Crypto Whales Are Dumping XRP – Here’s Why August Marks a Silent Exodus

Crypto's big players are slipping out the back door. XRP whales have been quietly offloading their holdings this August—no fanfare, no market panic. Just cold, calculated exits.

What’s driving the sell-off?

Ripple’s ongoing legal drama with the SEC isn’t helping. Neither is the stagnant price action. While other altcoins pump, XRP’s chart looks like a flatline—hardly inspiring for whales who crave volatility (and profits).

Meanwhile, institutional money keeps flocking to Bitcoin and Ethereum. Even meme coins are getting more love than Ripple’s darling. Maybe whales finally realized holding a 'security' isn’t as fun as trading pure-degen shitcoins.

Pro tip: When the smart money leaves, retail usually follows. Just saying.

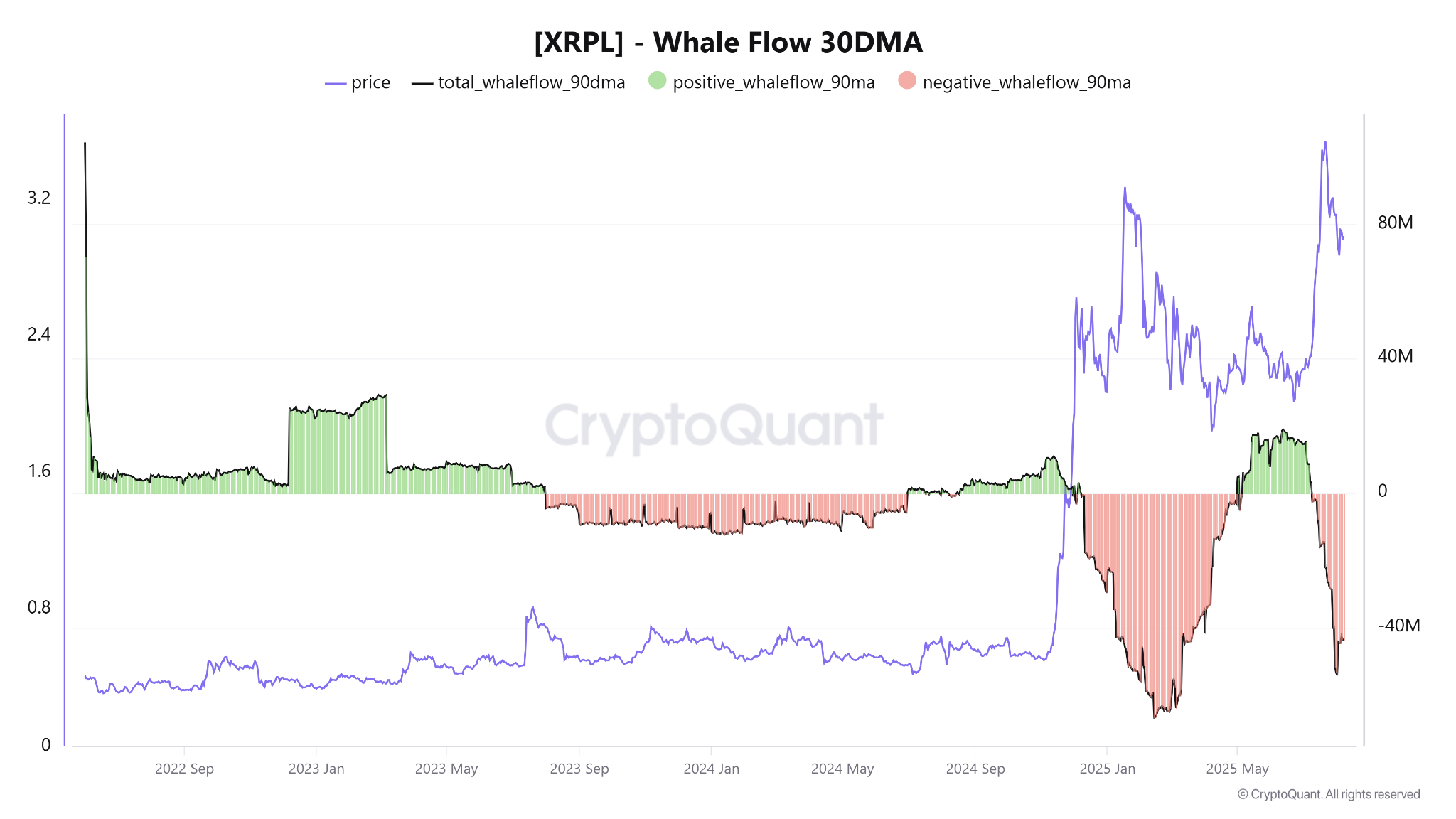

(XRPL Whale Flow 30DMA. Source: CryptoQuant)

The data also shows a similar pattern occurred earlier this year, in January and February. At that time, XRP peaked at $3.40 before sharply dropping to around $1.60. This decline aligned with significant whale distribution. A 50% price drop earlier this year highlights how much influence these entities have over XRP’s price.

