🚀 Crypto Price Surge Alert: PUMP, Mantle & Bitcoin Primed for Gains – European Market Watch Aug 5

Bullish signals flash across crypto markets as PUMP, Mantle, and Bitcoin show breakout potential. Traders brace for volatility while institutional money lurks on the sidelines—as usual.

PUMP: The meme coin defies gravity with retail FOMO reaching critical mass. When do the whales start dumping? Place your bets.

Mantle: Layer 2's dark horse gains traction as gas fees cripple Ethereum mainnet (again). Vitalik won't like this.

Bitcoin: The OG crypto flirts with key resistance levels. A clean breakout could trigger algorithmic buying frenzies—and another round of 'hyperbitcoinization' think pieces.

Meanwhile in traditional finance: Gold ETFs bleed inflows while bankers still argue about 'blockchain not Bitcoin.' Slow clap.

Pump.fun Price Forecast: PUMP eyes breakout rally after posting four days of gains

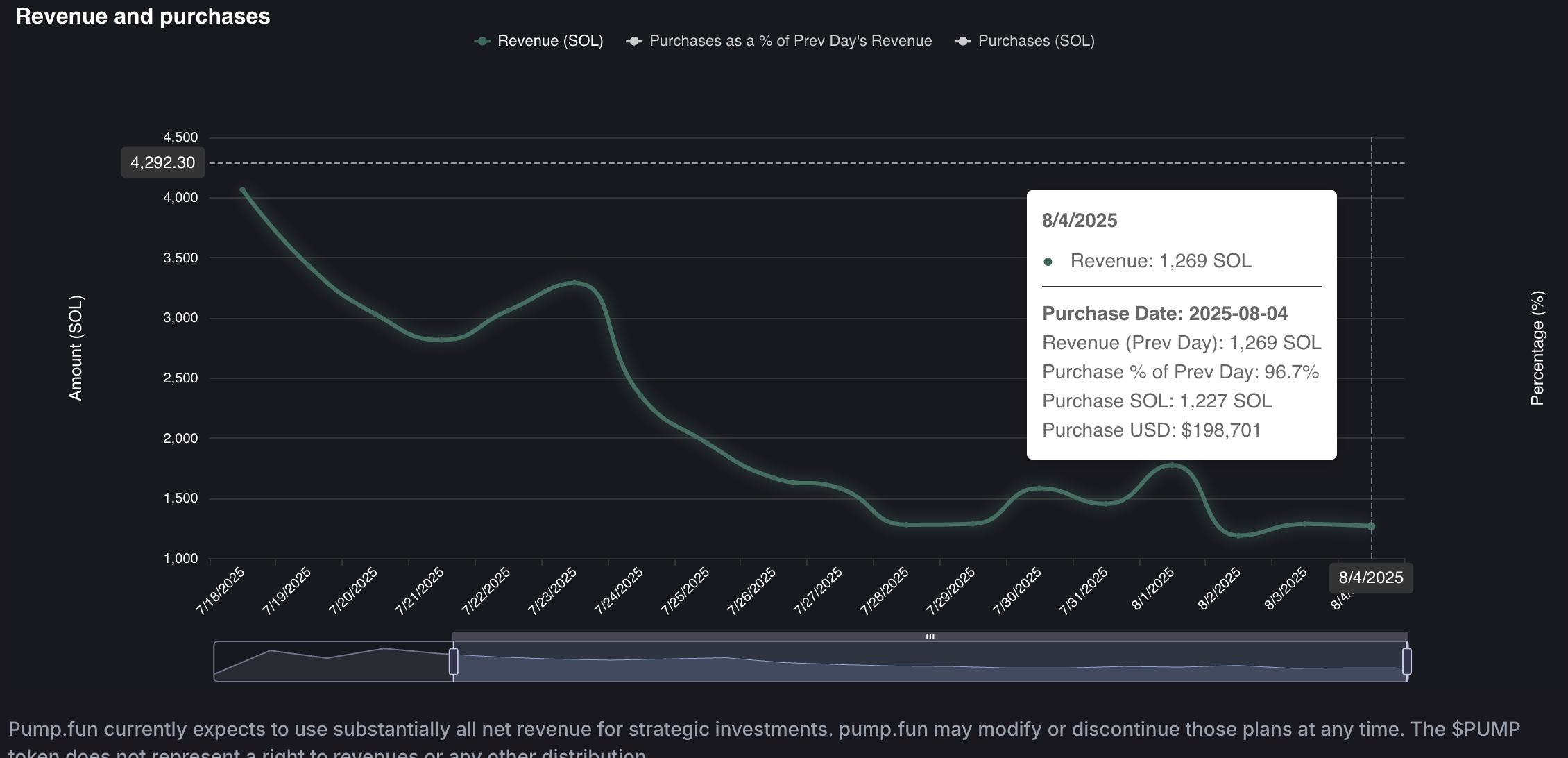

Pump.fun (PUMP) edges higher by over 3% at press time on Tuesday, extending the recovery for the fifth consecutive day. A whale has bet over $3 million on PUMP’s uptrend as it nears a breakout rally, underpinned by the stable revenue in the meme coin platform.

