XRP Primed for Historic Rally as Ripple and SEC Near Landmark Lawsuit Settlement

XRP bulls are charging as Ripple and the SEC finally signal an endgame in their marathon legal battle. The crypto that wouldn't die now eyes all-time highs—just as Wall Street 'experts' finish dumping their bags.

Breaking the Chains: Regulatory Clarity Looms

After years of regulatory limbo, XRP's fate may finally be decided. A settlement would remove the Sword of Damocles hanging over Ripple's head—and unleash pent-up institutional demand. Market makers are already positioning for what could be crypto's comeback story of the decade.

The Irony Play: SEC's Own Making

Nothing fuels a crypto rally like schadenfreude. Should Ripple prevail, it'll be the ultimate 'regulator pump'—the very institution that tried to kill XRP may inadvertently trigger its moonshot. Cue the SEC's inevitable press release claiming this was their plan all along.

FOMO Season Officially Open

With shorts scrambling and exchanges preemptively relisting XRP, retail traders face their favorite dilemma: chase the green candle or wait for the inevitable 'buy the rumor, sell the news' dip. Meanwhile, hedge funds quietly accumulate—somehow always one step ahead of Main Street.

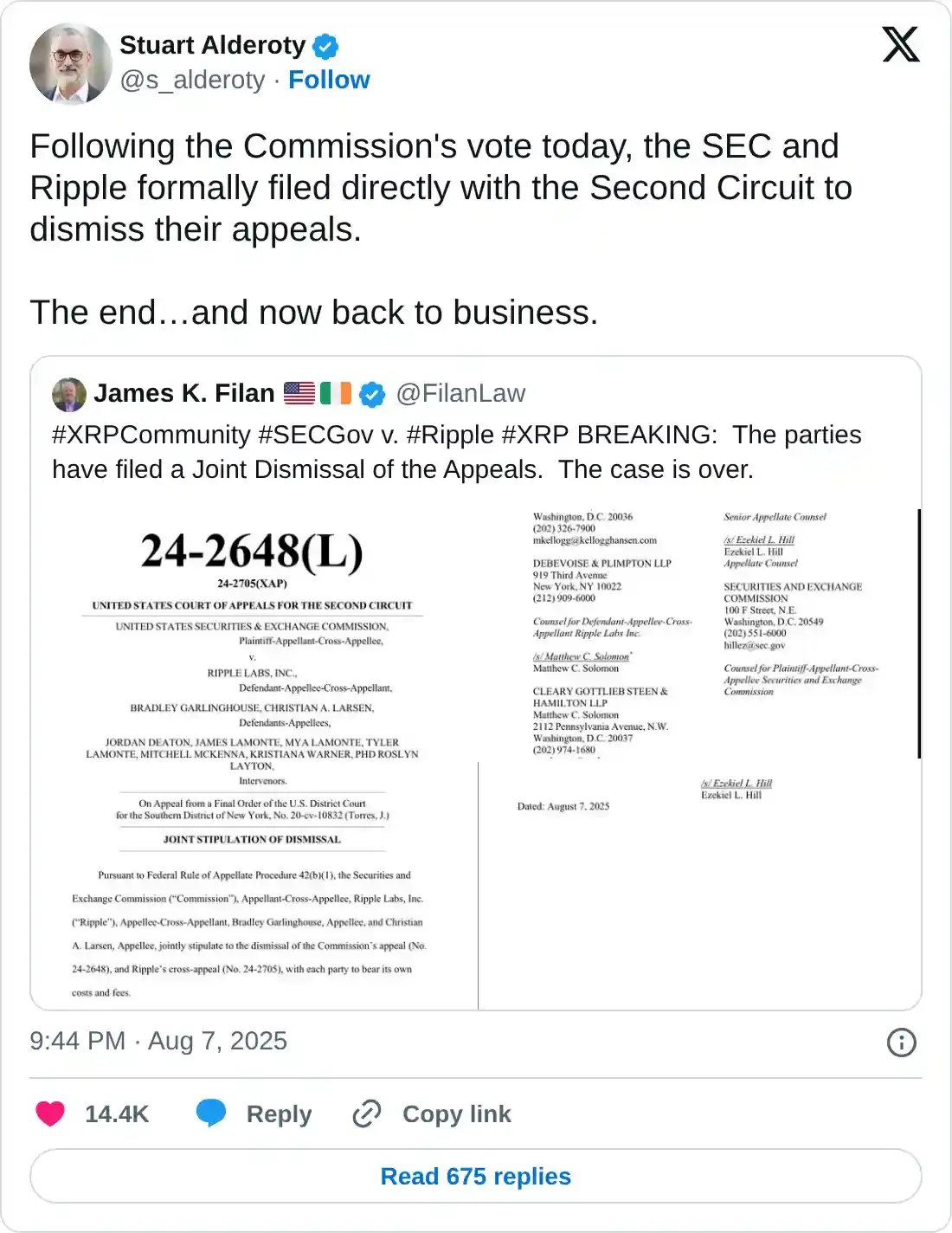

Ripple, SEC file to dismiss appeals

Ripple and the SEC have jointly filed directly with the Court of Appeals for the Second Circuit, requesting to dismiss their appeals.

According to the filing shared by Ripple’s Chief Legal Officer, Stuart Alderoty, each party is expected to settle its own fees and costs. The filing marks a major step toward the resolution of the legal standoff between Ripple and the regulator.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws. A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like Binance and Coinbase crypto did not constitute unregistered securities. Still, the court found Ripple answerable for direct sales to institutions.

In recent months, Ripple and the SEC have explored settlement paths, especially after the blockchain startup was penalized $125 million, currently in an interest-earning escrow account.

A $50 million settlement was signed by both parties this year. However, Judge Analisa Torres of the District Court for the Southern District of New York rejected the joint motion seeking to end the lawsuit, citing an incomplete legal process.

The SEC is also expected to provide a status report to the court by August 15. However, the joint motion to the Second Circuit offers insight, suggesting that a resolution could be imminent.

Technical outlook: Can XRP sustain the uptrend?

XRP is consolidating gains at around $3.36 at the time of writing, following a rejection from an intraday high of $3.38. Interest in the token picked up the pace on Thursday, following the report regarding the joint motion with the SEC.

The Relative Strength Index (RSI), which is retreating into the bullish region after being slightly overbought at 75, indicates waning buying pressure, possibly due to profit-taking and sentiment in the broader crypto market.

Key support levels include $3.32, which was tested toward the end of July, the 50-period Exponential Moving Average (EMA) at $3.07, the 100-period EMA slightly below at $3.06 and the 200-period EMA at $2.95.

XRP/USDT 4-hour chart

On the other hand, the technical outlook could remain bullish if the Moving Average Convergence Divergence (MACD) indicator upholds a buy signal, triggered on Thursday when the blue line crossed and settled above the red signal line.

A daily close above the intraday high resistance at $3.38 could bolster the uptrend and potentially increase the chances of bulls accelerating the uptrend to the record high of $3.66 and the medium-term target of $4.00.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.