Crypto Holds Its Breath: Bitcoin, Ethereum, XRP Flatline Ahead of Pivotal US CPI Data

Crypto markets hit the pause button as traders brace for inflation fireworks.

The Calm Before the Storm?

Major cryptocurrencies enter holding pattern—no wild swings, just nervous sideways action. Bitcoin plays statue at $X, Ethereum mimics at $Y, while XRP barely bothers to fluctuate (not that it ever does much).

CPI: The Only Chart That Matters Today

Forget TA—every algo's tuned to Washington's inflation math. One hot number could vaporize those 'Fed pivot' hopium dreams faster than a Celsius withdrawal request.

Institutional Whispers

OTC desks report hedge funds loading puts and praying—some things never change. Meanwhile, retail 'investors' keep buying dog-themed tokens because fundamentals.

The crypto market's playing possum. Question is—will CPI bring the shotgun or the carrot?

Market overview: What to expect from US inflation data

The Bureau of Labor Statistics (BLS) is set to release the US CPI data on Tuesday, following the implementation of President Donald Trump’s higher tariffs earlier this month.

Markets anticipate a 0.2% monthly increase in July inflation and a 2.8% annual rise. The Core CPI, which excludes the volatile prices of food and energy, is expected to rise by 0.3% on a monthly basis and 3% annually.

US inflation showed a rising trend in June, with the CPI rising 2.7% annually after increasing 2.4% in May. The CORE inflation, less the cost of food and energy, rose 2.9% over 12 months in June.

Inflation data could reassess the market's interest-rate cut bets for September's Federal Reserve (Fed) decision. Investors expect the US central bank to slash rates next month, but increasing signs that tariffs are feeding through to prices could trim these expectations. The Fed has delayed interest rate cuts this year, citing the impact of higher tariffs on inflation.

As for the cryptocurrency market, investors will likely tread with caution amid the possibility of a surge in volatility. Since Bitcoin has reversed from its weekly top of $122,335, investors could be eyeing a rebound above $120,000 and toward the record high of $123,218 reached on July 14 if inflation data comes out favourably.

Data spotlight: Ethereum ETFs inflows hit $1 billion

Ethereum spot Exchange Traded Funds (ETFs) extended their bullish streak on Monday with inflows averaging $1.02 billion, the highest level on record. SoSoValue data shows that BlackRock’s ETHA led other spot ETFs in the US, recording $640 million in inflows, followed by Fidelity’s FETH with $277 million.

