539.62 million tokens.

LINK supply held by whales. Source: Santiment