🚨 Bitcoin Alert: Potential Drop to $112K Before Next Bull Run – Here’s Why

Bitcoin's rollercoaster isn't done yet. On-chain data suggests a sharp correction could hit before the next leg up—because Wall Street loves a good 'buy the dip' narrative.

The $112K Pressure Valve

Liquidity clusters and whale activity point to a temporary pullback target. No surprises here—crypto markets have always moved in brutal, beautiful waves.

Rally Fuel Loading

Every 20%+ drop in BTC history eventually became a footnote after new ATHs. Traders stacking stablecoins suggest they're ready to front-run the rebound.

Remember: 'Risk management' is just banker-speak for 'we missed the last pump.' Brace for volatility—then buckle up.

Bitcoin triggers market-wide cooldown

The surge in Bitcoin price to fresh all-time highs triggered subsequent rallies in altcoins, front-lined by Ethereum (ETH) approaching the $4,000 mark and Ripple (XRP) reaching a new all-time high of $3.66.

Still, Bitcoin's upside-heavy outlook, characterised by a cooling spot market and a notable correction in some on-chain metrics, could put the brakes on the coveted altcoin season.

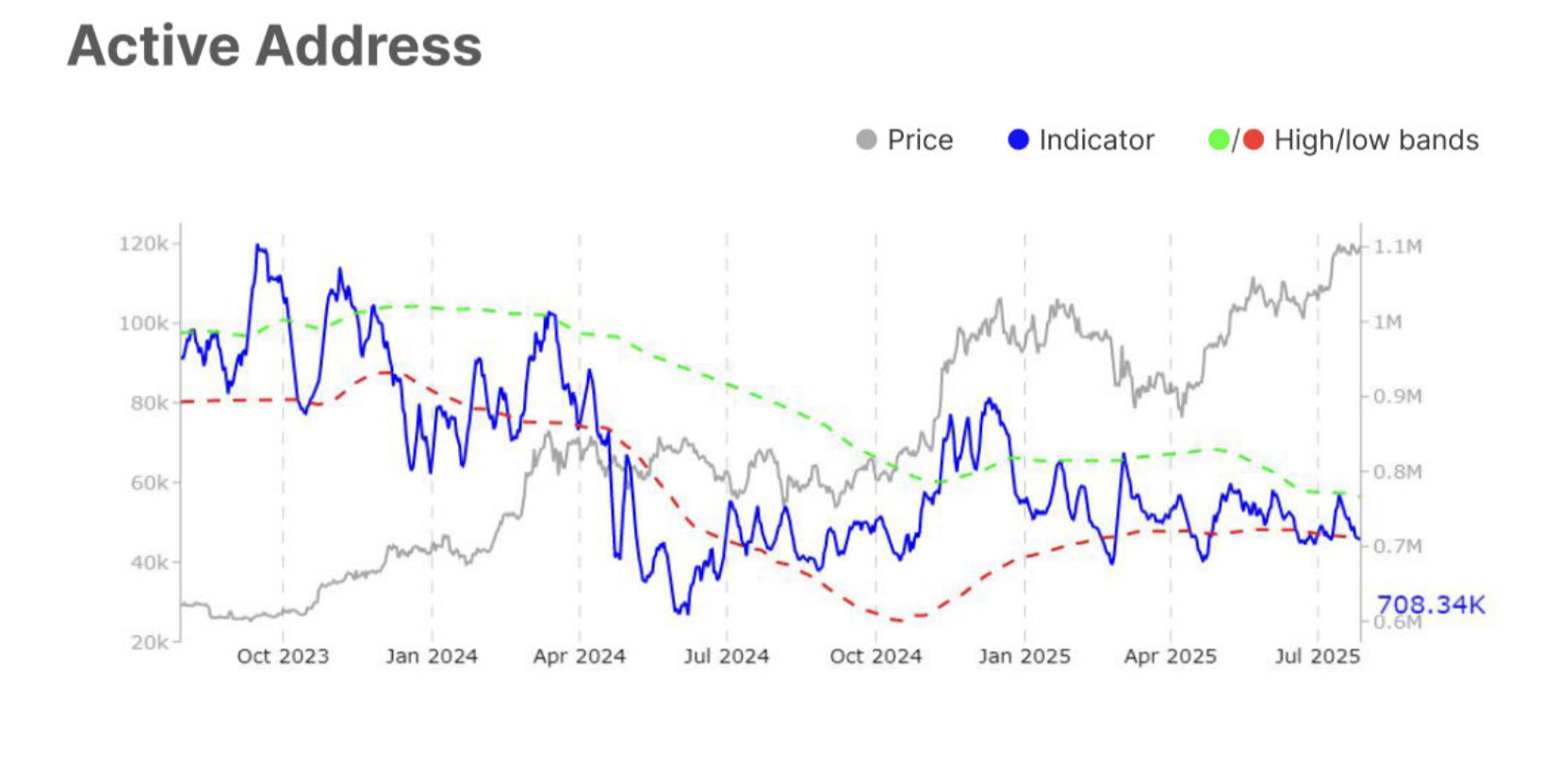

Bitcoin's Daily Active Addresses metric declined moderately by 2.4% from approximately 725,000 to 708,000, a MOVE that indicates a slight contraction in user engagement and transaction activity following the record high.

