🚀 Ethereum’s Explosive Rally Hints at 200%-500% Altcoin Boom—Veteran Trader Confirms

Ethereum isn't just climbing—it's dragging the entire altcoin market into the stratosphere. Traders are bracing for a seismic shift as ETH's momentum signals an impending altseason.

The domino effect: Why altcoins are next

When Ethereum sneezes, altcoins catch pneumonia. The 200%-500% pump potential isn't wishful thinking—it's historical pattern recognition meeting bullish on-chain metrics. Forget 'wait and see'—this is 'buy or cry' territory.

Wall Street's watching (and fumbling their spreadsheets)

Traditional finance still can't decide if crypto is a scam or their next bonus check. Meanwhile, degens are quietly stacking those 5x gains—between coffee breaks and meme-stock PTSD therapy sessions.

The smart money? It's already moved. The question is whether you'll be early or just another exit-liquidity tourist.

Altcoins may start posting gains by October

MN Trading Capital co-founder Michaël van de Poppe said in an X post on Thursday that he is “all-in” on altcoins, adding there could be “200-500% to be made in the next 2-4 months.”

“The recent MOVE of ETH is the first step forward to a more risk-on appetite,” he said.

Ether has gained 6.09% in the past 24 hours, to trade at $3,854 at the time of publication, according to Nansen.

Ether is trading at $3,854 at the time of publication. Source: Nansen

The ETH/BTC ratio, which measures Ether’s relative strength against Bitcoin is up 38.53% over the past 30 days, according to TradingView.

Many market participants perceive Ether’s rising price as a key indicator for upcoming altcoin rallies, signaling a shift in investor appetite toward higher-risk assets beyond Bitcoin.

Will Ether go against the trend of a weak Q3?

Trader Ash Crypto warned not to ignore Ether’s historically weak performance during this time of year, as August to September “are generally bearish months for crypto, so I WOULD be cautiously bullish.”

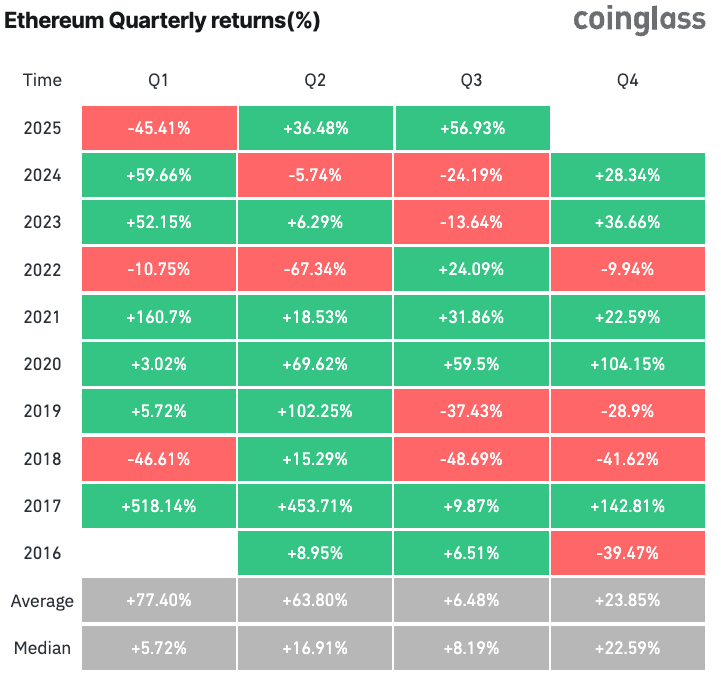

The third quarter has historically been Ether’s weakest-performing every year since 2016, delivering an average return of just 6.48%, according to CoinGlass.

Ether’s quarterly returns since 2016. Source: CoinGlass

Some market participants remain skeptical about the continuation of the rally. Crypto trader Muneeb said that, in his opinion, “this leg is done for now.”

A move to $4,000, representing a 3.7% spike from ETH’s current price, would put roughly $817 million in ETH short positions at risk of liquidation.

Others are suggesting that history will not repeat itself this time around. Crypto trader Cas Abbe said in an X post on Thursday that “this is the perfect time for ETH to rekt the bears,” pointing to declining supply on crypto exchanges and rising institutional interest.

Meanwhile, crypto analyst Wolf said “don’t act surprised” if Fundrat’s Tom Lee’s recent Ether prediction of $16,000 comes to fruition.

“Volatility, disbelief, then verticality,” Wolf said.