Pi Network Price Alert: PI Nears All-Time Low as Massive Token Unlock Looms

Brace for impact—Pi Network's native token is teetering on the edge of uncharted lows. Just as retail investors start questioning their life choices, the project gears up to flood the market with newly unlocked tokens. Classic crypto timing.

Blood in the water? The so-called 'people's cryptocurrency' now faces its ultimate stress test. Will the community hold the line, or will this turn into another masterclass in how not to manage tokenomics? (Spoiler: Wall Street hedge funds are taking notes—for their villain origin stories.)

One thing's certain: that 'HODL' mentality's about to get a brutal reality check. The unlock's coming. The charts look grim. And somewhere in Silicon Valley, a VC just ordered another yacht—using traditional finance, of course.

Monthly token unlock in August risks increased selling pressure

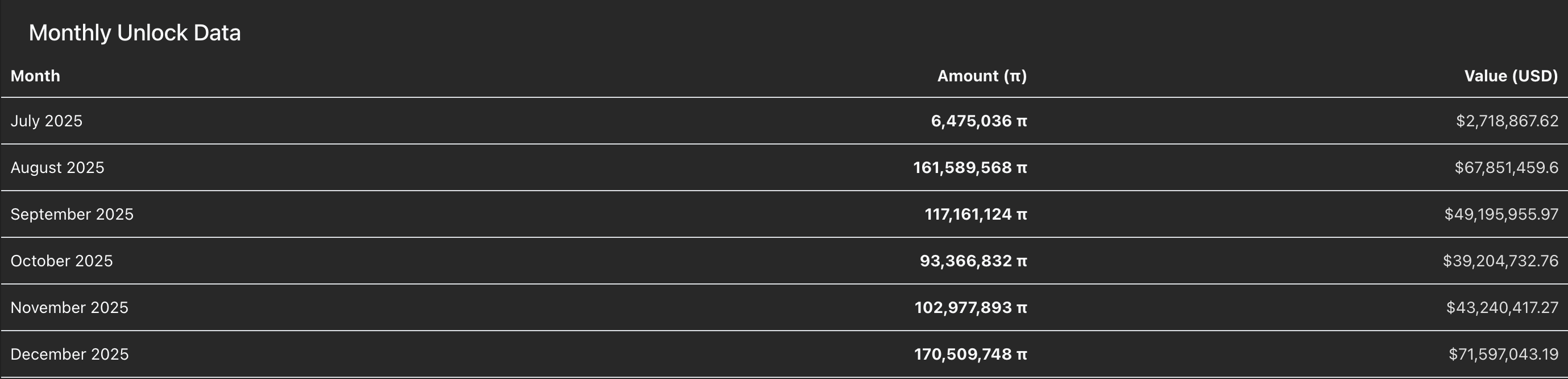

PiScan data indicates that 161.6 million PI tokens will be unlocked in August, increasing the circulating supply by 2.09%. This monthly unlock is the largest until December, when 170.5 million PI tokens will be released into circulation.

PI token unlock data. Source: PiScan

Sidelined investors expecting a reversal in PI should temper their bullish expectations, as unlock events tend to increase selling pressure, allowing investors to book profits.

Onramp Money delays official integration of PI

Onramp Money announced on Tuesday that the PI integration is still in progress. The on-ramping company will allow users to buy PI tokens directly in exchange for fiat currencies, with the official launch expected in the second or third week of August.

Until the official launch announcement on social media handles, the company urges users to avoid making purchases via Onramp Money. As of Thursday, the Pi Network app displays on-ramp alternatives by Banxa and TransFi, although Pi Network has made no official announcement.

PI risks further losses below its $0.4000 crucial support level

Pi Network holds the bearish trend with over 17% decline so far in July. At the time of writing, PI inches closer to its all-time low of $0.4000 last tested on June 13.

The Relative Strength Index (RSI) at 35 on the daily chart holds a declining trend towards the oversold boundary, suggesting a steady decline in buying pressure and signaling prices still have some room to fall. Investors could increase the bearish exposure as the Moving Average Convergence Divergence (MACD) line draws closer to crossing below its signal line. This potential crossover, along with the resurgence of red histograms, WOULD flash a sell signal.

A decisive push below the $0.4000 level could extend the decline to the S1 pivot level at $0.3837, followed by the S2 level at $0.2585.

PI/USDT daily price chart.

Looking up, PI should reclaim the $0.5000 psychological level to negate the downtrend.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.