A continued decline in the metric would indicate a significant drop in speculative interest or a broader decline in on-chain participation as users step back to allow for price consolidation before the next leg up.

Bitcoin Active Addresses metric | Source: Glassnode

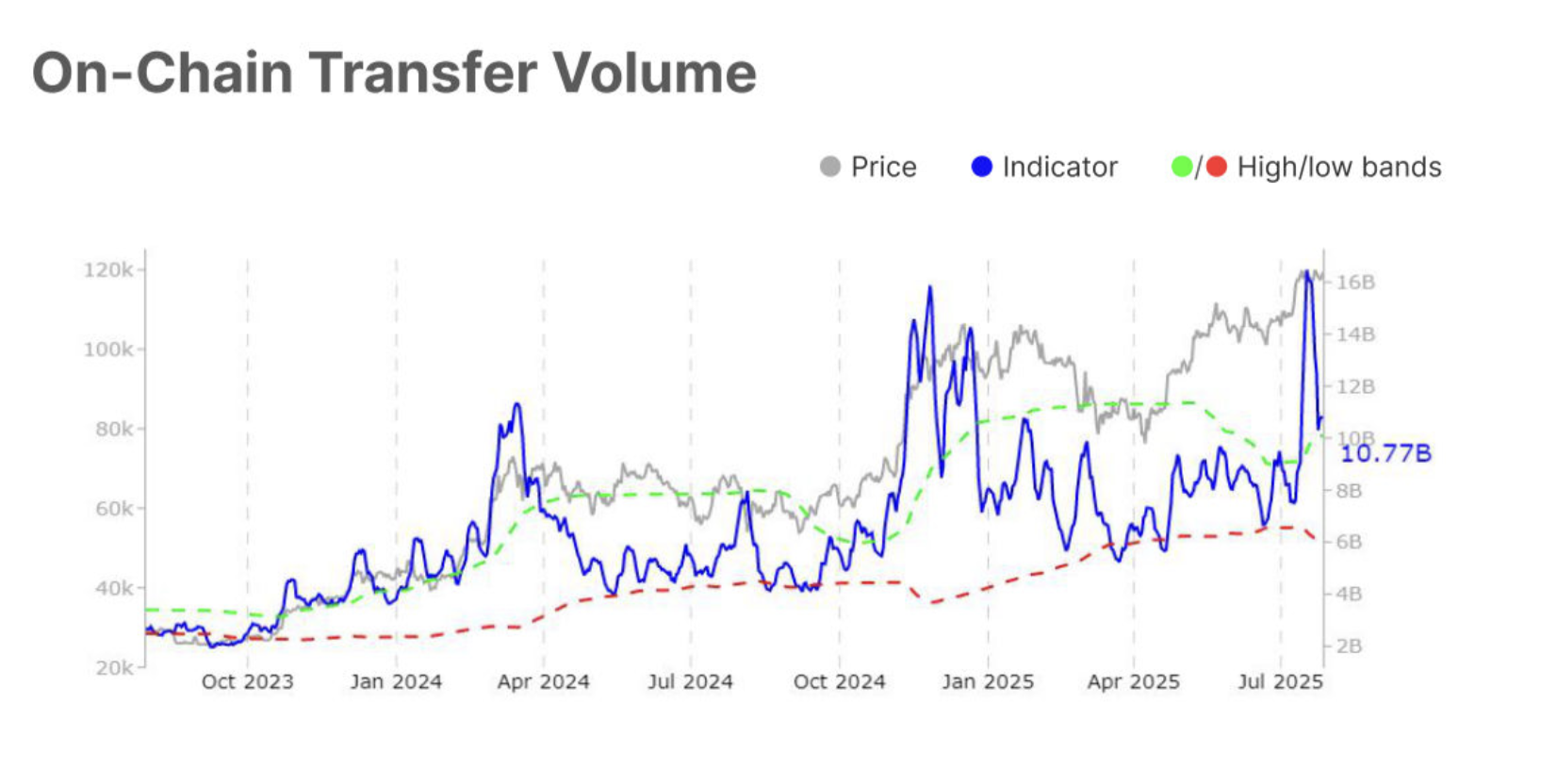

Glassnode highlights Bitcoin's On-chain Transfer Volume as another key metric of interest to investors. According to the chart below, the blue line is down by 23.1% from $14 billion to $10 billion, which points to a slowdown in the network's economic activity. In other words, less capital is flowing across the chain on the backdrop of the surge to the new all-time high.

Bitcoin On-chain Volume metric | Source: Glassnode

The percentage of Supply in Profit has edged higher from 96.7% to 96.9%, indicating that the majority of BTC holders are sitting on unrealized profit, a situation that reflects bullish sentiment.

