Bitcoin Rally Hits Speed Bump as Long-Term Holders Take Profits – What’s Next?

Bitcoin’s bull run slams the brakes as diamond hands finally crack.

After months of relentless gains, BTC’s momentum falters—not from weak hands, but from veterans cashing in chips. The OGs are booking tickets to exit the casino.

Smart money or premature celebration? The market’s about to find out.

Meanwhile, Wall Street still can’t decide if crypto’s the future or just a very expensive spreadsheet. Some things never change.

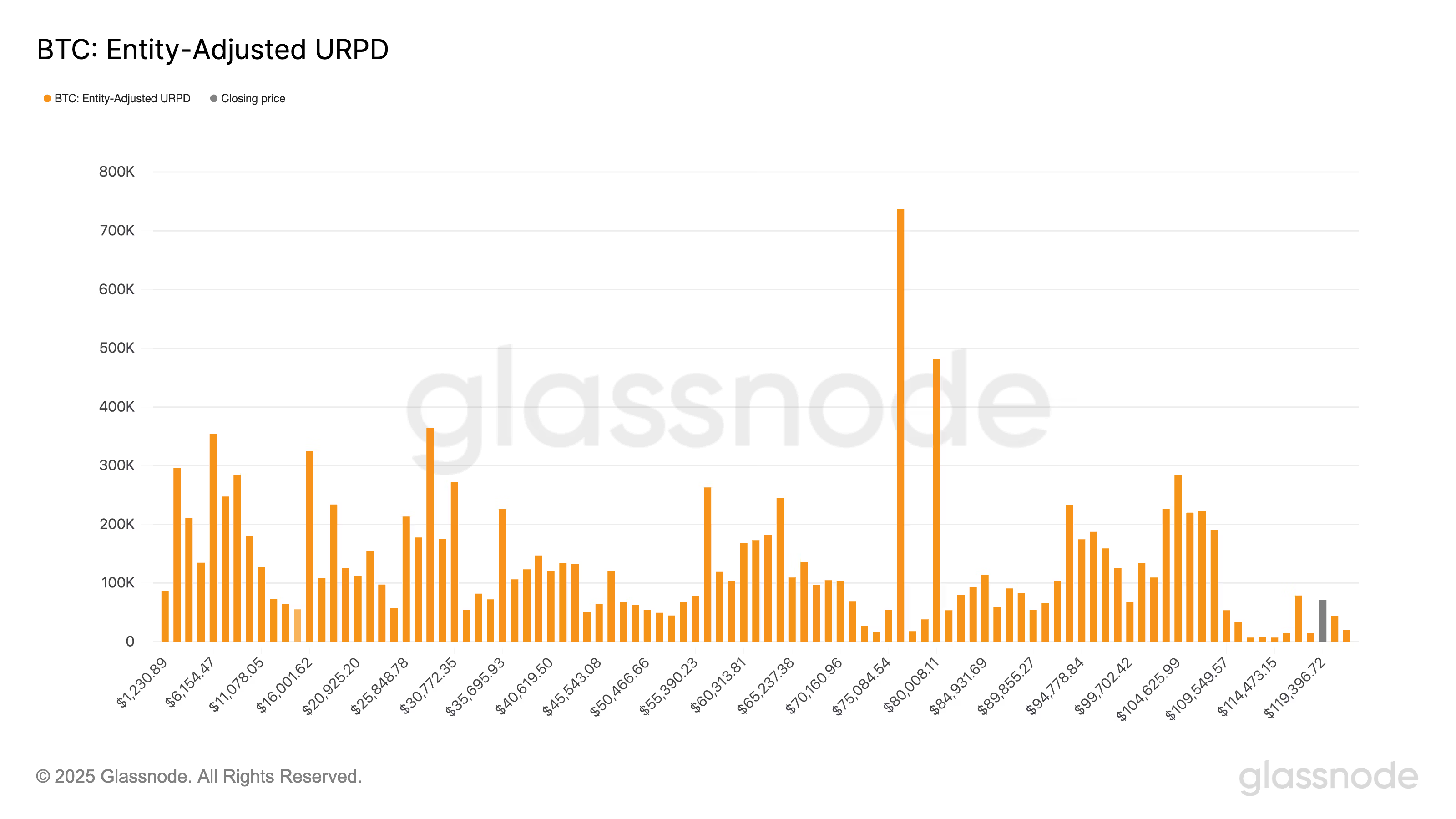

Each bar in the chart shows the amount of bitcoin that last moved within a specific price range. The entity-adjusted version of this data show above accounts for the average purchase price of each entity’s full balance and excludes internal transfers between addresses owned by the same entity, which do not represent genuine market activity. It also filters out supply held on exchanges, because aggregating millions of users’ funds into a single price point WOULD create distortions in the data.

With minimal supply sitting between $110,000 and $116,000, as shown by the dip at the right-hand side, the market remains vulnerable to sharp moves in either direction.