July 2025 Crypto Alert: Bitcoin, Ethereum, XRP Dip—But Soaring Open Interest Hints at Bullish Frenzy

Crypto markets wobble while traders double down. Are the bulls loading up for a breakout—or just setting themselves up for another 'smart money' rug pull?

Blood in the streets (but not in the order books)

Bitcoin flirts with key support levels as Ethereum gasps below psychological thresholds. XRP? Still stuck in its perpetual courtroom limbo dance. Yet derivatives traders keep piling in like Wall Street tourists at a crypto conference open bar.

The open interest paradox

Futures markets scream conviction while spot prices whimper. Either this is the smartest accumulation play since MicroStrategy's treasury went full degen—or another case of 'institutional interest' meaning 'hedge funds shorting to retail bagholders.'

One thing's certain: when open interest spikes during weakness, someone's either about to get very rich... or very liquidated. Place your bets before the Fed spoils the party again.

Market overview: Bitcoin ETF outflows persist as Open Interest rises

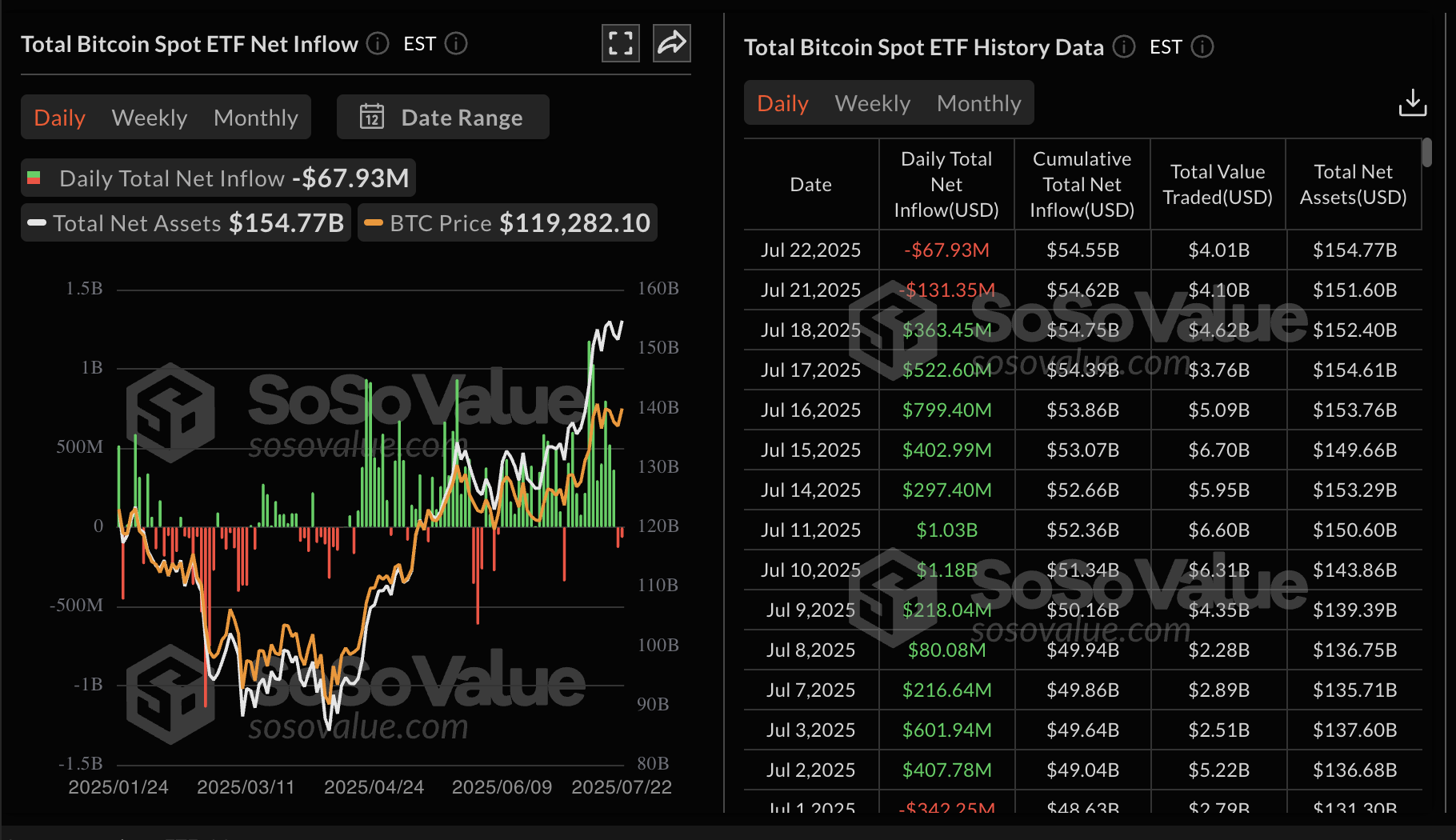

Bitcoin spot Exchange Traded Funds (ETFs) started the week on the back foot, recording outflows of approximately $131 million and $68 million on Monday and Tuesday, respectively. According to SoSoValue, the cumulative total net inflow averages nearly $55 billion, with net assets at $155 billion.

