Ethereum Primed for $8.5K Surge If Bitcoin Hits $150K—Trader Bets Big

Brace for impact—Ethereum's price could rocket to $8,500 if Bitcoin smashes through $150,000, according to a bold trader prediction. Here's why the smart money's watching.

When Bitcoin moons, altcoins often follow. Ethereum—the undisputed king of smart contracts—is no exception. A $150K Bitcoin would send shockwaves through crypto markets, and ETH's 5.6x upside potential has traders buzzing.

Of course, Wall Street will still call it 'speculative'—right before launching their 37th crypto ETF. The math's simple: BTC dominance + institutional FOMO = altseason on steroids.

One question remains: Will Ethereum finally flip Bitcoin's market cap? Place your bets—the casino stays open 24/7.

Analysts predict Bitcoin surpassing $150,000

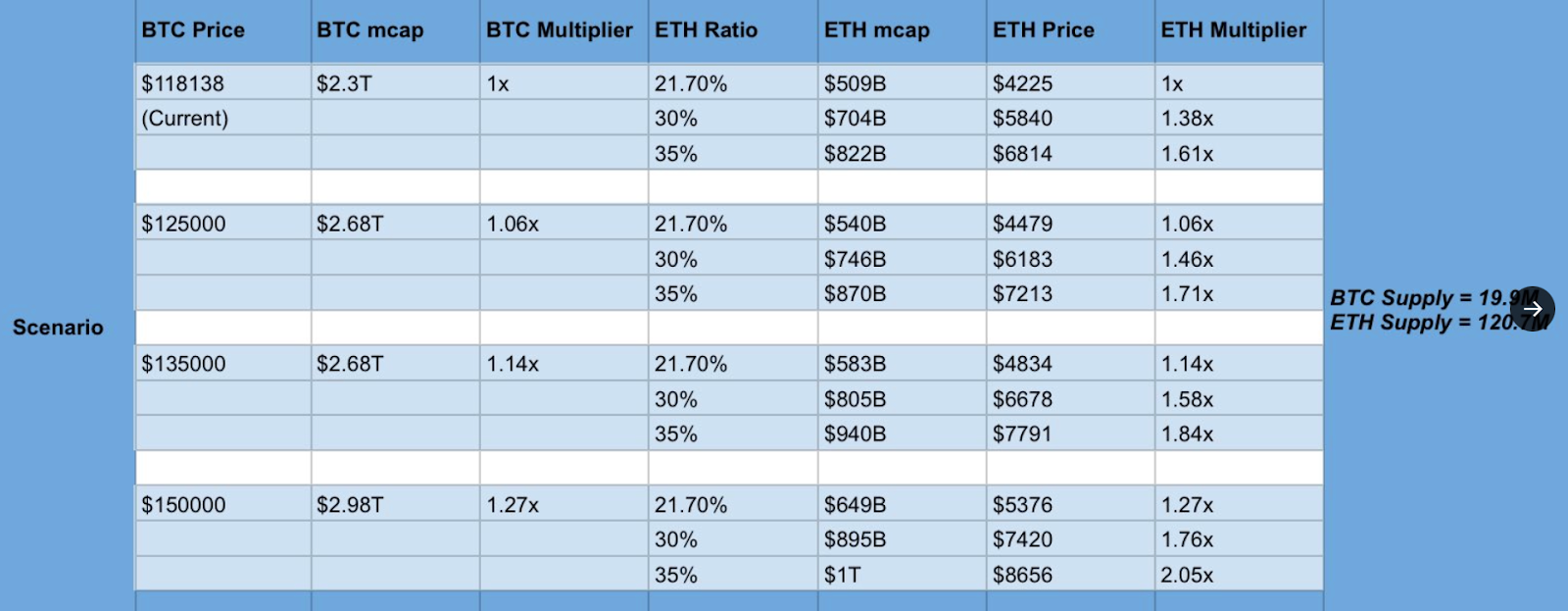

Yashasedu said that if bitcoin (BTC $119,327) reaches $150,000 — a 25% increase from its current price of $119,335 — then ETH may soar to $8,656, assuming Ether reaches 35% of Bitcoin’s market cap as in previous cycles.

They added that even at the lower range, if ETH reached 21.70% to 30% of Bitcoin’s market cap when Bitcoin hit $150,000, its price could trade between $5,376 and $7,420.

Based on historical patterns, Ether may reach as high as $8,656 if Bitcoin taps $150,000. Source: Yashasedu

Yashasedu said that the pattern of Ether reaching between 30% and 35% of Bitcoin’s market cap is set for a repeat.

“We’re seeing a similar setup now,” they said, noting that Ethereum’s total value locked (TVL) recently topped $90 billion, alongside surging institutional interest and growing exchange-traded fund (ETF) demand for Ether.

Several crypto firms and analysts expect Bitcoin to surpass $150,000 by the end of the year. Fundstrat co-founder Tom Lee, BitMEX co-founder Arthur Hayes, and Unchained market research director Joe Burnett all predict it will reach up to $250,000 by the end of 2025.

Institutional and ETF demand for ETH raises chances

On Tuesday, blockchain technology firm BitMine Immersion Technologies said it WOULD raise up to $20 billion for ETH purchases. A day earlier, spot Ether ETFs recorded their biggest day of net inflows ever, with flows across all funds totalling $1.01 billion.

In the NEAR term, there is high anticipation that Ether will soon reclaim its all-time highs, currently trading at $4,630, about 5.35% below its November 2021 peak of $4,878, according to CoinMarketCap data.

Yashasedu doesn’t anticipate a “cool off” in Ether’s price until it reclaims the all-time high. MN Trading Capital founder Michaël van de Poppe foresees a similar situation.

“We’ll likely see a new ATH for ETH and then some consolidation,” van de Poppe said on Tuesday.