Bitcoin Shatters Records Again—Why This Rally Has Legs

Bitcoin just bulldozed through its previous all-time high—again. The crypto king isn’t just back; it’s rewriting the rules of the game.

Here’s why this isn’t another dead-cat bounce.

The breakout nobody saw coming (except the permabulls)

Traditional analysts are scrambling as BTC defies gravity—and their bearish predictions. Meanwhile, crypto natives are quietly stacking sats like it’s 2021.

Liquidity tsunami meets digital scarcity

With institutional FOMO reaching fever pitch and the halving still fresh, the supply-demand math looks brutal for shorts. Even Wall Street’s latecomers are now paying retail prices.

The cynical take

Sure, the rally could stall—right after hedge funds finish front-running the ETF they swore they’d never touch. But for now? The charts scream higher.

One thing’s clear: Bitcoin isn’t asking for permission anymore. It’s taking names.

Bitcoin holders show reluctance to take profit despite all-time high rally

Bitcoin briefly surged above $118,000 over the past 24 hours following $1.18 billion net inflows into US spot BTC exchange-traded funds (ETFs) on Thursday, according to SoSoValue data. The strong inflows combined with rising prices have boosted the total net assets of the products past $141 billion as of the time of publication.

Despite Bitcoin's recent peak, on-chain metrics reveal that market Optimism remains cool compared to previous cycles.

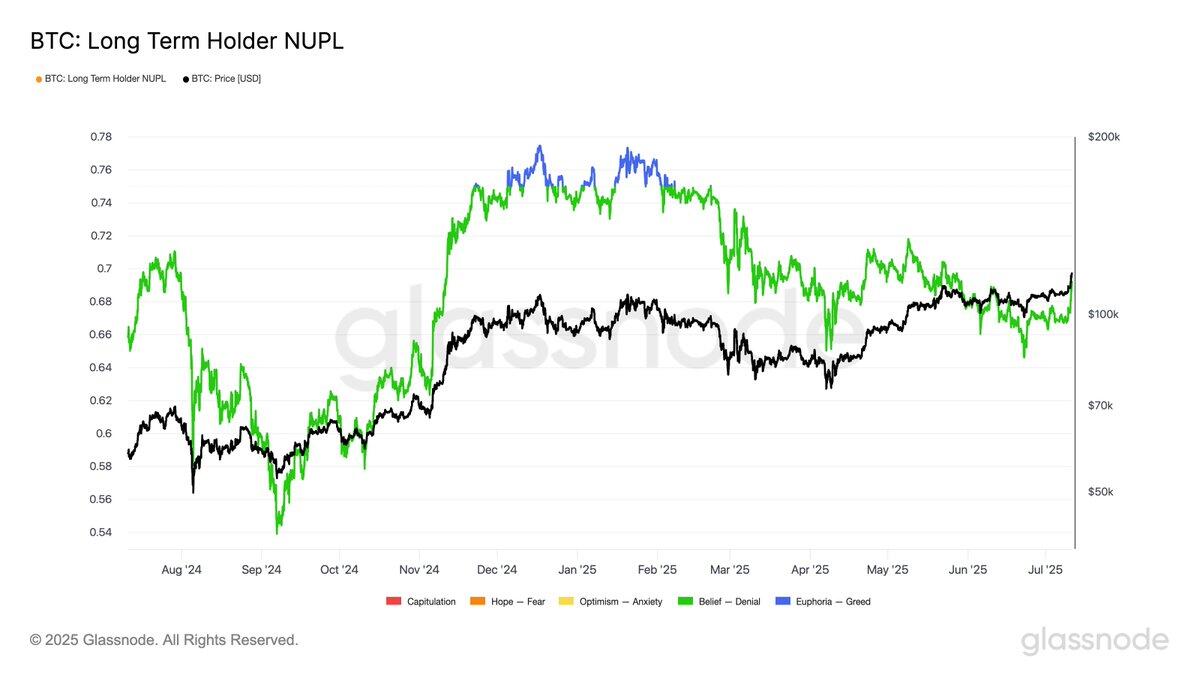

The Long-Term Holder (LTH) Net Unrealized Profit and Loss (NUPL) metric is at 0.69, slightly below the 0.75 threshold, which is typically associated with euphoric market conditions, blockchain analytics firm Glassnode stated in an X post on Friday. The current cycle has only seen 30 days above that level, compared to 228 days during previous bull cycles.

