🚀 Bitcoin & Altcoin Forecast: PI Network Surge & Crypto Market Outlook – Europe Update July 29

Bitcoin flexes resilience as institutional inflows hit $1.2B this week—despite Wall Street's 'risk-off' theatrics.

PI Network defies bearish whispers with 23% monthly gains—retail FOMO meets mainnet hype.

Altcoin bloodbath? Not today. Ethereum and BNB cling to key support levels while traders eye September ETF catalysts.

European regulators circle like vultures—because nothing says 'market stability' like bureaucrats discovering DeFi exists.

Prediction: The next 10% BTC move gets blamed on Elon Musk's Twitter account. Always does.

Bitcoin Price Forecast: BTC holds steady as ETF inflows rise ahead of key macro events

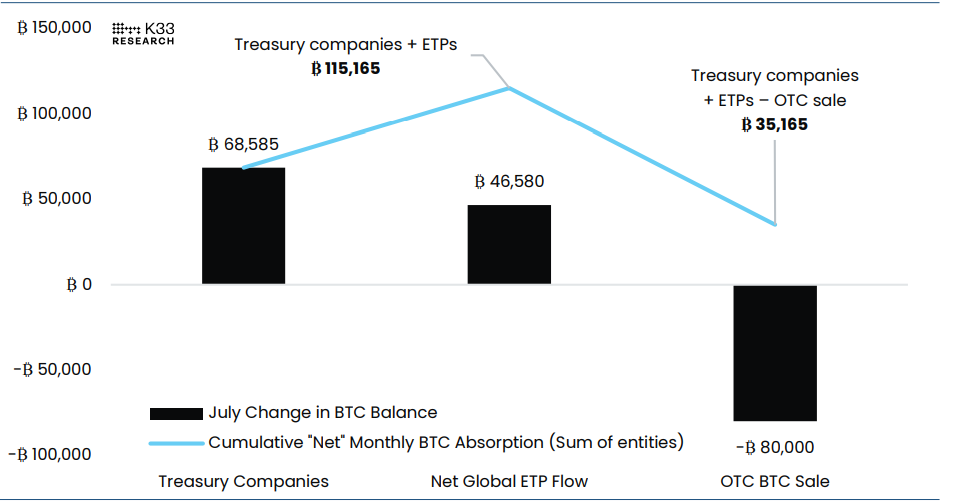

Bitcoin (BTC) has been trading sideways between $116,000 and $120,000 for two weeks, signaling indecision among traders. Despite the lack of strong price direction, investor confidence appears to be growing, as US-listed spot bitcoin exchange Traded Funds (ETFs) recorded $157.02 million in inflows on Monday, extending a three-day streak. However, traders should keep a watch on potential volatility, with the upcoming US tariff deadline and the Federal Reserve’s (Fed) interest rate decision expected to drive volatility across crypto assets, including the largest cryptocurrency by market capitalization.

Pi Network Price Forecast: PI slides to $0.43 support as bearish signals intensify

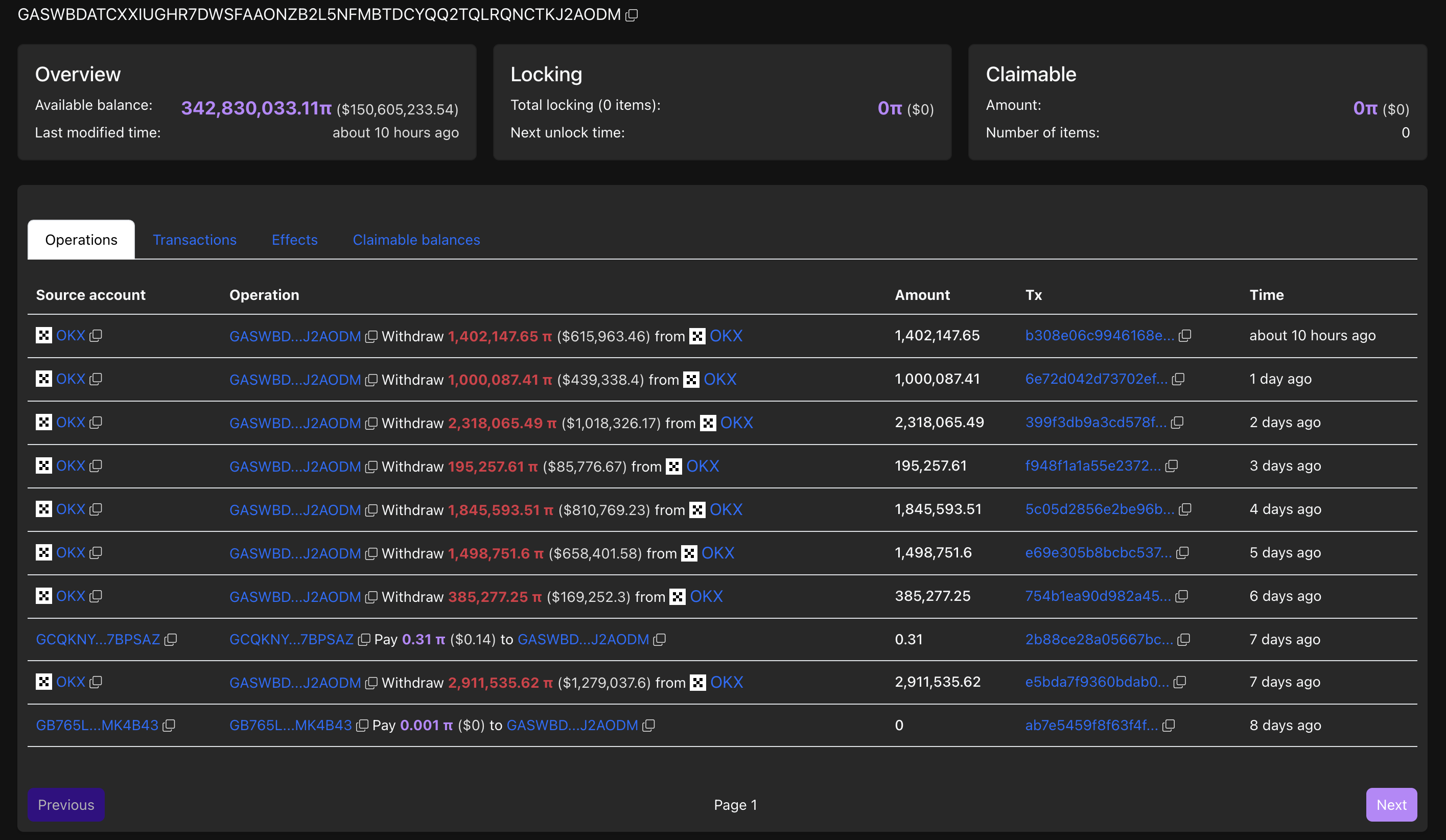

Pi Network (PI) edges lower by 0.61% at press time on Tuesday following the bullish failure to hold at higher levels on Monday. Amid the pullback to its weekly support of $0.43, an unknown wallet address has acquired 1.40 million Pi tokens, advancing its week-long buying spree. Still, the technical outlook remains bearish as the bullish momentum wanes.

Crypto Today: Bitcoin, Ethereum, XRP on cusp of another breakout

The cryptocurrency market offers mixed signals on Tuesday, with Bitcoin (BTC) holding above $118,000 but staying below the $120,000 resistance. This consolidation comes after last week’s sell-off to $114,728 and mirrors growing institutional demand, as evidenced by the resurgence of BTC spot Exchange Traded Fund (ETF) inflows.