Ethereum spot ETF data | Source: SoSoValue

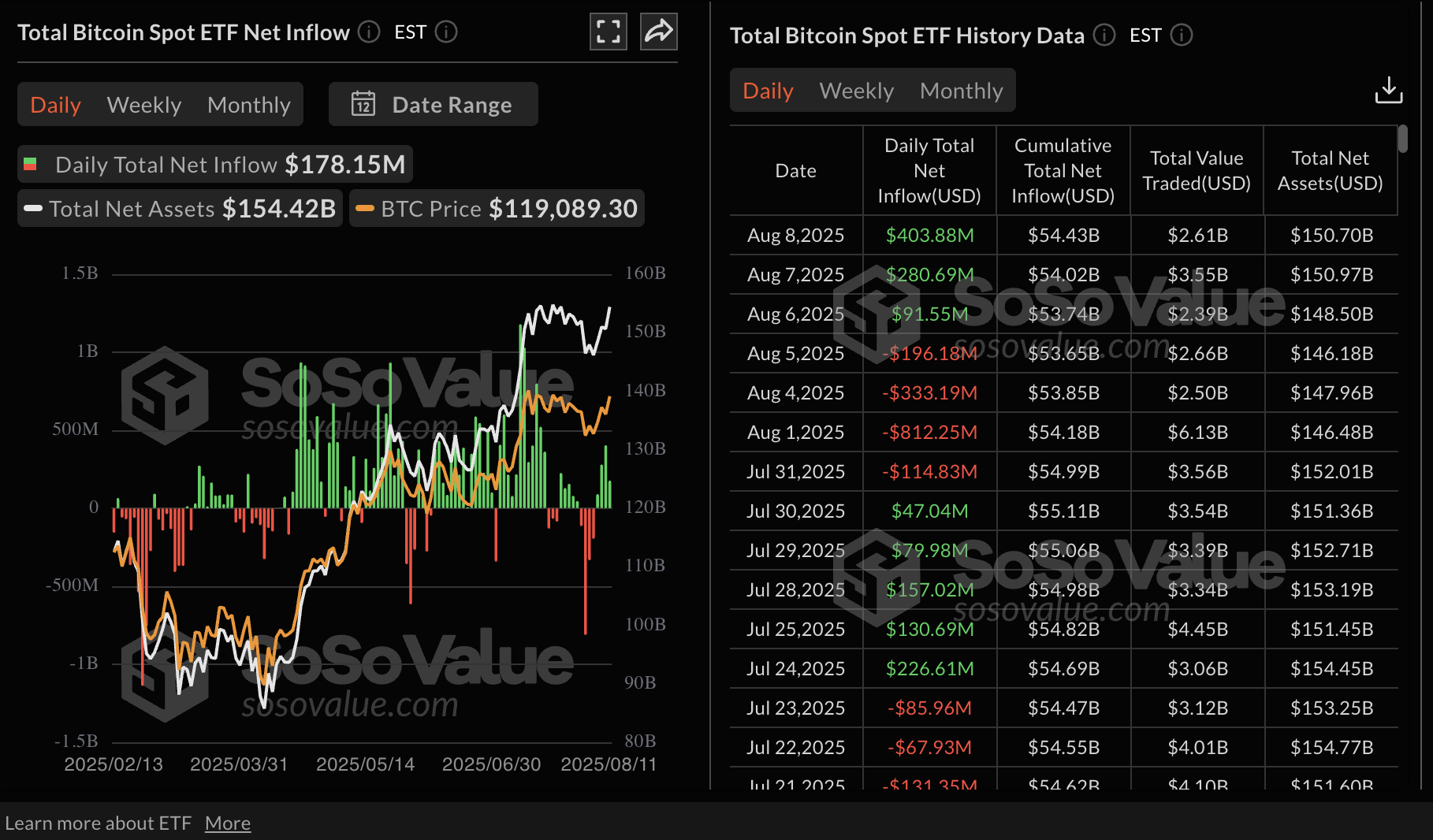

Inflows in Bitcoin spot ETF operating in the US inched higher on Monday with $404 million, bringing the cumulative total net inflow to $54.4 billion. The total net assets average $151 billion at the time of writing.

Bitcoin spot ETF data | Source: SoSoValue

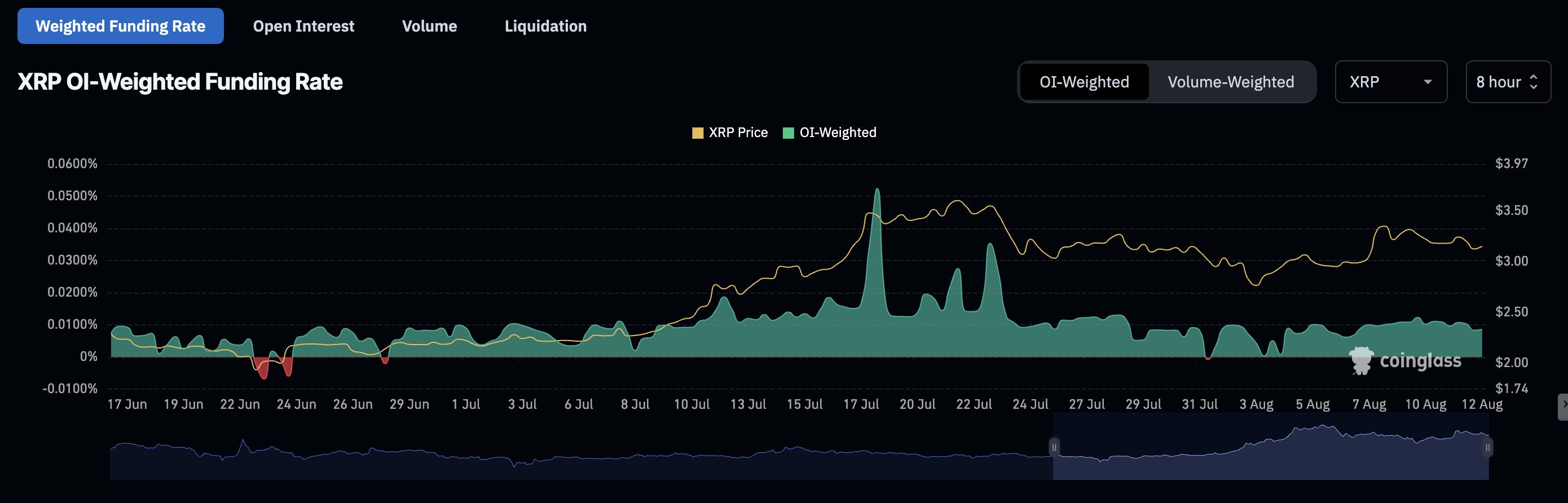

As for XRP, interest in the token appears steady based on the futures weighted funding rate, which averages at 0.0086%. This is a healthy level , as readings above 0.05% often signal a potential correction. Steady funding rates indicate more traders are leveraging long positions, anticipating the price to sustain the uptrend.

XRP Futures Weighted Funding Rate | Source: CoinGlass

Chart of the day: Bitcoin retests critical support

Bitcoin price shows weakness in shorter time frames, edging lower to test the support range of $117,000 to $118,000. The Relative Strength Index (RSI), which is declining toward the midline on the 8-hour chart after peaking at around 72 in overbought territory on Monday, indicates a reduction in buying pressure.

Traders may continue de-risking or shorting bitcoin if the RSI extends the decline below the midline.

BTC/USDT 8-hour chart

Still, Bitcoin holds above the uptrending moving averages, including the 50-period Exponential Moving Average (EMA) at $116,872, the 100-period EMA at $115,666 and the 200-period EMA at $112,352. In the event of a reversal, these levels WOULD serve as tentative support to prevent the decline from extending toward the $110,000 round-figure support.

Altcoins update: Ethereum upholds uptrend, as XRP consolidates

Ethereum price is holding below the critical $4,300 level as bulls aim for the next breakout toward the record high of $4,878. The RSI holds in overbought territory but shows signs of extending the uptrend, reflecting the steady demand.

Key areas of interest to traders in upcoming sessions are the immediate resistance at $4,300 and the all-time high of $4,878, which, if broken, could see the price of ETH close the gap to $5,000 for the first time.

On the other hand, the range support at $4,000 is in line to absorb the potential selling pressure due to profit-taking and keep the uptrend intact.

ETH/USDT daily chart

As for XRP, the price is consolidating above support at $3.00. However, the RSI’s decline NEAR the midline indicates that overhead pressure could overwhelm demand, and keep the path of least resistance downward in the short term.

XRP/USDT daily chart

If traders buy the dip between the current price of $3.13 and the support at $3.00, the tailwind on XRP could fuel a rebound.

The seller congestion at $3.40 remains crucial in the recovery toward the record high of $3.66 reached on July 18. If XRP is rejected at this level, the $3.00 support would remain insight with further decline to the 50-day EMA at $2.89 staying within reach.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.