XRP Defies ETF Delay FUD—Holds Strong at 50-Day SMA Support

XRP shrugs off regulatory speedbumps as bulls defend critical moving average.

Key Levels Hold Despite ETF Setback

While traditional finance drags its feet on crypto adoption—shocking absolutely nobody—XRP's chart tells a different story. The 50-day SMA has become the battleground, and for now, the bulls are winning.

Technical Resilience Meets Regulatory Reality

Price action consolidates neatly above support, proving once again that crypto markets move faster than bureaucratic paperwork. Meanwhile, Wall Street still can't decide if digital assets are 'too risky' or 'the future of finance'—pick a lane, guys.

Next Stop: Breakout or Breakdown?

All eyes on whether this stability is accumulation before a push higher... or just the calm before another storm. Either way, XRP's showing more backbone than your average TradFi ETF committee.

XRP investors maintain resilience amid ETF delay

XRP briefly declined below $3 on Monday, continuing a weak price action that spanned from last Thursday's inflation-induced market-wide correction.

The hotter-than-expected inflation data has increased caution among market participants who were predominantly bullish just a week ago.

Despite signs of caution and de-risking in the general market, profit-taking or loss realization among XRP investors has remained muted compared to previous weeks.

%20%5B22-1755554627918-1755554627919.42.50,%2018%20Aug,%202025%5D.png)

XRP Network Realized Profit/Loss. Source: Santiment

A similar sentiment is evident in the Age Consumed metric, which tracks the movement of previously idle tokens. The almost invisible red lines between August 11-18 show that distribution from long-term holders has been minimal. At the same time, accumulation has edged upward slightly as seen in the Mean Coin Age, which tracks the average number of days all tokens have stayed in their current addresses.

%20%5B22-1755554659669-1755554659671.42.59,%2018%20Aug,%202025%5D.png)

XRP Age Consumed & Mean Coin Age. Source: Santiment

The uptick in demand partly stems from XRP investment products, which attracted nearly $127 million in inflows last week, reflecting sustained institutional buying pressure, according to data from a CoinShares report on Monday.

While international products focused on XRP attracted interest, several asset managers seeking to launch ETF wrappers for the cryptocurrency faced another round of delay on Monday. The SEC postponed its decision on XRP ETF filings from Bitwise, Canary Capital, and Grayscale.

"...The Commission, pursuant to Section 19(b)(2) of the Act, designates October 18, 2025, as the date by which the Commission shall either approve or disapprove the proposed rule change..." the SEC commented on Grayscale's XRP ETF filing.

Despite the delay, experts are confident that the agency will greenlight the filings, especially after concluding its case with Ripple over the past few weeks.

XRP bounces off 50-day SMA, resumes trading in symmetrical triangle

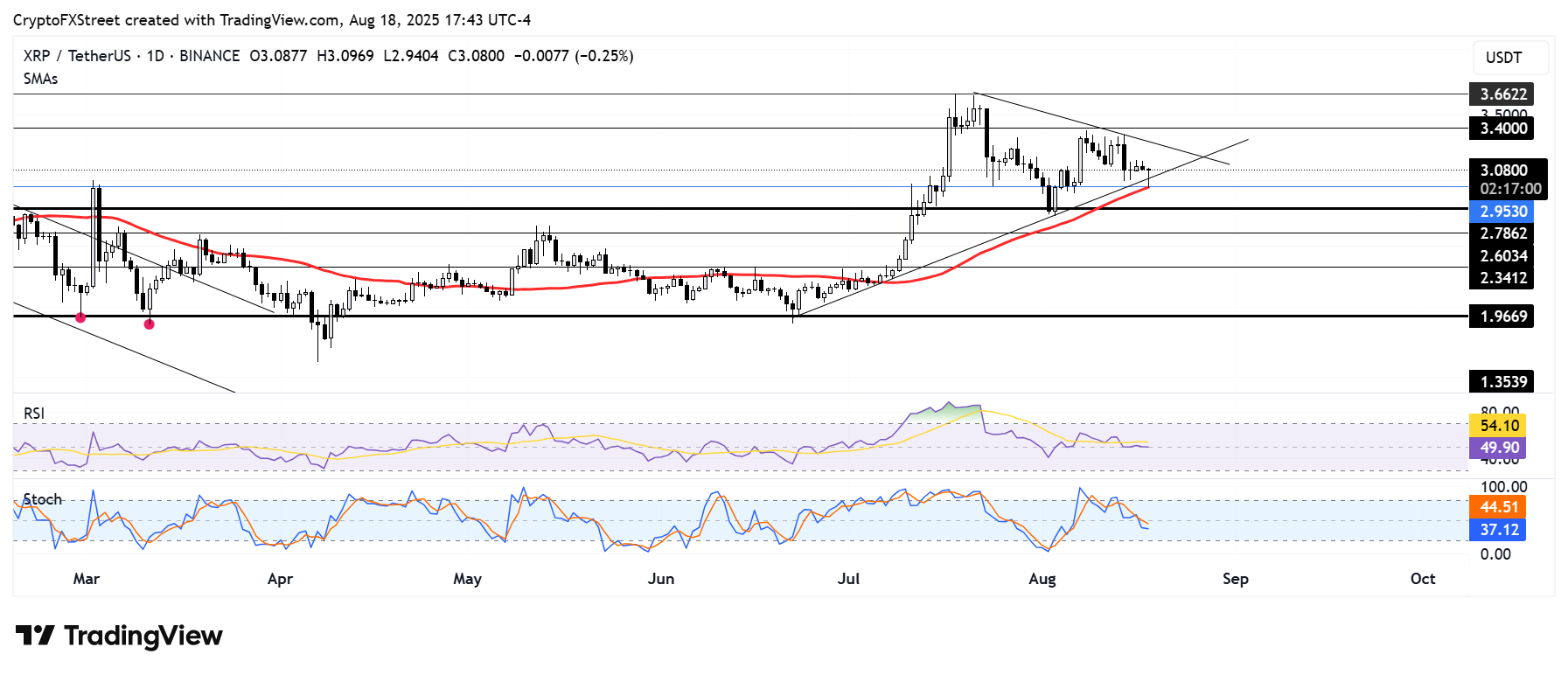

After seeing a brief decline in the early hours of Monday, XRP bounced off the support at $2.95, strengthened by the 50-day Simple Moving Average (SMA). As a result, the remittance-based token is looking to hold the lower boundary support of a symmetrical triangle.

XRP/USDT daily chart

On the upside, XRP has to overcome the upper boundary of the triangle to test the $3.4 resistance, which bears have defended over the past two weeks. A firm MOVE above $3.4 could see XRP retest its all-time high at $3.66.

On the downside, XRP could test $2.78 if it declines below the 50-day SMA.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their moving averages and neutral levels, indicating a dominant bearish momentum.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.