🚀 Ethereum ETFs Explode: $1B Floods In as ETH Signals Major Bull Run Ahead

Wall Street's latest crypto crush just hit a fever pitch—Ethereum ETFs are swallowing cash like a black hole. A cool billion poured in this week alone, while ETH's price action screams 'buckle up.'

### The Institutional Stampede

Forget dipping toes—asset managers are cannonballing into ETH. That $1B inflow isn't just smart money hedging bets; it's a full-scale FOMO assault on the second-largest crypto.

### Chart Whisperers See Green

Technical indicators? Flashing neon buy signals. The same traders who called ETH's 2024 surge now spot eerily similar patterns—right as traditional finance finally stops pretending blockchain is a fad.

### The Cynic's Corner

Of course, banks only love decentralization when they can slap a 2% management fee on it. But hey—if the suits want to pump ETH while pretending they 'get' Web3, retail investors might as well ride the wave.

One thing's clear: Ethereum isn't just for degens anymore. The question isn't if ETH breaks ATH again—it's how many Lambo dealerships will accept it this time.

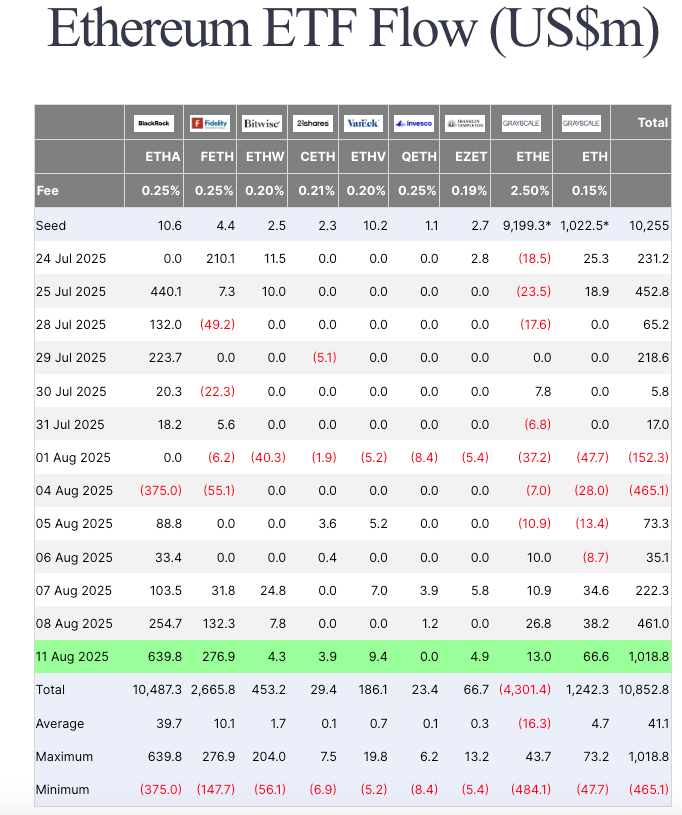

Net inflows into spot Ether ETFs exceeded $1 billion on Monday. Source: Farside Investors

NovaDius president Nate Geraci said on X that Ether ETFs were previously underestimated as institutional investors did not understand Ethereum.

“Feel like spot ETH ETFs were severely underestimated simply [because] tradfi investors didn’t understand eth,” Geraci said.

He added that institutional investors are now resonating with ETH, as it is being touted as the “backbone of future financial markets.”

Bullish indicators for Ethereum

The record inflows come as key indicators have turned bullish for ETH, which has surged 45% in the past 30 days, according to CoinGecko.

Ether held on exchanges hit a nine-year low on Thursday, dropping to 15.28 million ETH, its lowest level since November 2016, according to data from Glassnode.

Investors taking their crypto assets out of exchanges is typically considered a bullish signal, meaning they could be moving them for long-term storage.

In a Monday X post, onchain data platform Token Terminal noted that Ethereum remained the dominant chain for tokenized assets, as the blockchain accounted for about 58% of all tokenized assets across all chains.

The company also said that assets staked on the Ethereum network surpassed the $150 billion milestone for the first time.

Ether ETFs, treasuries keep on stacking

Crypto influencer Anthony Sassano posted that Ether ETFs have bought over 50% of the ETH issued since the Merge in late 2022.

The blockchain has issued over 451,000 ETH since its switch to proof-of-stake, while net inflows into the ETFs on Monday bought up 238,000 ETH, Sassano said.

“In a *single day*, the ETH ETFs bought over 50% all the net issued ETH since The Merge,” he said.

Corporate holders of Ether witnessed their assets under management swell to $13 billion on Monday due to the price increase of ETH.

Ethereum observers urge caution

The recent price rally has seen an uptick in short-term traders booking profits, suggesting short-term traders may be expecting ETH to pull back

Ethereum co-founder Vitalik Buterin warned on Thursday that the recent trend of corporations buying ETH for their treasuries could turn into a dangerous “overleveraged game.”