"However, such a widespread profitability can also increase the risk of sell-side pressure as investors look to secure gains. For now, the sustained high reading reflects confidence, though continued stability depends on profit-taking pace," Glassnode highlighted in its Weekly Market Pulse report.

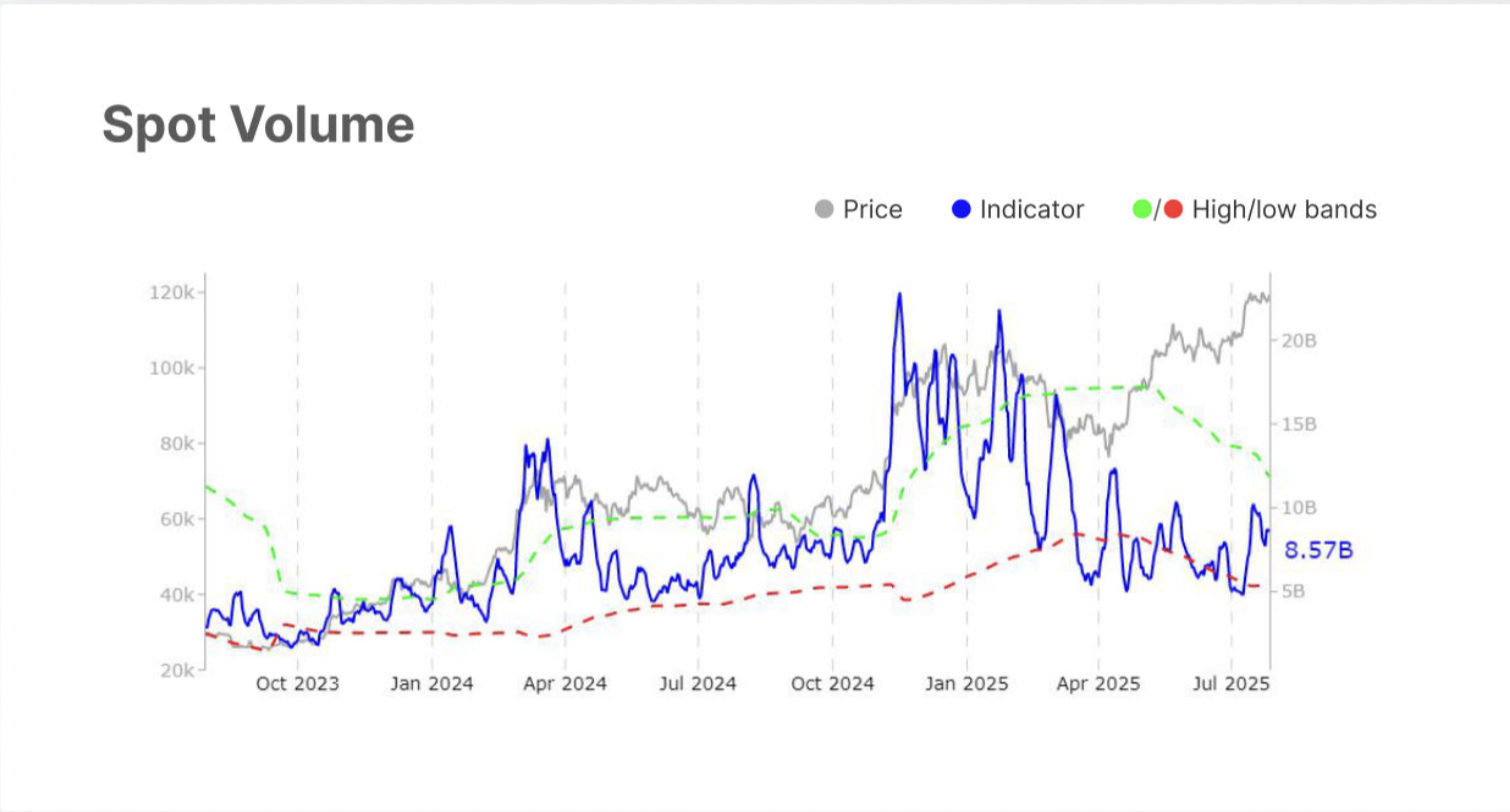

Technical outlook: Why Bitcoin's pullback could extend

Bitcoin's price is no longer trading in overheated market conditions after the Relative Strength Index (RSI) dropped to 56 from an overbought high of 75. This decline indicates buyer exhaustion, with the spot volume falling to $8.6 billion, according to Glassnode. If the spot volume continues to cool, it would signal "a wait-and-see" approach from market participants, characterised by lower conviction to buy or sell aggressively.

Bitcoin Spot Volume | Source: Glassnode

A buy signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Wednesday affirms bears are tightening their grip. Traders will continue to reduce exposure as this indicator drops toward the mean line and red histogram bars expand.

BTC/USDT daily chart

Key areas of interest to traders include the support around $115,000, tested on Friday, the 50-day Exponential Moving Average (EMA) at $112,495, and the previous all-time high around $112,000 in case the decline in bitcoin price persists.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is the funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.