Ripple Price Forecast: XRP Slumps as Traders Pocket $300M Profit Ahead of Powell’s Critical Fed Speech

XRP takes a hit as smart money cashes out ahead of Powell's podium moment.

Profit-Taking Frenzy

Traders just locked in a cool $300 million in gains before the Fed chair takes the mic—because why risk actual market movement when you can pre-game the volatility?

Powell's Shadow Looms

All eyes are on Jerome Powell's upcoming speech. Crypto markets hate uncertainty almost as much as traditional finance hates innovation.

Timing the Exit

This isn't panic selling—it's calculated profit-booking. Because in crypto, sometimes the best trade is knowing when to walk away before the central bankers start talking.

Of course, the same traders dumping now will likely be the first ones back in after the speech—because nothing says 'conviction' like chasing your own tail around Fed announcements.

XRP bows to $300 million profit-taking pressure

XRP saw an uptick in profit-taking activity over the past 24 hours as a brief recovery in the market was dented by hawkish FOMC minutes.

The remittance-based token tagged $3 on Wednesday but quickly retraced as policymakers signaled a preference for inflation data in establishing interest rates. With inflation coming in hotter-than-expected last week, the minutes have fueled concerns that the Fed may hold rates steady in its September meeting.

As a result, risk-off sentiments continue to rock the crypto market. Notably, XRP investors have realized over $300 million in profits since Wednesday, per Santiment data. The selling activity came from both long-term and short-term holders, as evidenced in the chart below.

%20%5B01-1755822635890-1755822635891.27.17,%2022%20Aug,%202025%5D.png)

XRP Network Realized Profit/Loss & Dormant Circulation. Source: Santiment

XRP exchange FLOW data from Coinglass aligns with the profit-taking activity as net inflows rose to $76.8 million — its highest level since July 19, after XRP hit a new all-time high the prior day. An increase in exchange net inflows signifies rising selling activity and vice versa for net outflows.

With more than 90% of supply in profits, the selling trend is expected to continue if Fed Chair Jerome Powell's speech at Jackson Hole on Friday comes with a hawkish undertone.

However, XRP's futures market remains fairly calm compared to the recent rising activity seen in its spot counterpart. Open interest, which represents the total worth of positions held by traders, declined by only 100 million XRP over the past week. This suggests that, while slightly tilted toward the downside, the remittance-based token isn't primarily leverage-driven.

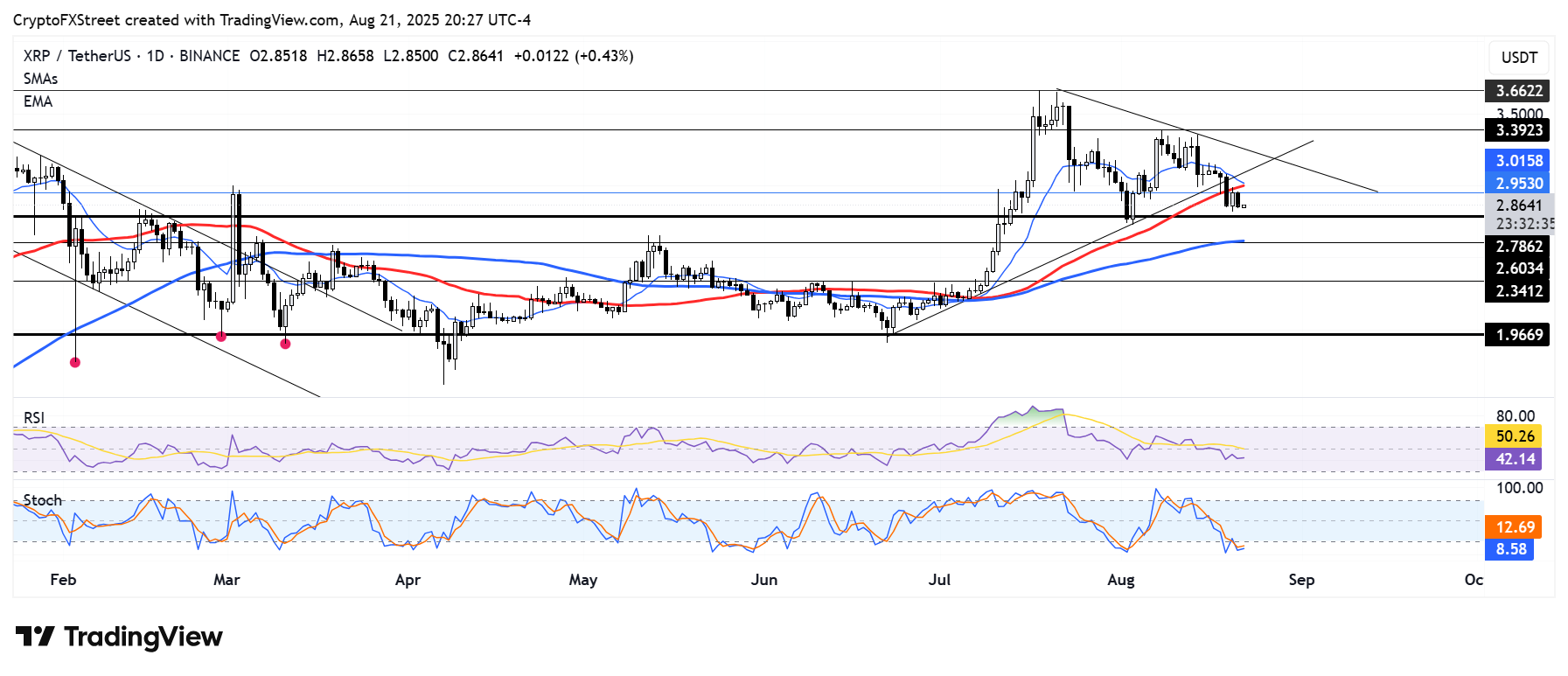

XRP faces rejection at $3.00, eyes $2.78 support

After declining below the lower boundary of a symmetrical triangle and the 50-day Simple Moving Average (SMA) earlier in the week, XRP bounced NEAR the $2.78 support and attempted to reclaim the $3 psychological level. However, it saw a rejection on Friday, registering a 3% decline in the process.

XRP/USDT daily chart

On the downside, the remittance-based token could find support near $2.78. A failure to hold this level could see its price decline toward the $2.60 level, which is strengthened by the 100-day SMA.

On the upside, XRP has to reclaim the $3 level and break above a descending trendline to test the resistance at $3.39 before it can stage a MOVE toward its all-time high resistance.

The Relative Strength Index (RSI) is below its neutral level while the Stochastic Oscillator (Stoch) has crossed into its oversold region, indicating a dominant bearish momentum.