Mantle Price Forecast: MNT surges amid stablecoin market growth, defying cautious market tone

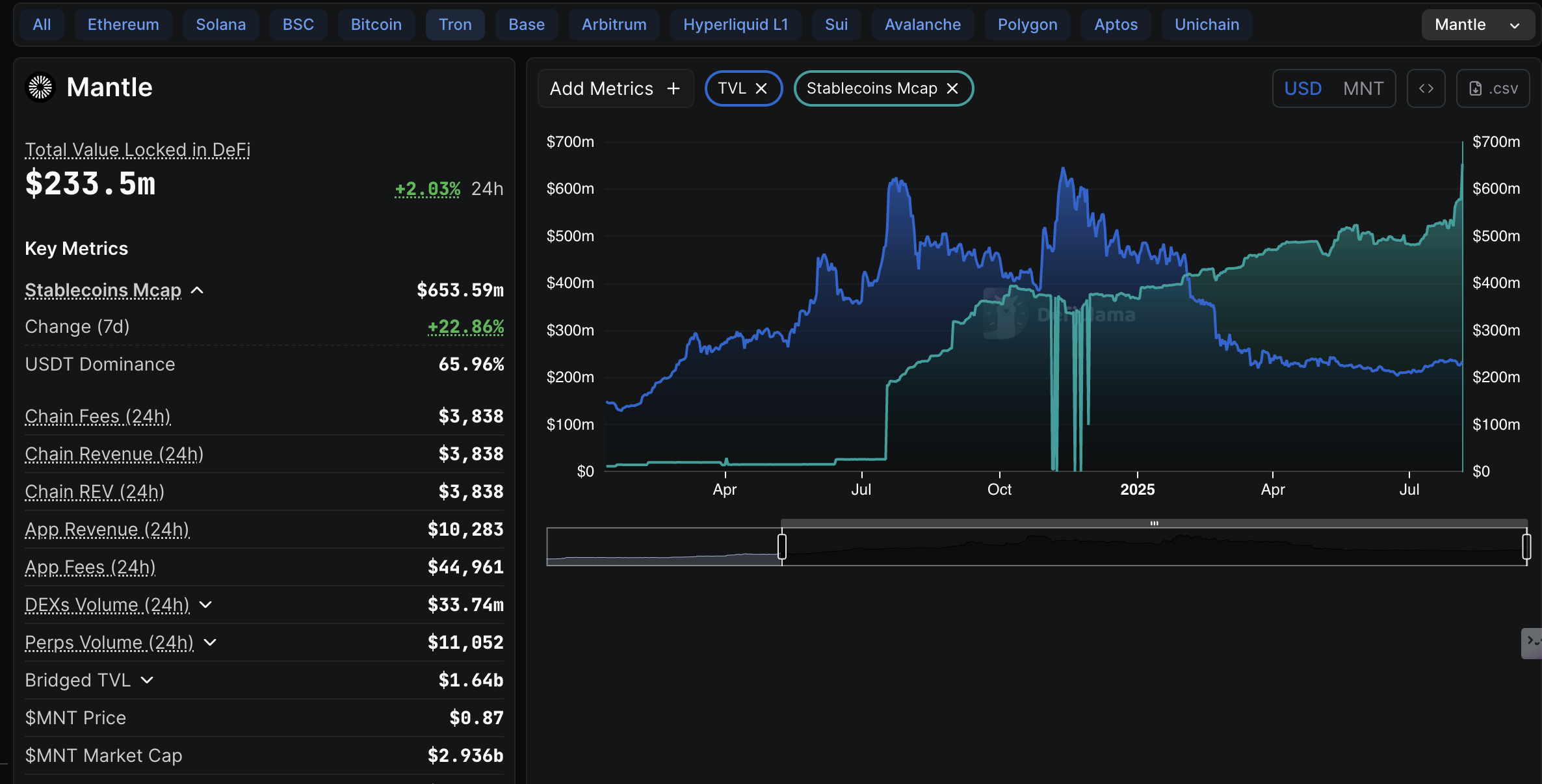

Mantle (MNT) price extends gains on Tuesday, trading at around $0.87 at the time of writing after Monday's almost 20% surge. The token known for bridging Traditional Finance (TradFi) and Decentralized Finance (DeFi) by ensuring security and scalability is experiencing an influx of capital underpinned by institutional and retail interest.

America’s debt problem is out of control — Bitcoin might be the only way out

Here’s the core problem: The U.S. government spends way more money than it earns. To fill the gap, it borrows trillions of dollars. But fixing this by cutting spending WOULD crash the economy. At the same time, the U.S. buys more from other countries than it sells — this trade deficit has been growing for decades. To keep this system alive, the government prints more dollars and convinces foreigners to keep buying U.S. debt.