BTC Long-Term Holder NUPL. Source: Glassnode

The current NUPL level highlights that while long-term holders are already realizing profits, they are yet to reach extreme selling levels, as seen in previous price tops. This points to the possibility of further upside if LTHs continue to accumulate.

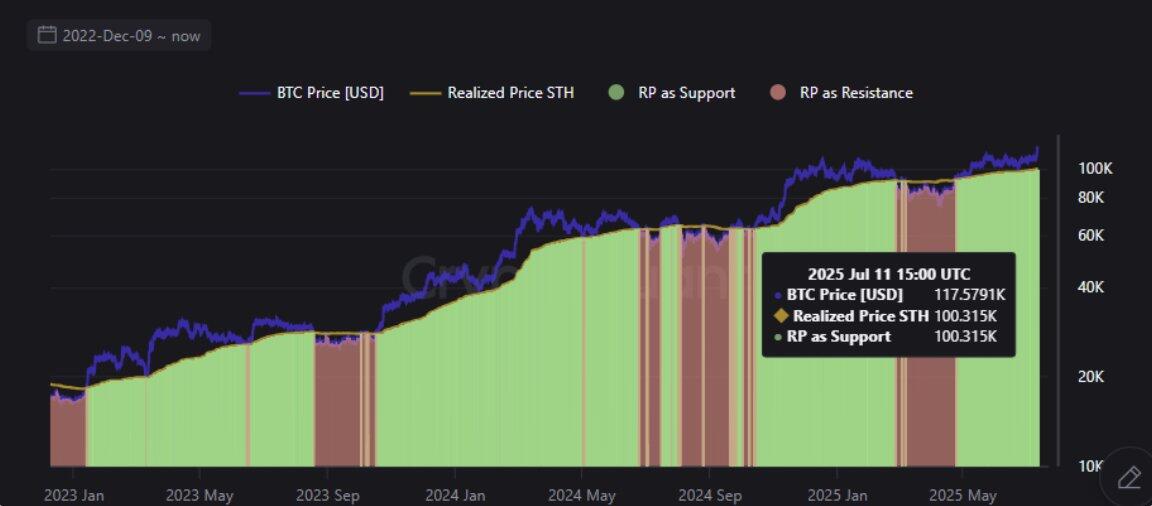

Likewise, short-term holders (STHs) have resisted the urge to lock in profits despite Bitcoin's push to a record high. The Short-Term Holder Realized Price — used to track the average acquisition cost for coins held for less than 155 days — is currently hovering around $100,000, according to a CryptoQuant report on Friday.

BTC Short-Term Holder Realized Price. Source: CryptoQuant

Usually, with Bitcoin's current rally, STHs should be locking in portions of their unrealized gains. However, the reluctance from this cohort reflects a broader decision to hold, similar to LTHs. "The market doesn't show signs of being overheated with excessive selling from profitable short-term holders," analyst CryptoMe wrote in the report.

CryptoQuant analysts also highlighted the notable rise in bitcoin open interest, which spiked to $81.4 billion on Friday following BTC's rally above its previous peak of $112,000. Despite this rise, funding rates have remained near neutral levels, signaling a low FOMO-driven environment among traders.

"This means investors are not opening aggressive long positions using high leverage with FOMO," the report states.

This restrained behavior suggests that, despite Bitcoin's climb to new highs, market sentiment remains below elevated levels seen in the November and January all-time high run as the current uptrend is not yet driven by excessive speculation.

Bitcoin is trading NEAR $117,400, up 1.3% over the past 24 hours, at the time of publication.