🚀 Ethereum Price Soars as Treasury Giants Fuel Demand Despite Historic ETH ETF Outflows

Wall Street meets crypto chaos—again. While ETH ETFs bleed record outflows, institutional players are quietly gobbling up Ethereum like it's a fire sale. Guess someone forgot to tell them about 'efficient markets.'

The Great Institutional Contradiction

Treasury departments—the same folks who called crypto a scam in 2022—are now piling into ETH. Meanwhile, ETF outflows hit all-time highs. Either this is the dumbest smart money play ever, or the sharks smell blood in the water.

Why This Rally Has Teeth

Forget retail FOMO. When corporate treasuries move, markets shift. They're not betting on memes—they're hedging against traditional finance's slow collapse. ETH's deflationary burn? Just icing on the dystopian cake.

The Bottom Line

Watch where the money flows, not where it leaks. And maybe—just maybe—stop trusting billion-dollar funds to be consistent. ETH to $10K? Wouldn't shock us. Neither would a 50% crash. Welcome to crypto.

SharpLink boosts Ethereum treasury, ETH ETFs post largest outflow

Ethereum treasury and esports marketing company SharpLink Gaming disclosed that it purchased 83,561 ETH last week, boosting its total holdings to 521,939 ETH as of August 3. The company said it made the purchase after raising $264.5 million through its at-the-market (ATM) facility during the period.

SharpLink pivoted to an ETH treasury strategy in May after it raised $425 million through a private placement. Since then, it has filed with the Securities & Exchange Commission (SEC) to expand its ATM facility to $6 billion, aiming to use the proceeds to expand its ETH stash.

The company, which stakes nearly all of its holdings, also reported a total staking rewards increase to 929 ETH since the launch of its treasury in June.

SharpLink's 521,939 ETH stash places it behind Peter Thiel's backed BitMine (BMNR) in the leaderboard of publicly-traded companies focused on building a treasury vehicle for the top altcoin. BitMine revealed holdings of over 833,100 ETH on Monday, adding that Bill Miller and Cathie Wood's ARK Invest are key shareholders of its stock. As a result, the combined holdings of ETH treasury vehicles have climbed above 1.9 million ETH.

The sustained buying pressure from ETH treasury companies follows record outflows in US spot ETH ETFs. The products recorded their largest daily outflow on Monday, worth $465 million, per SoSoValue data. This comes after breaking a 20-day inflow streak worth about $5.3 billion last Friday following fresh reciprocal tariffs from President Donald TRUMP on international trading partners.

Ethereum Price Forecast: ETH could find support near rising trendline

Ethereum experienced $108 million in futures liquidations over the past 24 hours, comprising $74 million and $34 million in long and short liquidations, respectively, per Coinglass data.

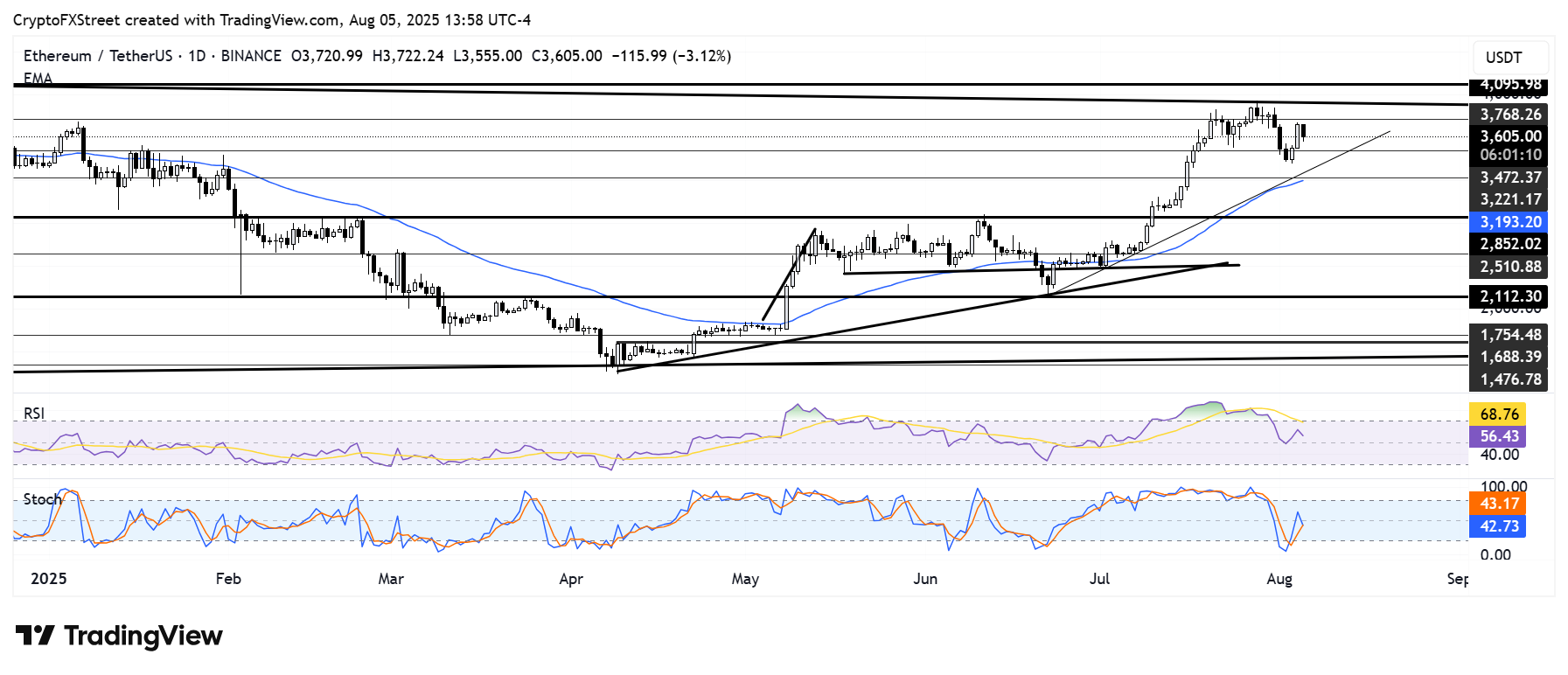

Ethereum saw a rejection just above $3,700 on Tuesday after kicking off the week with a 6% rally. As a result, the top altcoin is declining toward the $3,470 level.

ETH could find support NEAR a rising trendline — strengthened by the 50-day Exponential Moving Average (EMA) — extending from June 22. Just below this trendline is the $3,220 support. A breach of these levels could send ETH toward the $2,850 key level.

On the upside, a daily candlestick close above the descending trendline near $3,900 could send ETH to test its 2024 high of $4,107.

ETH/USDT daily chart

The Relative Strength Index (RSI) is below its moving average and trending downward toward its neutral level, indicating a weakening bullish momentum. Meanwhile, the Stochastic Oscillator is below its midline and trending toward the oversold region. A crossover into the region could spark a short-term recovery.