XRP Defies Market Pressure as Ripple’s Rail Acquisition Supercharges Stablecoin Ambitions

Ripple just placed another strategic bet on the future of payments—and XRP holders are grinning.

The blockchain giant's acquisition of Rail—a stablecoin infrastructure player—signals an aggressive push into the $150B stablecoin market. No more waiting for regulators to blink.

XRP's price action tells the real story: while other altcoins wobble, it's holding key support levels. Traders smell blood in the water—this could be the catalyst that finally breaks the multi-year consolidation.

Behind the scenes? Ripple's playing chess while competitors play checkers. Rail's tech stack lets them bypass traditional banking rails entirely. Take that, SWIFT.

One hedge fund manager muttered: 'They're building the PayPal of crypto—except PayPal wishes it had this regulatory moat.' Ouch.

Bottom line: When a company with $25B in reserves starts acquiring instead of lobbying, the market notices. The real question isn't if XRP rallies—it's which legacy finance giant gets disrupted next.

Ripple advances stablecoin infrastructure

Ripple has announced the acquisition of Rail, a stablecoin-powered platform tailored for payments, for $200 million. The company described the MOVE as a major milestone in advancing stablecoin payment solutions, aligning with its broader goal of building a digital asset payments infrastructure.

Rail will integrate with Ripple Payments, a platform that boasts an expansive payments network with market-leading liquidity and over 60 global licenses. Rail will ensure that Ripple Payments advances customers' capital flows with VIRTUAL accounts supported by an automated back-office infrastructure.

"Stablecoins are quickly becoming a cornerstone of modern finance, and with Rail, we are uniquely positioned to drive the next phase of innovation and adoption of stablecoins and blockchain in global payments," Ripple President Monica Long said.

The integration of Ripple Payments and Rail will support a range of services, including stablecoin on/off-ramp, asset flexibility, treasury payments, premium digital asset liquidity, virtual accounts, collections, and enterprise-grade, compliant-ready payments, Ripple said in a statement.

The advancement of Ripple Payments to support enterprise-grade and regulatory compliant flows and liquidity could boost demand for XRP and the RLUSD stablecoin, especially now that the US is clearing key hurdles to support innovation in the crypto industry.

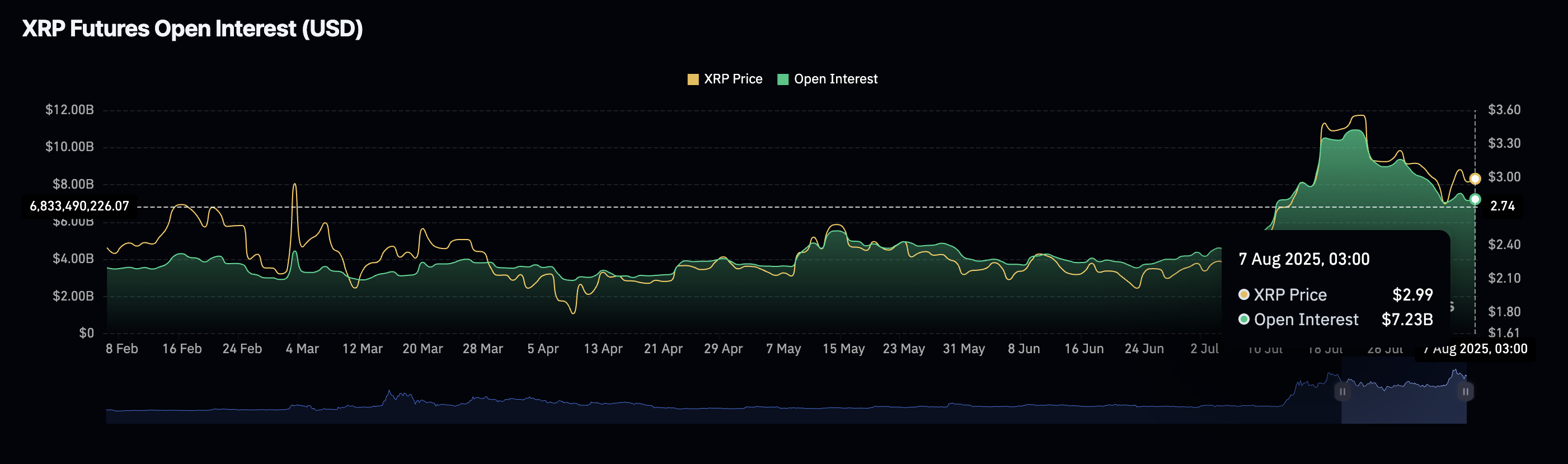

Interest in XRP remains relatively subdued, considering the futures Open Interest (OI) has declined by more than 34% to average at $7.23 billion from its July peak of $10.94 billion.

Since OI refers to the notional value of outstanding futures or options contracts, a steady increase often boosts speculative demand as more traders leverage long positions.

XRP Futures Open Interest data | Source: CoinGlass

Technical outlook: XRP upholds bullish structure

XRP price has broken above a descending channel on the 4-hour chart, extending the rebound from support tested at $2.72 on Sunday. The cross-border money remittance token also holds above key technical levels, including the 100-period Exponential Moving Average (EMA) at $3.03, the 50-period EMA at $3.01 and the 200-period EMA at $2.93, underscoring the short-term bullish structure.

Investors may consider increasing exposure, citing a buy signal from the Moving Average Convergence Divergence (MACD) indicator. If the blue MACD line remains above the red signal line, XRP could extend the recovery, aiming for the short-term hurdle at $3.10, which was tested on Tuesday, and the seller congestion at $3.32, tested on July 28.

XRP/USDT 4-hour chart

If sentiment shifts in the broader cryptocurrency market, recovery could be suppressed and even result in xrp price slipping below support at $3.00. Key levels of interest for traders are the 200-period EMA at $2.93 and the support at $2.72, tested on Sunday.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This FORM of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.