Bitcoin spot ETF data | Source: SoSoValue

The picture is distinctively different for Ethereum, whose spot ETFs continue to experience net inflows. Following a capital inflow of $296 million on Monday, the crypto investment products purchased directly on stock exchanges recorded approximately a $534 million inflow on Tuesday.

Ethereum currently boasts $8.32 billion in cumulative net inflows with net assets averaging $19.85 million.

Ethereum spot ETF data | Source: SoSoValue

As for the derivatives market, Bitcoin futures Open Interest (OI) remains elevated at $86.82 billion, 90% above the lowest level in March at $45.72 billion. As Open Interest surges, it reflects growing investor confidence in the future of Bitcoin, hence the increase in bets for higher price levels.

Bitcoin Futures Open Interest | Source: CoinGlass

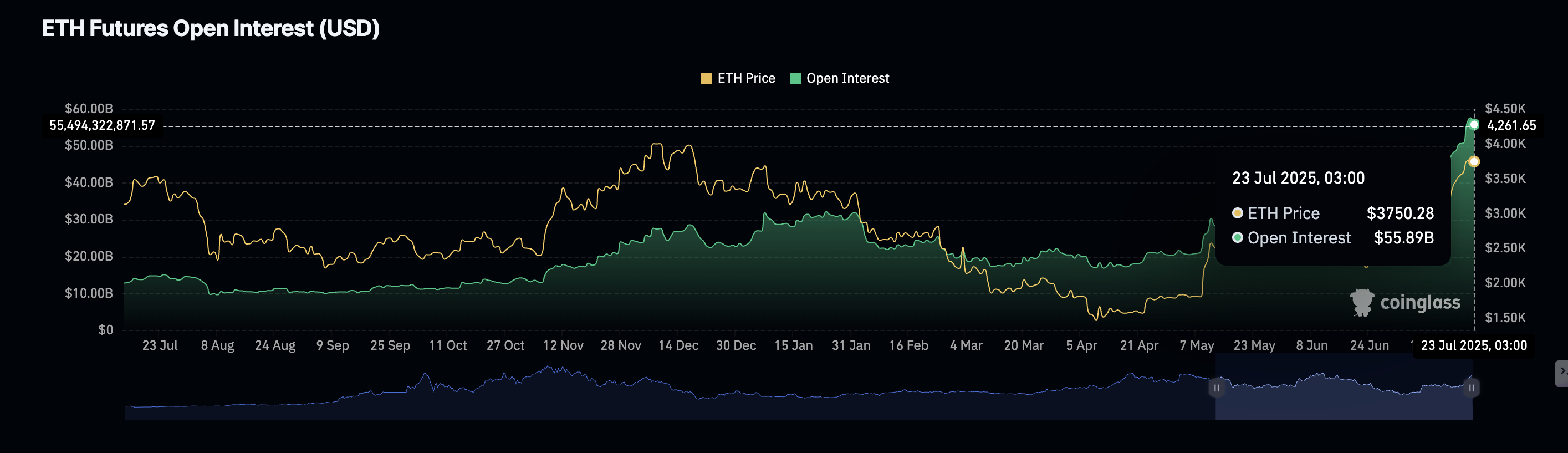

Interest in Ethereum remains relatively high, averaging $55.89 billion on Wednesday. Open Interest refers to the value of all the futures and options contracts that have not been settled or closed. If volume increases in tandem, the outcome is often heightened market activity, which helps to support price increases.

