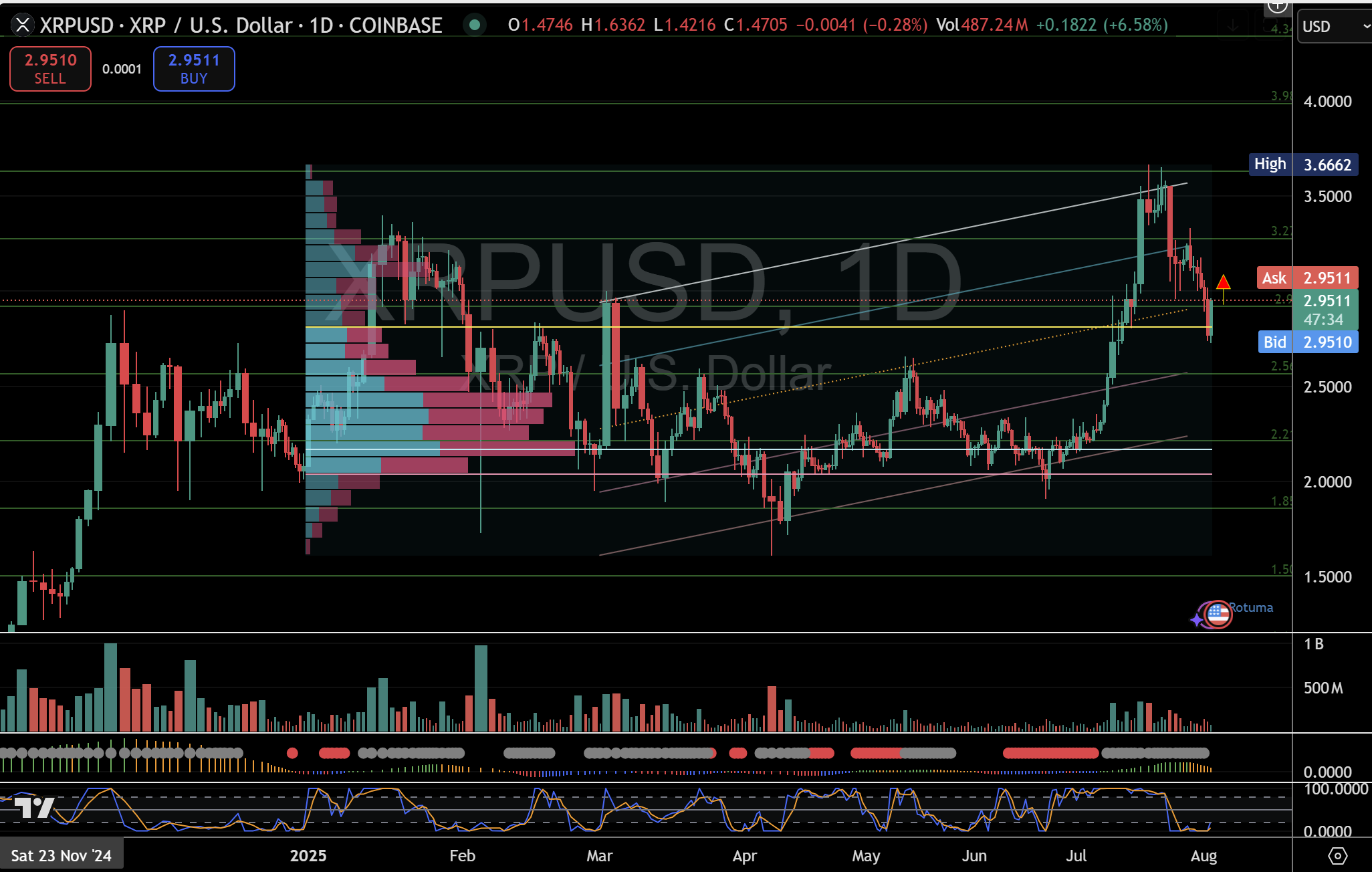

XRP’s Make-or-Break Moment: Can It Hold $2.76 and Break the 5-Month Channel?

XRP teeters on the edge—again. The $2.76 support level isn’t just a number; it’s the battleground for the next major move in this sluggish five-month channel.

The Line in the Sand

Break below $2.76, and bears might drag XRP back into the trenches. Hold? Bulls could finally muster a breakout—or just another fakeout. Traders are glued to their screens, wallets at the ready, while 'HODLers' recite 'this time is different' like a mantra.

Channeling Patience (or Desperation)

Five months of sideways action tests even the most diamond-handed investors. Meanwhile, Wall Street snickers into its overpriced coffee—'volatility’s too low? Try our 0.05% yield savings account!'

XRP’s next move won’t just define a trend—it’ll separate the opportunists from the bagholders.

Crucial levels to watch

- Hold & bounce: Validates mid-channel support, opens door for $2.92 (channel median), then $3.27 and $3.63.

- Break below: Confirms deeper correction, targets initial support at $2.56.

- Previous congestion zone and lower volume node; a typical stopping point in a moderate retracement.

- Near the channel’s lower parallel, a normal pullback could bottom here before bulls re-enter.

- Breach shifts medium-term bias bearish, risking a fall toward the 2025 range low at $1.50.

What lies ahead

- Bullish scenario:

- A decisive daily close above $2.76, coupled with rising volume, would confirm support—and likely trigger a fast move through $2.92 toward $3.27 and the channel top at $3.63.

- Bearish scenario:

- Failure to defend $2.76 could see stops cascade into $2.56, with the real test at $2.21–$2.12. A break below $1.85 would flip the outlook negative and invite lower lows.

Traders should monitor volume spikes at the major levels and watch for momentum shifts to gauge breakout or breakdown risk.