BNB Treasury Firm Plunges 77% After Nasdaq Delisting Shock - Here’s What Happened

Another day, another crypto firm gets the cold shoulder from traditional finance.

THE NASDAQ AXE FALLS

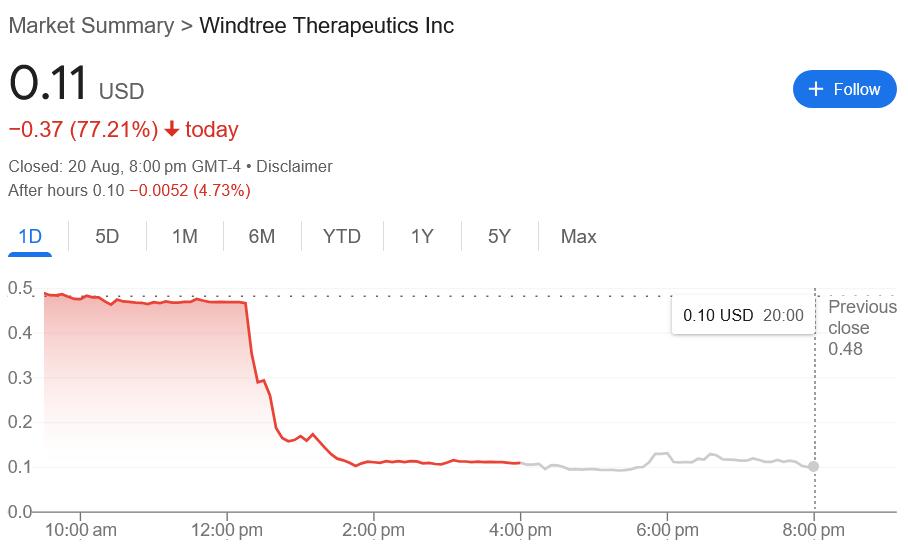

BNB's treasury management arm just got served a delisting notice—sending its valuation into a tailspin. Shares cratered 77% in a single session as traders scrambled for exits. The exchange cited 'failure to meet continued listing requirements' without elaborating further.

WHEN INSTITUTIONAL APPROVAL VANISHES

Nasdaq's move exposes the fragile bridge between crypto natives and legacy markets. One regulatory hiccup—one compliance misstep—and suddenly you're back trading on unregulated offshore platforms. The firm now faces either restructuring to meet exchange standards or embracing the decentralized ethos fully.

THE AFTERMATH

Investors are left holding bags while the company races to stabilize operations. The 77% wipeout echoes that classic crypto volatility traditional finance claims to despise—yet somehow always enables through opaque listing standards. Nothing says 'mature market' like getting delisted for reasons nobody will clearly explain.

WINT’s change in share price on Wednesday. Source: Google Finance

While some firms have gained after adopting a crypto treasury strategy, others haven’t been as lucky. Windtree is part of a growing number of publicly traded firms to adopt a BNB strategy, giving investors exposure to BNB without holding the cryptocurrency directly.

Windtree to continue making financial disclosures

The company’s CEO, Jed Latkin, said in the filing that Windtree would continue its reporting obligations despite the delisting.

Some crypto firms, such as Argo Blockchain, have been suspended on the Nasdaq but were relisted after satisfying compliance requirements.

Windtree made big announcements, then went quiet

Windtree kickstarted its BNB treasury on July 16, disclosing a $60 million purchase agreement with Build and Build Corp, with options for an additional $140 million.

WINT ROSE 32.2% over the next two days before it started tumbling down.

About a week later, it signed a $500 million equity line of credit with an unnamed investor, with a separate $20 million stock‑purchase pact with Build and Build Corp to purchase more BNB tokens.

Windtree hasn’t disclosed how much BNB it holds or whether it intends to continue its BNB treasury strategy. Cointelegraph reached out to Windtree for comment.

BNB rises on Wednesday, notches another high

BNB was one of the best performers among blue-chip altcoins on Wednesday, rising 5.6% to $876.26 and setting a new all-time high as the broader crypto market bounced back from a two-week low, CoinGecko data shows.

BNB is one of the only large altcoins to set a new high this bull cycle, along with XRP (XRP $2.92) and Solana (SOL $187.89) — while the likes of Ether (ETH $4,313), Dogecoin (DOGE $0.2238), chainlink (LINK $25.79) and Cardano (ADA $0.8785) are still chasing highs set from back in 2021.