Ethereum Futures Open Interest | Source: CoinGlass

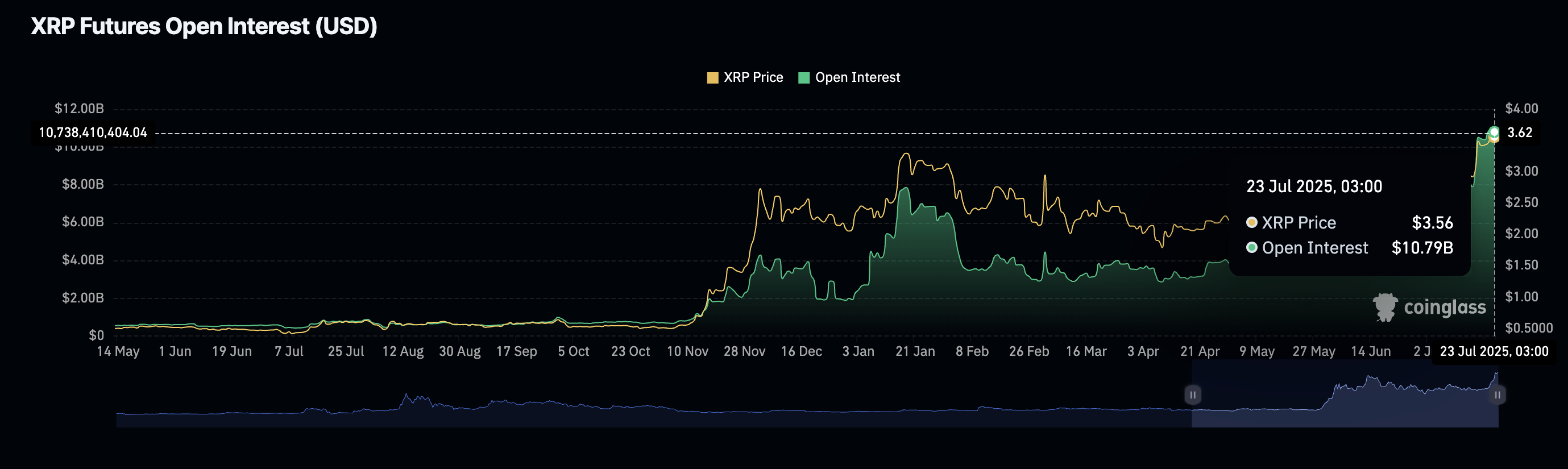

The same bullish outlook is reflected in the XRP derivatives market, where the futures OI has surged to new record highs, reaching $10.79 billion at the time of writing. xrp price hit a new all-time high of $3.66 on Friday before correcting to $3.44 at the time of writing. The decline could be a sweep through liquidity before the next attempt at breaking out to a new record high.

XRP Futures Open Interest | Source: CoinGlass

Chart of the Day: Bitcoin offers bearish signals

Bitcoin is extending its intraday down leg toward near-term support at $118,000 at the time of writing, backed by a downtrending Relative Strength Index (RSI) at 62. As the RSI falls, it suggests that buying pressure is shrinking. Michaël van de Poppe, a crypto analyst and investor, notes that Bitcoin could extend the decline to a lower range of $115,603 to $116,813 before regaining bullish momentum.

A glance at the Moving Average Convergence Divergence (MACD) indicator shows that the spot market inclines bearishly on the daily chart. This outlook could stand out if the blue MACD line closes below the red signal line, prompting investors to consider reducing their exposure.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP uptrend falters

Ethereum is in the red, trading at around $3,652 at the time of writing. With the RSI still relatively overheated but declining, the path of least resistance could remain downward in upcoming sessions until demand starts to overshadow supply.

The next key support level in line to absorb selling pressure is $3,500, which was tested in late December and early January as resistance. If the headwinds intensify, the MACD indicator WOULD confirm a sell signal, encouraging traders to consider reducing exposure.

However, with institutional and retail interest backing the recent surge in price, traders should temper their bearish expectations. A recovery could ensue, propelling the price of ETH toward the $4,000 milestone.

ETH/USDT daily chart

As for XRP, bears appear to be gaining control amid an overheated RSI on the daily chart, which is overbought at 77. If the RSI continues to decline, it would signal a reduction in buying pressure, resulting in the XRP price falling to test lower levels in search of strong support.

The previous record high of $3.40 set on January 16 is worth watching as a key tentative support level. A rebound from this level could sustain the uptrend, targeting the record high at $3.66 and the subsequent price discovery phase.

XRP/USDT daily chart

Still, an extended drop below the $3.40 level cannot be ruled out yet, especially with the RSI still overheated. Notably, a drop in spot volume to the current $78 million could make it difficult for bulls to tighten their grip, leaving XRP susceptible to increasing supply amid a slump in buying pressure.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.