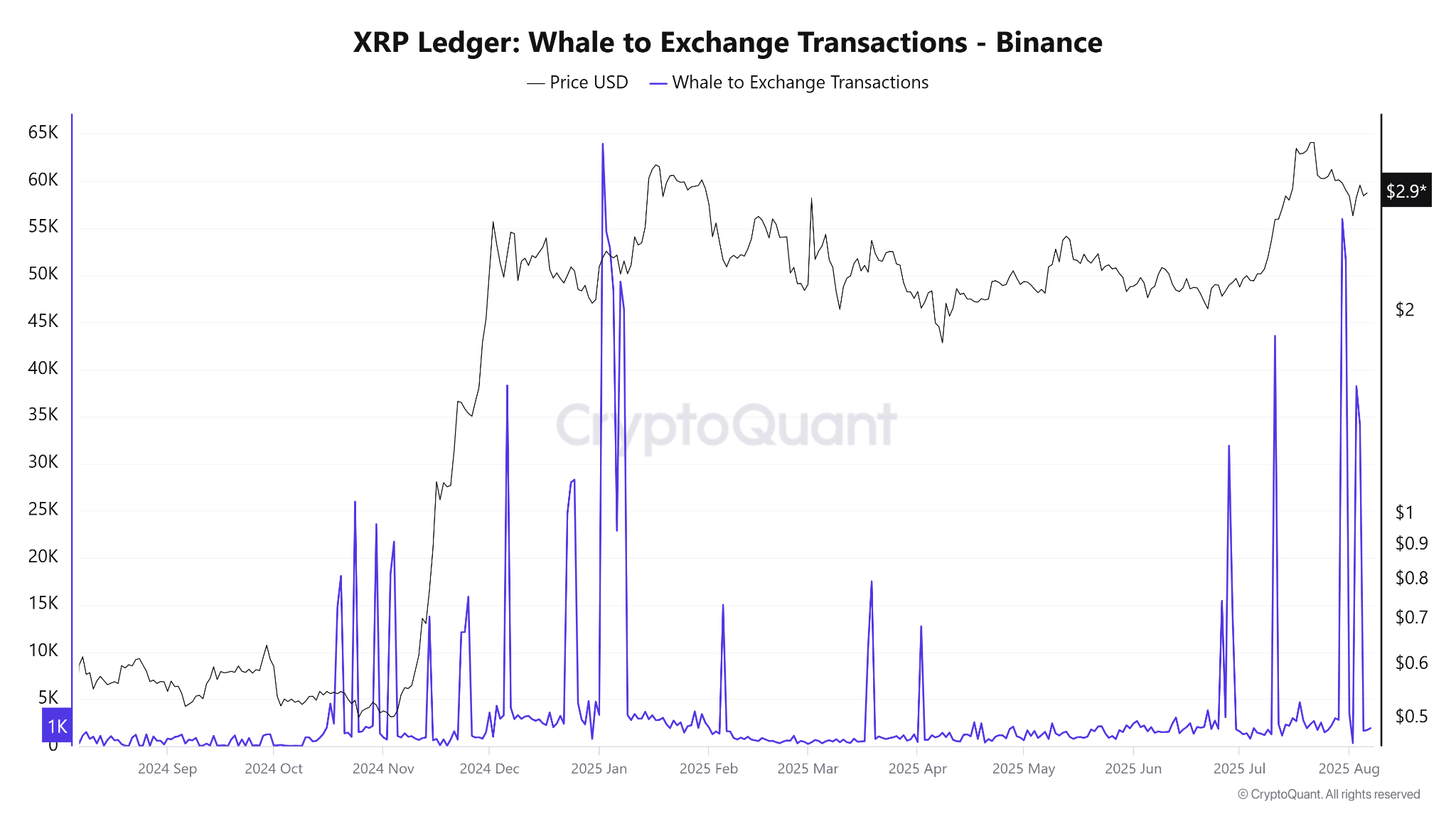

Additionally, CryptoQuant data reveals a sharp increase in the number of whale transactions sending XRP to exchanges. On July 31, there were more than 51,000 such transactions. By August 4, that number was still high—over 38,000.

This trend mirrors early-year behavior. Back then, whale transactions to exchanges spiked to nearly 65,000. XRP didn’t crash immediately, but the rally lost steam and entered a distribution phase.

Taken together, the two sets of data suggest more than just growing outflows from whale wallets. They also point to a rising number of whale deposits to exchanges—supporting the case for heavy selling in the first week of August.

However, there are possibilities that whales may have already completed their sell-offs, and XRP could be preparing for a strong rebound.

There’s a glimmer of hope supporting this bullish outlook. Outflow activity from whale wallets has slightly decreased since the beginning of the month. A closer look at the XRPL Whale Flow chart shows that on August 1, net outflow was around -$54 million. By August 7, that figure had declined to -$43.7 million.

BeInCrypto's latest XRP analysis emphasizes the importance of holding the $2.65 support level in the coming days.

Traders must monitor whale activities and the xrp price action. A base formation near the support level could be a sign of a reversal.