Bitcoin’s Beta Spike: Harbinger of Doom or Buy-the-Dip Opportunity for Crypto Investors?

Bitcoin’s volatility just cranked up to eleven—but is this a red flag or a golden ticket?

### The Beta Surge: Fear or Greed Driving the Market?

When Bitcoin’s beta spikes, traditional investors reach for their risk models—and maybe a stiff drink. The crypto crowd? They’re already scouting entry points.

### Wall Street’s Playbook vs. Crypto’s Rulebook

Beta measures risk, but in crypto-land, ‘risk’ is just another word for ‘Tuesday.’ While hedge funds panic, OGs are stacking sats—because when has conventional finance ever understood this market?

### The Cynic’s Corner

Let’s be real: if beta correlations actually predicted crypto crashes, every MBA would be a billionaire by now. Meanwhile, Bitcoin keeps mooning while portfolio theorists keep frowning.

Bottom line: This isn’t your grandfather’s volatility. Buckle up.

In brief:

Bitcoin’s increasing correlation and high beta with stock markets mean it now amplifies market volatility.

Data shows Bitcoin's beta reacts more violently than stocks to market movements.

Analysts warn that Bitcoin now behaves like a high-risk tech stock.

A worrying shift

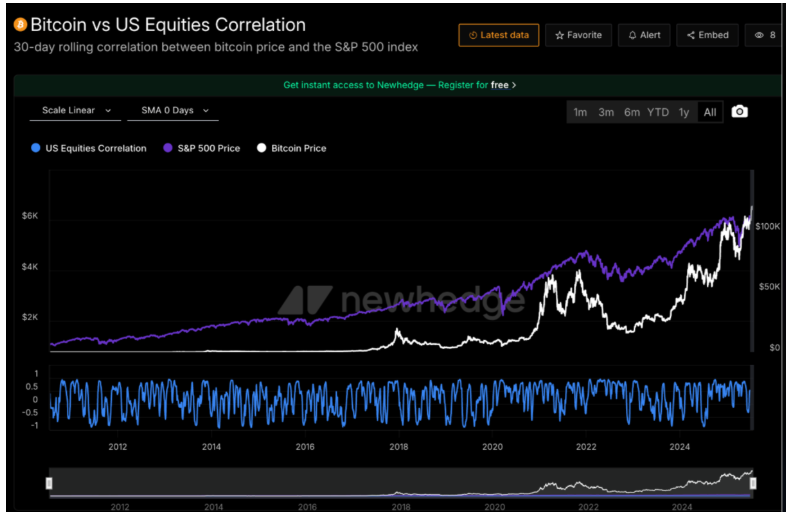

Data from CME Group show Bitcoin’s correlation with the S&P 500 and Nasdaq‑100 has surged from almost nothing ten years ago to

Even more alarming, Bitcoin’s— the measure of how violently an asset reacts to market movements — has beenand has breached 1 against the S&P 500 several times this year.

Put bluntly, bitcoin is. When markets stumble, Bitcoin doesn’t just follow;

The numbers don’t lie

An analysis of three‑month rolling beta data paints a disturbing picture:

This means that a modest pullback in equities could turn into a full‑blown crypto bloodbath.

Bitcoin vs US Equities Correlation.

What is beta – And why should you be afraid of it?

Beta measures how much an asset moves relative to the market.

-

Beta of 1: moves in lockstep with the market.

-

Beta above 1: magnifies moves — gains and losses alike.

-

Beta below 1: dampens volatility.

Negative beta: moves opposite to the market.

Bitcoin’s beta is firmly above 1 — which means when markets fall,

Analysts are worried

Even seasoned market observers are unsettled by the shift.

Citigroup analysts say “equities now explain 15 per cent of BTC’s price volatility, with beta sitting between 1.4 and 1.5.”

Leah Wald, chief executive of SOL Strategies, is blunt:

“Bitcoin still behaves structurally like a high‑beta risk asset: it tends to outperform during bullish sentiment and underperform when markets de‑risk.”

A recent academic study goes even further, concluding that Bitcoin’s volatility is four times higher than the S&P 500’s at the same risk level — a terrifying prospect if the stock market enters a prolonged downturn.

What it means for you

Investors hoping Bitcoin WOULD protect them in a crisis may instead be

If the S&P 500 drops 5–10 per cent, Bitcoin could easily crater 15–20 per cent — or worse.

Portfolios heavy on crypto may bewithout even realising it.

With beta this high, Bitcoin looks less like a safe‑haven and more like a

A history of pain

This isn’t just theory. Bitcoin has repeatedly demonstrated its tendency to collapse when markets sour:

In March 2020, Bitcoin lostas panic swept through markets.

In 2022, it shadowed the Nasdaq into the ground when the Federal Reserve raised rates.

And earlier this year, fresh volatility saw Bitcoin

The bottom line

Bitcoin’s

Once marketed as “digital gold,” Bitcoin is now, perfectly poised to